Money moves the world, but each time we will see less money. In just five and a half years, in 2025, 5% of the Spanish population will not have access to cash. Your town is not going to have a bank office or a cashier, nor will it be on the route of one of the mobile offices that many of our population centers now travel. Nothing. The cash will have to go look for it elsewhere.

The financial gap is a reality against which institutions and banks themselves are already fighting, but their progress is firm. The need to reduce costs in search of profitability continues to force the Spanish banks to further staff adjustments and to further jarrize the office park. This has already been reduced by 42% since the beginning of the crisis, but an annual closing rate of 5% persists and does not seem to slow down soon. If nothing remedies it, in the aforementioned five and a half years, three million Spaniards will be at serious risk of financial exclusion.

But what can happen if you don't carry real, physical money in your pocket? "A society without access to cash is the paradigm of inequality," warned from the Coordinated Institute of Governance and Applied Economics chaired by Germán López Madrid, senior advisor of Volvo Spain, and vice president of former Socialist Labor Minister Valeriano Gómez.

“The economy of three million people and that of thousands of small businesses in rural areas is based on cash. Preventing or hindering access to money will not do anything other than increase inequality and promote an unfair distribution of wealth, generating the bankruptcy of equal opportunities and the exclusion of people over 60 years ” , they insist from the aforementioned institution of research and thought.

That worrying 2025 horizon, with a 5% population without access to cash, is already a reality in many parts of our country. In 2017, 2.9% of Spaniards did not have a bank branch in their municipality of residence, being the most unpopulated areas [the emptied Spain that moved politicians so much during the last electoral contest] the ones that suffer most from this reality.

And it is that 83% of those towns without offices have less than 500 inhabitants , 30% concentrating those that do not reach 100 inhabitants, according to data compiled by the IVIE analysis laboratory, the Valencian Institute of Economic Research.

And the gap does not stop advancing: between 2016 and 2017, the number of Spaniards without access to a bank office climbed 7.2%, to the mentioned 2.9% of the total population: 1,351,276 people.

Although it is a widespread phenomenon throughout the country [more than half of the villages, 52%, no longer have a bank office] , the adjustment has had different intensities by communities. The most depopulated financial map is headed by Castilla y León , with 16.4% of its inhabitants in villages without a bank, but in Madrid , Murcia , Asturias or the Balearic Islands , the percentage barely reaches 1%.

Although digital banking has experienced more than remarkable progress in recent years, cash remains the preferred payment method for 53% of the Spanish population , compared to 41% of the debit card, according to the Bank of Spain. Also, a recent study by the European Central Bank on the use of cash in euro area households shows that citizens are not replacing as much as physical money was believed by alternative payments. They claim comfort, greater control of spending and lower cost.

ATMs

Along with the closing of offices, also the number of ATMs, the main source of obtaining cash from citizens, has been reduced in recent years, but to a lesser extent.

In 2017, in fact, the number of ATMs has experienced a slight rebound as entities have chosen to increase their presence in points with large numbers of people, such as shopping centers, airports or stations. They are called displaced tellers.

According to the extensive study Closure of bank offices and access to cash in Spain by Concha Jiménez Gonzalo, general director of Cash and Branches of the Bank of Spain, and Helena Tejero Sala, director of the Issuance and Cash department of the banking supervisor, the number of Points for obtaining cash through bank windows or ATMs have increased from 107,293 in 2008 to 78,545 in 2017.

To compensate for this blackout in some of the most unpopulated areas, the bank has developed other access channels such as mobile offices, ofibuses [yesterday Bankia made public that its 12 mobile offices serve 250,000 people in 373 municipalities], or financial agents without establishment permanent.

According to data from the Bank of Spain, at the end of 2016 there were at least 690 mobile agencies and about 966 municipalities or districts had access to cash covered by collaborating agents, displaced employees themselves or through the services of fund transport companies .

Other channels have also emerged outside banks and in some shops or supermarkets it is possible to withdraw cash with cash back purchases , and initiatives have been developed through the network of Post Offices they serve, according to the authors of the Bank's study Spain mentioned above, to "reduce" the growing decline in access to cash.

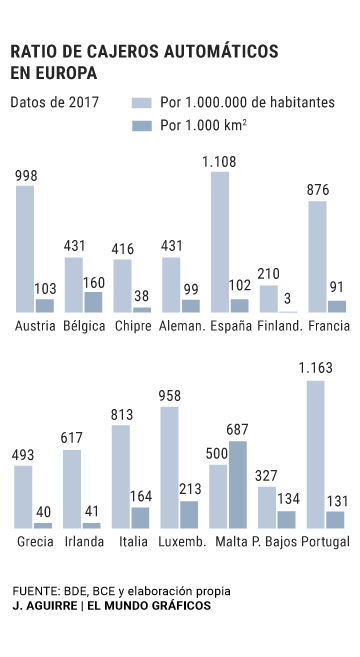

However, Spain remains one of the countries with the largest network of ATMs in its environment. In 2017, the number amounted to 50,839, which is 17.6% less than in 2008. The ECB data allows comparing data from Spain with those of other Eurozone countries: the number of bank offices per million inhabitants (595) and the number of ATMs (1,108) are similar to the proportions of neighboring countries, France and Portugal , but much higher than the euro zone average, with 474 offices and 715 ATMs per million inhabitants .

In terms of geographic density, according to the data compiled by the directives of the Bank of Spain Tejero and Jiménez, Spain has 55 offices and 102 ATMs per 1,000 square kilometers, the European average being 57 and 85, respectively.

«Irreparable»

According to Jesús Sánchez Lambás, executive vice president of the Coordinates Institute, the study that shows that 5% of the Spanish population may be left without access to physical money in 2025 “points out the serious risk of financial exclusion of a good part of the population if they follow the tendency to hinder or prevent access to cash ».

«A society without cash», Sánchez Lambás warns, «is an obvious risk, but it is imperative to start all kinds of actions for a significant percentage of the population not to be outside the financial system. The consequences will be irreparable.

And, according to this study on the financial gap, "social control is achieved by intervening in people's decisions and privacy," being the restraining of cash, "one of the most effective ways to achieve it," being the "tool that people have to carry out their operations protecting their right to privacy and confidentiality".

The advance, however, seems unstoppable and not only in Spain. Just a few weeks ago, Brian Moynihan, the CEO of Bank of America, launched an unequivocal message, encouraged by the rapid advancement of technology and digital operations: "Let's go to a society without money . " Moynihan's statement, almost a declaration of intent, resonated strongly among his colleagues present at the Fortune Brainstom Finance conference in Montauk, New York. What is needed is that when the light goes out, it does not catch the most vulnerable portion of the population.

According to the criteria of The Trust Project

Know more- Spain

- Bank of Spain

- European Central Bank

- Volvo

- Portugal

- Castile and Leon

- Asturias

- Bankia

- Bank of Madrid

- France

- Murcia

- Health

CourtsThe five meetings that endorsed the fake accounts of BFA-Bankia

currencies Facebook ensures that it will not release its global currency until it calms the restlessness of central banks

Prices have risen 50% since 2013 The Bank of Spain notes that job insecurity increases the housing rental market