Hundreds of thousands of homes left the regulated electricity tariff in 2018 to end up in the liberalized market seduced by the supply of electricity companies or, directly, without really knowing what they were doing. In 2018 alone, a total of 301,606 households made the leap, 2.6% of those that still remain under the supply model established by the Ministry of Ecological Transition. The figure is equivalent to 826 daily electric removals.

The transfer of users from what is known as the Voluntary Price for the Small Consumer (PVPC) - old Last Resort Rate (TUR) - is not new and highlights the inability of different governments to seduce consumers with a clear regulated offer and transparent Only since 2014 more than three million consumers have abandoned this tariff attracted by the greater number of offers in the liberalized market or unconsciously pushed by the electricity company on duty, as evidenced by several sanctioning records on bad practices approved by the CNMC in recent years.

The number of changes contrasts considerably with the ignorance data of the electricity market itself that periodically publishes the energy regulator itself. According to its last panel of consumers, 67% of users do not know if it is supplied in the regulated or free market and 38% admit they have no idea what type of rate - hourly, night, fixed price ... - pays each month.

Most of the movements are linked to the campaign of large power companies to strengthen their portfolio of free customers, where both parties - customer and supplier - agree on a bilateral price and supply conditions. These include from a fixed annual price to variations in the cost of the kilowatt per hour or daily slots adapted to the consumption profile. In the case of the PVPC the cost of the kilowatt hour is given by the fluctuation of a wholesale market that varies hour by hour and does not include additional services.

In 2018, two out of every three supply changes from the regulated market took place within one of the six large electricity companies - Iberdrola, Endesa, Naturgy, EDP, Viesgo and CHC - which are assigned the role of regulated suppliers. That is, it is these companies that have proposed to their own customers a change of contract that may include additional services such as assistance or maintenance and discounts on the fixed part of the receipt.

Its objective is to beat the PVPC, which in principle is the lowest price by replicating the cost of the wholesale electricity market hour by hour. This situation, however, gives this supply a strong volatility component due to the ups and downs experienced by the electricity cost throughout the year, mainly due to weather conditions.

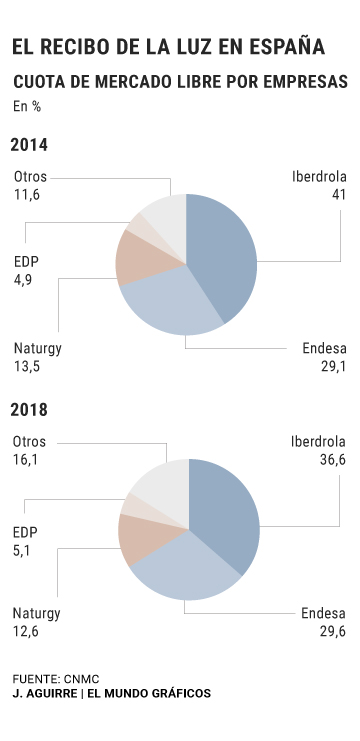

But not all companies maintained the same commercial pattern in 2018. The most active group in trying to move its customers last year was Iberdrola, which already accumulates 6.6 million domestic users in the liberalized market after fattening its commercial portfolio with 38,000 new supplies. It is in line with the increase experienced by Endesa (+45,000), although the group continues to lose customers globally due to the loss of quota in the regulated business.

On the other hand, Naturgy suffered last year the first reduction of users in the free market by a large power company, with 96,000 customers transferred. The fall coincides with the arrival of Francisco Reynés at the top of the company and the new portfolio optimization strategy, which led the group to purge thousands of contracts with clients that were supplied at a fixed price and were not profitable for the group, especially large industrialists.

The liberalization of the electricity market has also led to the flourishing of dozens of new electricity retailers that are gradually trying to snatch part of the energy pie from large business conglomerates. There are currently 314 electricity suppliers registered in the country, although some are focused on very specific markets such as SMEs or belong to large industrial groups to which they supply themselves. These companies have been made with 1.1 million customers in the last five years.

In the electric battle, other energy giants such as Repsol and Cepsa have also burst in recent years, combining the supply of kilowatt hours with discounts on the price of fuel. Both companies counterattack Iberdrola, Endesa and Naturgy, which have powerful plans to boost the electric car to compete with the oil companies in the mobility business.

According to the criteria of The Trust Project

Know more- Iberdrola

- Naturgy

- Special Economic News

- economy

The next economy Dear brands, greenwashing no longer leaks

CompaniesIberdrola sells 40% of its East Anglia One offshore wind farm to Macquarie for some 1,750 million euros

Macroeconomics The devaluation of the yuan plunges Wall Street and the United States calls China "manipulator"