- Foro.Sánchez demands "a new fiscal model around data"

- Collection: Government calculations that do not convince the sector

- Taxation: Shock and negotiation between France and the US

- Sociedades.Netflix disburses 3,146 euros per year in Spain

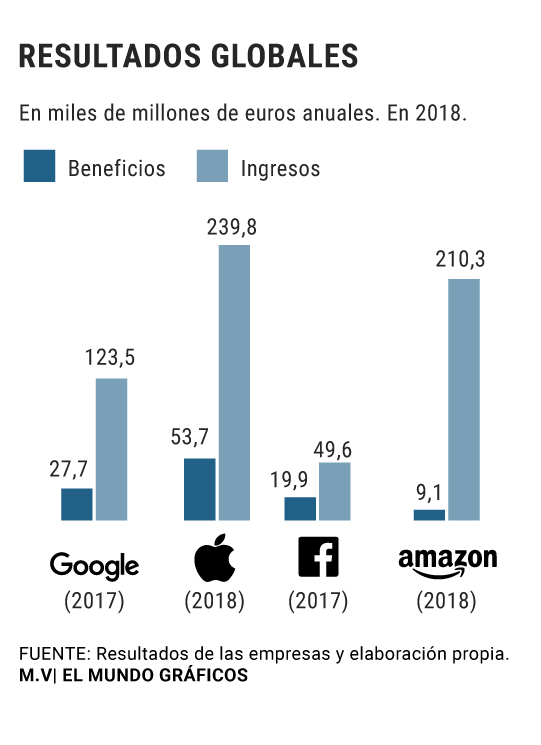

The big techs pay taxes, but the least possible and not where every government would like. Just look at Spain: the four digital giants disburse a total of 23.9 million euros a year (9.1 million from Google, 10.1 million from Apple, 0.2 million from Facebook and 4.4 million from Amazon) . Those four companies invoice hundreds of billions in the world; they are ubiquitous in devices, but not in public coffers.

In this scenario, the proposals of the PSOE to reissue the last Executive include the creation of the "Tax on Certain Digital Services in order to tax those operations of the digital economy that currently do not pay." The Google rate , as the tax has been baptized, fits into "a new fiscal model around data," Pedro Sánchez said last week at a technology forum organized by Ametic.

Javier Santacruz, principal investigator of the think tank Civismo, considers that a tax of these characteristics would work as “a brake on the growth of the digital market in Spain, a tariff in practice that would isolate the country from the rest of Europe and an added cost of control and inspection in many cases more expensive than the collection that is intended to be obtained ”, as indicated to THE WORLD. This liberal thesis platform estimates that Internet companies already assume an average effective rate of between 49.67% (small ones) and 61.57% (large ones). However, the European Commission highlights that digital companies assume 9.5% of taxes compared to 23.2% of conventional ones. The accounts do not quite add up, much less if you look at the results of the big tech in Spain, global giants that reduce their tax burden to a minimum.

If the focus is on the internet, it is because economic activity inevitably passes by today. Due to their dimensions, Google, Apple, Facebook and Amazon (the so-called GAFA) appear in all debates or, if Netflix is included, the FAANGs (to refer to fang , fang in English). «Digitalization has exacerbated the fact that, to generate business, I don't have to be in a country; I don't need it, ”says Álvaro Sánchez-Herrero, from the PwC Technology, Telecommunications, Entertainment and Leisure area:“ All previous international tax law structures have pivoted on the concept of permanent establishment, which requires physicality, ”he adds.

That single yardstick is part of the past, so that face-to-face economic activity and taxation have been decoupled. Governments have taken action on the matter, with France - facing the US if necessary - as the main example, although there are others such as Hungary, Italy, India, Chile, New Zealand, the United Kingdom and, of course, Spain .

France, pioneer and criticized

The gala rate charges 3% of revenue for companies that bill 25 million in France or 750 million worldwide. The socialist group aims to raise up to 1.2 billion euros per year in Spain, a forecast that different studies downgrade. Other political parties, such as the PP, warn that a Google rate will harm Spain in international competition. "In the best scenario, we would be around 900 million in revenue, but the cost in the entire value chain would be more than 300 million annually," Santacruz calculates. The Adigital and Ametic associations estimate that the negative impact on GDP would be "between 586 and 662 million."

