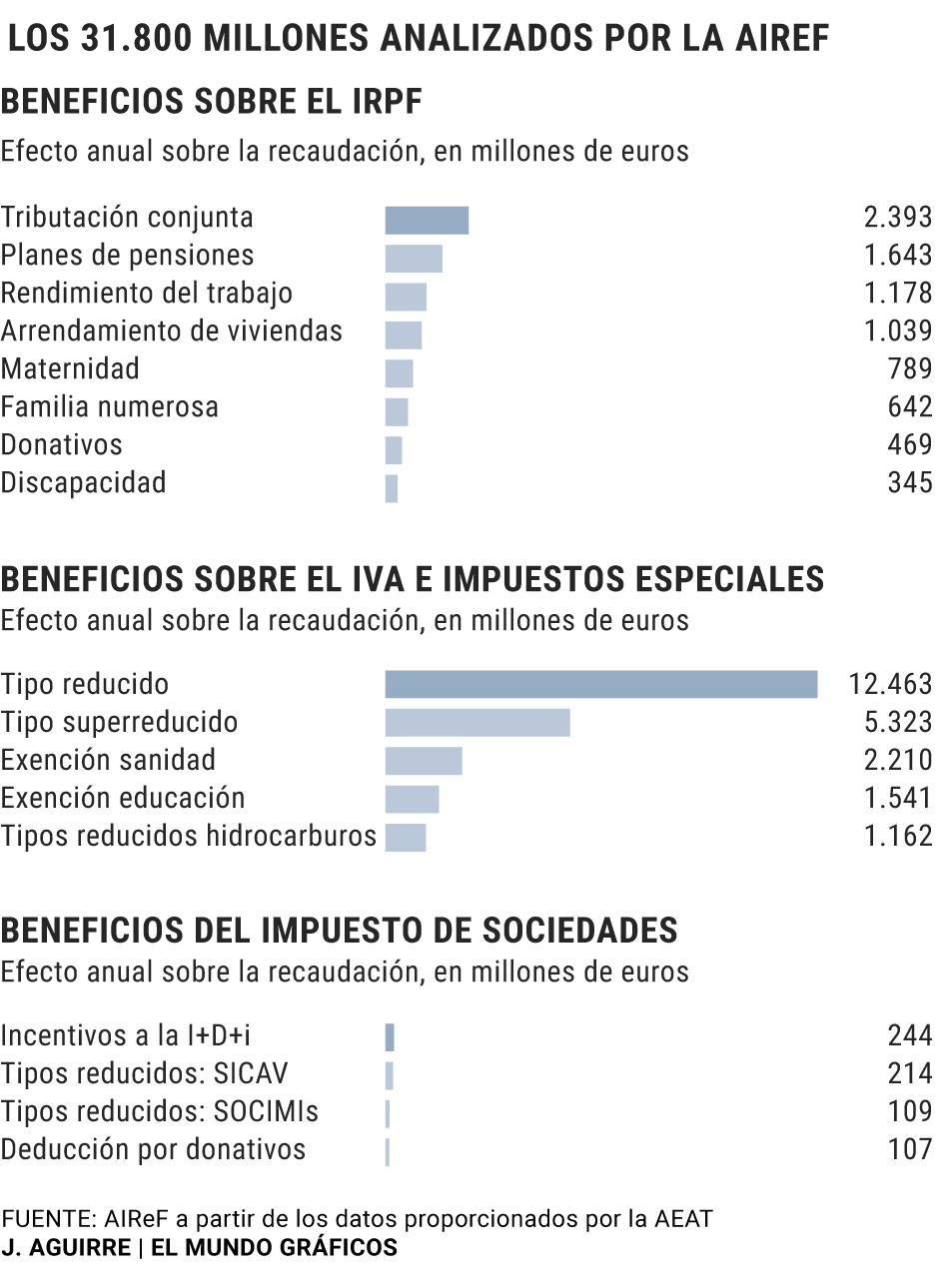

The Government already knows how much it will raise tax revenues by completely eliminating the tax benefits currently presented by pension plans: 1,643 million euros per year . The information has been transferred by the Independent Authority of Fiscal Responsibility (AIReF), which includes the data in the second phase of the review of the total public expenditure (the so-called spending review ) that is being carried out and that, in this way, puts figures to one of the electoral promises of United We and a measure that has also been noted since the PSOE.

Moreover, after Pedro Sánchez arrived in La Moncloa, in June 2018, the Ministry of Finance already considered this possibility. Finally, the department led by María Jesús Montero did not specify any measures in this regard, and sources of the Treasury added that the elimination of the tax advantages of the pension plans is not one of the immediate priorities of the Coalition Government.

However, the third vice president and minister of Economic Affairs, Nadia Calviño, did acknowledge last October that the Sanchez Executive wants to "analyze to what extent the existing incentives are working or not," and cited the work being done by the AIReF. " We are going to see what the conclusions of that study are, in which we are collaborating from the Ministry, before making a specific decision in one way or another, " he said.

These conclusions are not yet known, since they will not be made public until next summer. But it is known that the previous president of the Fiscal Authority, José Luis Escrivá, showed himself on more than one occasion contrary to the tax advantages of these products . It is also public that Escrivá himself pointed out, after taking possession of his new position at the head of the Ministry of Inclusion, Social Security and Migration, that he wanted to promote business plans, with models that could be similar to those that exist in the Basque Country or even the United Kingdom, and therein lies one of the keys to ensure the viability of the pension system. And finally, and according to sources close to the minister himself, that the second phase of spending review began under the mandate of the minister today and that many of his conclusions and data could be in line with what has already been said by him.

For example, and in addition to what has already been pointed out, that pension plans are "regressive" , and that they benefit almost exclusively those who have the most. Or, also, that in a few occasions the fiscal advantages are really running out of funds and that the returns offered are limited.

In this sense, a work published by the IESE business school is known and usually used, which consists of different updates and which shows that many pension plans offer a significantly lower return than the Spanish Stock Exchange.

«In the period December 2003- December 2018, the profitability of the Ibex 35 was 118% [annual average 5.33%] and that of the 15-year government bonds, 95% [annual average 4.55%]. The average return on pension funds was 38.7% [annual average 2.11%]. Among the 385 pension funds with 15 years of history, only six exceeded the profitability of the Ibex 35 and 12 that of the 15-year government bonds, ”explains the latest work signed by Pablo Fernández and Juan Fernández Acín.

The last tax advantage

However, any modification of the taxation of pension plans will meet the resistance of the sector, which has a notable presence in Spain and pressure power. In the first place, because these products allow those saved to deduct from their declaration contributions made for a maximum of 8,000 euros, which undoubtedly represents one of the last great tax advantages of high incomes, but also of the middle classes .

But, also, because, in the opinion of the industry, the future of Social Security does happen to give greater relevance to private plans. The Association of Collective Investment Institutions and Pension Funds (Inverco) has defended it on numerous occasions, with proposals of a public-private model , and so do many managers in an individual capacity. These same firms recognize that, in many cases, the participants have products that are not suitable for their profile and even speak of "commercial pressure" in hiring. But for this reason, they add, proper marketing and contracting of products would eliminate these situations and make pension plans a profitable and fiscally attractive option.

According to the criteria of The Trust Project

Know more- Social Security

- José Luis Escrivá

- Pensions

SOCIAL SECURITY 23 ways to save pensions from this week

Social Security Escrivá denies the transfer of pensions to the PNV: "What has been agreed is a discussion from 2021"

Policy The PNV ensures that it will collect the contributions and pay the pensions but the Government lowers the agreement