- Economy: The devaluation of the yuan plunges Wall Street and the United States calls China "manipulator"

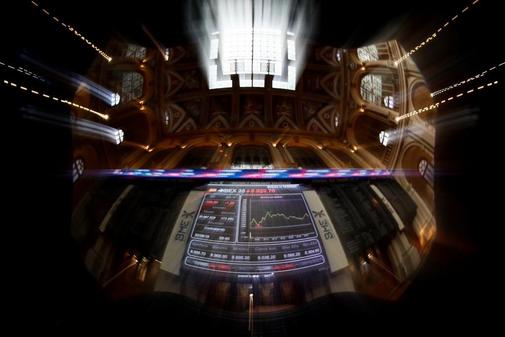

- Stock market. Consult the price of the Ibex 35

The Ibex 35 has started the session on Tuesday with slight falls (0.14%) after the opening, which has led the selective to stand at 8,766 integers, in a scenario marked by a new escalation of trade tensions between states United and China after the tariffs imposed by the Government of Donald Trump on the Asian country and for fear of a currency war with this country.

Thus, the selective Madrid, which on Monday closed with a decrease of 1.35% , began the session clinging to the psychological height of 8,700 points, after Wall Street suffered its biggest fall of the year on Monday , with losses of 2 , 9% for Dow Jones, 3.47% for Nasdaq Composite and 2.98% for the S&P 500, on a day in which China dropped the yuan to a low of 2008 with the dollar.

Specifically, the price of the yuan against the dollar weakened on Monday at lows of the last eleven years , until it exceeded the seven yuan barrier for each 'greenback', after the People's Bank of China has related the ups and downs of the currency of the Asian giant to the impact of the protectionist measures of the US, which has unleashed the wrath of the US president, Donald Trump , who has not hesitated to call the collapse of the Chinese currency "manipulation."

In the first stages of the session, IAG led the 'red numbers' of the Madrid team , with a drop of 1.3%, followed by MásMóvil (-0.8%), Sabadell (-0.5%), Cie Automotive (-0.4%), Red Eléctrica Corporación (-0.3%) and Mediaset (-0.3%), while Siemens Gamesa (+ 1.6%), Acerinox (+0 were on the opposite side) , 8%), Caixabank (+ 0.3%) and Enagás (+ 0.3%).

The rest of European exchanges opened with increases of 0.3% in the case of Frankfurt, while Paris was left 0.1% and London 0.3% .

On the other hand, the price of a barrel of Brent quality oil , a reference for the Old Continent, was priced at $ 60, while Texas stood at $ 55.

Finally, the price of the euro against the dollar stood at 1,1202 'green notes', while the Spanish risk premium stood at 75 basis points, with the interest required of the ten-year bond at 0.2% .

According to the criteria of The Trust Project

Know more- economy

- Wall Street Bag

- Stock Market Chronicle

CampoLa Unió de Llauradors estimates 280 million 'historical' losses in Valencian citrus farming

Economy The United Kingdom registers the largest increase in sales of the ceramic sector in Europe in fear of a hard Brexit

Economy Industry orders up 2.2% and service sector sales 5.3%