Both the Spanish IDSD and the French regulations, which have already been approved, take as reference the income instead of the benefits, unlike the Corporation Tax and the global solution that is pursued by consensus of 130 countries and OECD approval before the end of 2020. "Emmanuel Macron says that, when the agreement is reached on how to pay international activity, he will be accountable," Sánchez-Herrero reviews. " We cannot find the disruption of having to fix the systems established in each country in which we operate," says a director of one of the internet giants. Google underlines EL MUNDO that complies with tax laws and also acts as a growth engine for the country. In conversation with this newspaper, Amazon sources show that, in addition to the Corporation Tax, the epicenter of the dispute, they employ 5,400 workers (IRPF) in 23 locations (IBI) and house 8,000 Spanish companies in their mammoth market place . Paul MacDonnell, executive director of the Global Digital Foundation, maintains that "many consumers will perceive the digital rate as a rate of sin, something that is wrong, such as those applied to alcohol or tobacco ."

The view set in the GAFA

The view is on the GAFA , but you can not forget other corporations such as Microsoft, the corporation with the highest market capitalization. In his failed investiture speech, Sánchez recalled from the rostrum that "a well-known digital platform paid a little more than 3,000 euros in taxes in Spain," in reference to the 3,146 euros paid by Netflix in 2018. "Charging against Spanish banks is expensive , but all if you consider the debt of the parties, but nothing happens if you criticize American companies, which also make very little noise. If Google were French and German Facebook, the position of any EU country would be quite different, ”says a position in the technological field. It should be remembered that Apple's 10.1 million, the one that pays the most taxes in Spain among the GAFAs , are well below the 464 million of Santander only for Companies for 2018 or the 360 million from Inditex.

Do internet giants then pay taxes? According to studies such as the one published by the European think tank Ecipe, yes: the Alphabet Corporation Tax (Google) would be around 26% on the average of the last 10 years; that of Netflix, in 26.29%; and that of Amazon, at 48.93%. "They can be compared to sectors such as food, automobile or telecommunications," says MacDonnell of the Global Digital Foundation.

Others think very differently, such as the ITEP (Institute of Taxation and Economic Policy), which has exposed how Amazon, not only got rid of paying federal taxes in 2018 in the US, but also received compensation thanks to the deductions and the reduction of the Corporation tax from 35% to 21% in the Donald Trump era .

The European fiscal labyrinth

The tax engineering of digital colossi is especially intricate in the EU, where any joint tax reform would require unanimity that has not been achieved with the Google rate . For starters, the Corporation Tax varies by country, so that 25% of Spain doubles 12.5% of Ireland . Google, Apple and Facebook are based in that country, in which it is also not difficult to refer the commitments to tax havens with an even more favorable taxation, if not zero.

“In general, putting rates on digitalization is negative, and a Google rate as it is proposed would affect mainly SMEs and consumers; this would happen, not because corporations move it, but because the rate affects any point in the activity chain, ”warns Agustín Baeza, director of Public Affairs of the Spanish Startup Association.

Some fiscal adjustment seems advisable, but any unilateral decision involves risks when competing globally. Amazon has already made it clear what will happen with the tax: «We will have no choice but to pass it on to our business partners . We recognize that this can put small businesses in France at a competitive disadvantage ». Spain advances in the same direction, alone or accompanied?

Pedro Sánchez watches the Netflix series and his 3,146 euros in taxes

Pedro Sánchez, commissioned last week to close a technological forum held in Santander, referred to different fiction series such as Black Mirror , available on Netflix, but also remembered that platform to draw attention to the low taxation assumed by some large digital corporations operating in Spain. The acting president had already pointed to Netflix before, since Congress.

This fixation is justified by the fact that the Los Gatos-based Californian giant disbursed 3,146 euros for Spain in 2018 taxes. The global streaming leader landed in the country in 2015, using a partnership in Holland; Last year, it enabled two subsidiaries, Los Gatos Transmission Services Spain and Los Gatos Entertainment Spain. These new companies jointly credited an income of 538,921 euros per year and a net profit of 9,439 euros, although those accounts only collected half of the year, since the subsidiaries were established in the summer of 2018. Netflix, also pays VAT on Subscription revenue, of course, as you remember from that company to THE WORLD. In addition, the company has been installed in a production center in Tres Cantos and has moved part of the communication team from Amsterdam to the new headquarters established on the outskirts of Madrid.

According to the criteria of The Trust Project

Know more- Spain

- Amazon

- France

- Netflix

- THE WORLD

- PSOE

- Pedro Sanchez

- PP

- GDP

- OECD

- United Kingdom

- Chile

- European Comission

- Donald Trump

- Emmanuel Macron

- Europe

- New Zealand

- Hungary

- Personal income tax

- India

- Italy

- Microsoft

- Television

- Santander Bank

Savings and Consumption Algorithms and logistic poles, the revolution that nobody saw coming

Consumption These are the most reliable technology brands

In the G7 France agreement with the US suspend the Google rate in exchange for reviewing international taxation