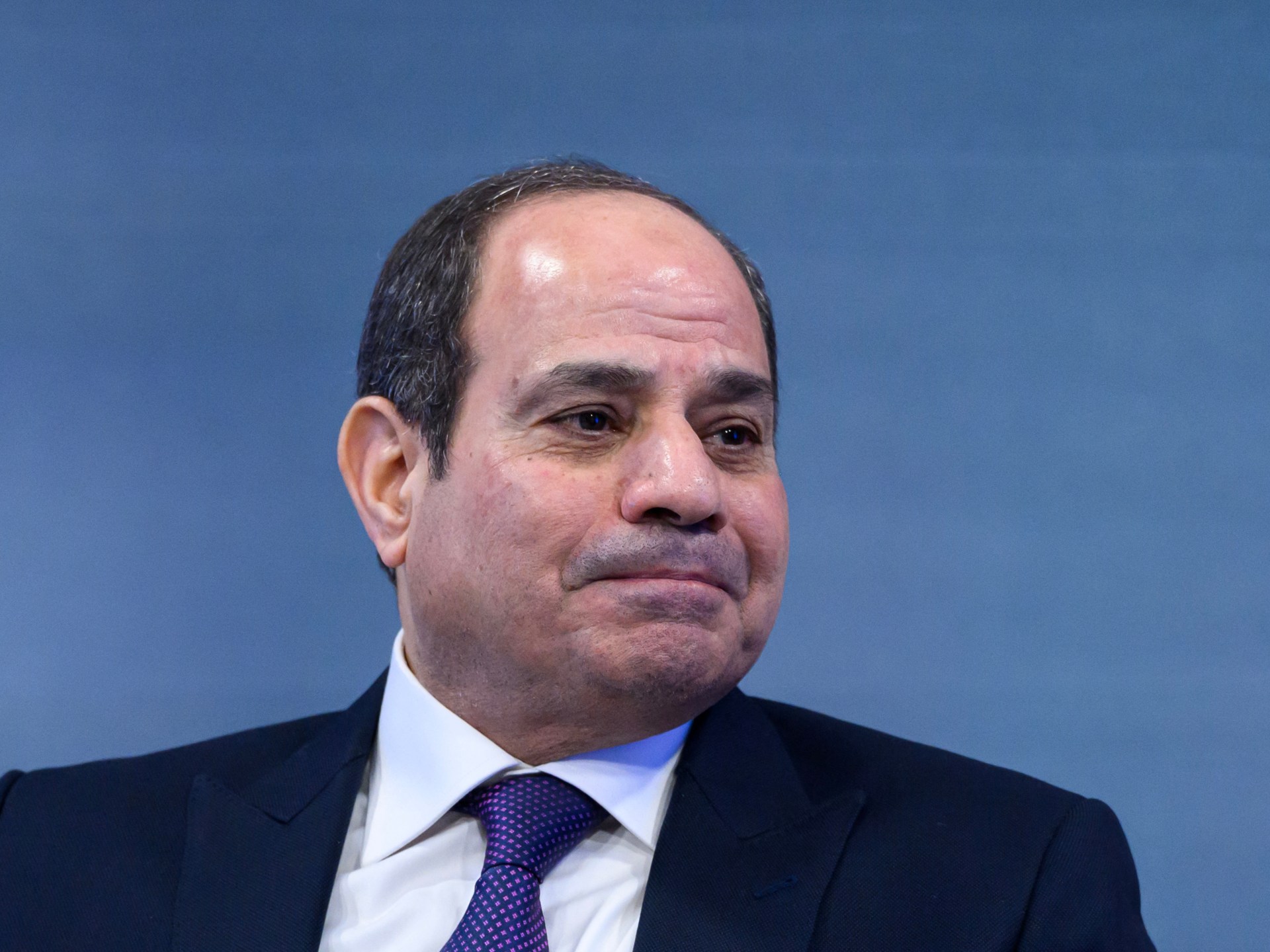

Al-Sisi said that he stopped floating the pound last year for reasons related to national security (Reuters)

Egyptian President Abdel Fattah El-Sisi said on Saturday that it has become possible to switch to a flexible exchange rate, with the help of new financing worth tens of billions of dollars from the UAE and the International Monetary Fund, according to Reuters.

He added that he stopped floating the pound last year for reasons related to national security.

Because a large amount of financing is needed before such a step can be taken.

A few days ago, the Central Bank of Egypt allowed the pound to decline and pledged to switch to a more flexible exchange rate system, coinciding with Egypt signing a loan program with the IMF.

Last Wednesday, the International Monetary Fund approved an $8 billion loan to Egypt, an increase of $5 billion from what was previously being talked about, which was $3 billion.

The agreement was signed after the devaluation of the Egyptian pound against the dollar, as its price rose from about 30.85 pounds to more than 49 pounds, as part of the Central Bank of Egypt’s adoption of a more flexible exchange rate in response to the Fund’s support program, which it said was looking forward to a sustainable move towards a unified exchange rate. Determined by the market.

The Central Bank of Egypt says that sufficient funding has been secured to ensure foreign exchange liquidity, and Central Bank Governor Hassan Abdullah told reporters last Wednesday that the bank has the ability to intervene based on market rules, as central banks in any country have the right to intervene if there are inappropriate movements. Logical.

The exchange rate of the pound exceeded 50 against the dollar before falling slightly the day after a new movement of the Egyptian currency (Al Jazeera)

The chief market strategist at Orbex in Egypt, Asim Mansour, said in a previous interview with Al Jazeera Net that what happened last Wednesday was a movement of the exchange rate to specific ranges, and not a complete float (leaving the exchange rate to be determined by supply and demand).

Last Wednesday, the Central Bank of Egypt's policy committee raised the interest rate by 600 basis points.

The bank stated that it raised the overnight deposit and lending rates, and the bank’s main operation rate, by 600 basis points to 27.25%, 28.25%, and 27.75%, respectively.

The credit and discount rates were also raised by 600 basis points, reaching 27.75%.

Experts believe in a previous interview with Al Jazeera Net that these measures would create a state of stability in the exchange rate of the Egyptian pound, provide the dollar for import, and release goods held in Egyptian ports as a result of the scarcity of foreign currency.

Source: Al Jazeera + Reuters