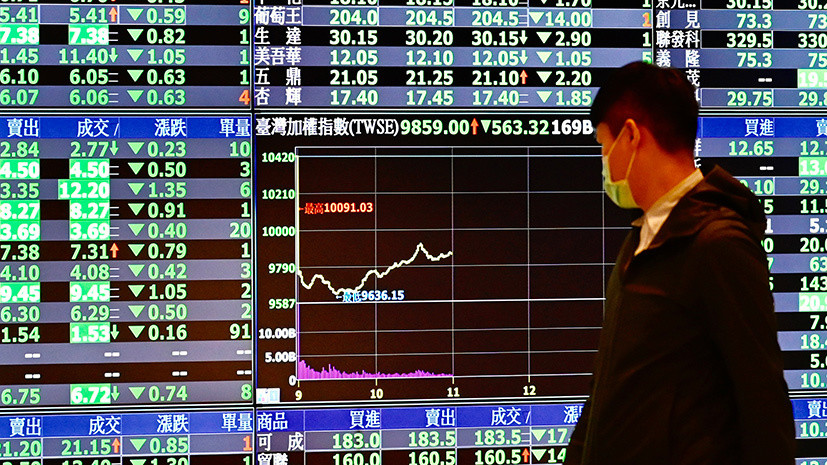

On Friday, March 13, trading on the global stock market is accompanied by mixed dynamics of stock quotes. As a result of the Asian session, the Shanghai SSE Composite index fell by 1.23% (to 2887 points), the Japanese Nikkei fell by 6% and updated the minimum of the last four years (17,431 points), while the South Korean KOSPI slipped by 3.43% to 1771 points. The value has become the lowest since 2011.

European markets showed moderate growth in the middle of the day. The British FTSE 100 index grew by 7% to 5604 points, the German DAX - by 6.7%, to 9777 points, and the French CAC 40 - by 7.1%, to 4332 points. European markets are trying to recover after a sharp collapse on Thursday, when quotes fell by 10-12%.

“The indices opened with correctional growth, largely due to measures taken by the European Central Bank (ECB). On the eve of the regulator kept the base rate at zero, and also increased the volume of the quantitative easing program. However, compared with a serious drop in the value of securities during the week, the observed growth is not so significant, ”said Sergey Suverov, senior analyst at BCS Premier, in an interview with RT.

According to the expert, uncertainty remains in the world market after a large-scale collapse on the US stock exchanges. On March 12, in the United States, the Dow Jones industrial index fell by almost 10% to 21,200 points, the corporate S&P 500 - by 9.51%, to 2,480 points, and the high-tech NASDAQ - by 9.43%, to 7201 points. Such a sharp drop in the US market has become the largest since 1987.

Moreover, amid a significant decrease in the indices, securities trading had to be suspended - the second time in a week. Previously, a similar situation could be observed even during the global financial crisis.

Investors began massively selling stocks after the World Health Organization (WHO) announced the global coronavirus pandemic.

“A WHO statement triggered a new round of panic in the markets. In a hurry, investors began to withdraw money from risky assets. Such actions led to a drop in stock indexes in the United States, and then the trend spread to Asian sites, ”added Suverov.

According to recent estimates, the total number of coronavirus infected in the world exceeded 136 thousand, of which more than 5 thousand died. Most infected were registered in China (more than 80.8 thousand people), Italy (over 15 thousand people), Iran (11 thousand), South Korea (more than 7.9 thousand), Spain (4.2 thousand ) and France (2.8 thousand).

As an analyst with Finam Group of Companies Alexei Korenev told RT, the further spread of the disease could increase investor concerns and trigger an even greater collapse in the markets. As a result, the global economy risks facing a new financial crisis.

“The global stock market is now characterized by instability, and if exchanges do not begin to win back the fall in the near future, this could push the global economy to a recession, which runs the risk of eight to nine months,” said Korenev.

According to him, the main signal of a possible global recession was the record growth of the VIX stock indicator. This indicator among investors is called the “fear index” - it reflects market expectations regarding the future instability of the S&P 500 index. On March 12, VIX during the trades grew immediately by 40% and reached 75 points - the highest level since the global financial crisis of 2008.

“The global economy could go into recession due to extraordinary quarantine measures introduced by governments and slowing down business activity. Thus, for example, established production and trade chains are broken. In addition to China, the most affected countries may be those in which the epidemic has spread most. At the moment, these are Europe, Iran and South Korea, ”added Sergey Suverov.

According to experts at the UN Conference on Trade and Development (UNCTAD), depending on the effects of coronavirus in 2020, the global economy could lose up to $ 2 trillion. Moreover, according to experts' forecasts, the EU countries will be the first to enter the phase of economic recession.

“Europe will definitely enter the recession in the coming months. And the German economy is particularly fragile. But now, too, the Italian economy and other parts of the European system are experiencing serious shocks, ”said Richard Kozul-Wright, Director of Globalization and Development Strategies at UNCTAD.

According to a McKinsey study, if the coronavirus pandemic completes relatively quickly, global economic growth in 2020 could be around 2%. Meanwhile, if the infection continues to spread actively during the second and third quarters, the global GDP will either show only a small increase (by 0.5%) or decrease by 1.5%.