Rapid increase in funding consultations for small and medium-sized enterprises Swift financing through simple screening 5:30 on March 16

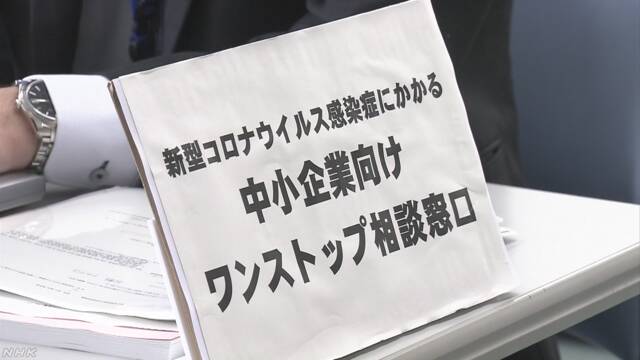

Due to the spread of the new coronavirus infection, consultations on cash flow for SMEs are increasing rapidly. Government-affiliated financial institutions, etc., respond to loans promptly by minimizing the documents required for screening.

The government has expanded its financing and guarantee frameworks to help small and medium-sized businesses affected by the spread of the new coronavirus infection, and has substantially provided freelancers and other sole proprietorships. We will also provide interest-free and unsecured loans.

Nearly 50,000 consultations have been received at consultation desks located around the world by the 12th of this month, and more than 90% of them are related to cash flow. It has been pointed out.

In response to this situation, the Japan Finance Corporation and the Credit Guarantee Association have decided to provide financing quickly by minimizing the documents required for submission at the time of screening.

The government is also urging financial institutions to respond promptly, and will provide guidance and supervision when necessary.