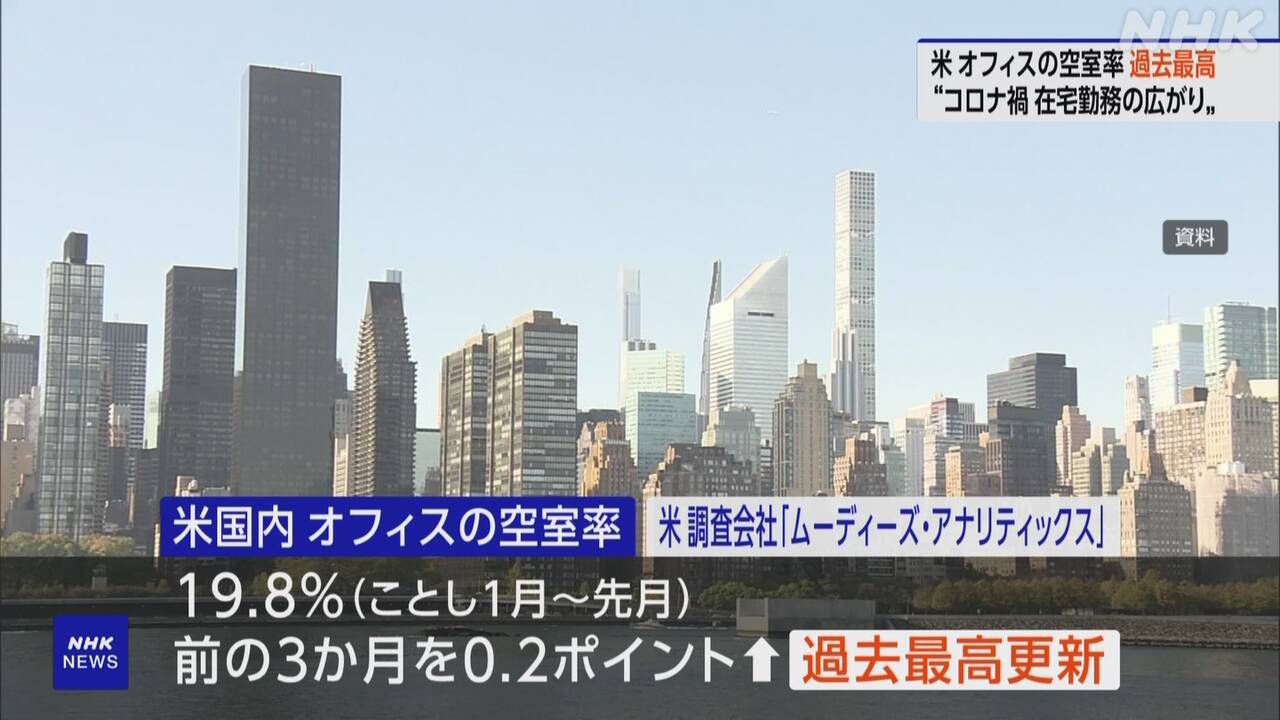

The vacancy rate, or the percentage of American offices without tenants, rose to a record high of 19.8% in the three months up to last month. The spread of telecommuting due to the coronavirus pandemic is a major factor, which has led to a decline in the prices of commercial real estate, leading to deterioration in the business performance of some banks.

This was announced on the 1st by Moody's Analytics, a research company affiliated with Moody's, a major American rating agency.

According to this report, the office vacancy rate in the United States from January to last month was 19.8%, a record high, 0.2 percentage points higher than the previous three months.

In the background, there is a movement among American companies to reduce office space as telecommuting becomes established due to the coronavirus pandemic.

The research firm analyzes that although the economy is strong, this is due to the spread of hybrid work styles among companies that combine working from the office and working from home.

The high office vacancy rate reduces rental income, which is a factor in the decline in commercial real estate prices.

In addition, rising interest rates have increased borrowing costs, and there are simmering concerns at some banks that the costs of disposing of non-performing loans for commercial real estate loans have ballooned, leading to deterioration in business.