Noto Peninsula Earthquake: Locally-based Shinkin Bank faces recovery of local industry February 21, 2:39 p.m.

Wajima lacquerware, Suzu ware, Noto beef, Noto wine...

producers of traditional crafts and specialty products suffered great damage during the Noto Peninsula earthquake.

Many of them are sole proprietorships or small and medium-sized enterprises, and they are in need of detailed support.

Under these circumstances, financial institutions play an important role in providing financial and other management support.

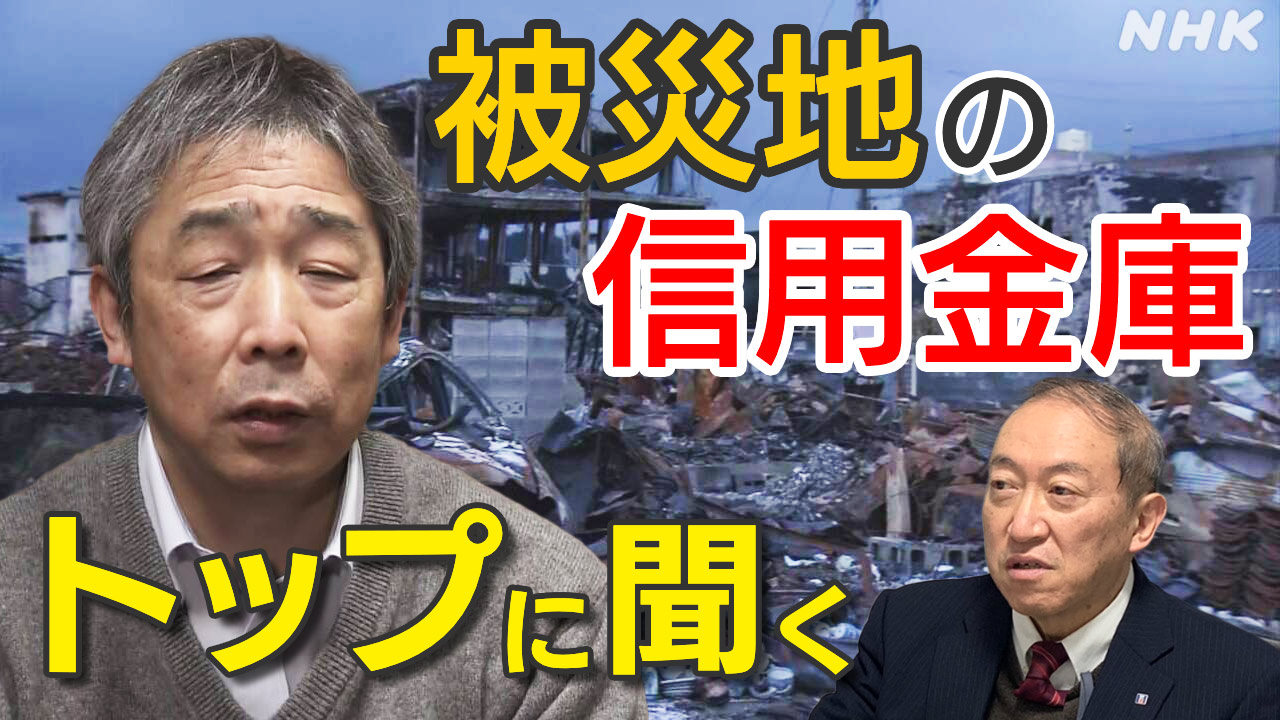

We asked the chairman of a locally-based Shinkin Bank about the actual state of the damage and the revitalization of the industry.

(Economy Department reporter Airi Enokishima, Kanazawa Broadcasting Bureau reporter Masashi Takemura)

60% are “not in a situation where they can operate”

``What about the effects of the earthquake?'' `

`The building was fine, but the effects of the water outage are still being felt.''

Kono Shinkin Bank is visiting customers one by one in the disaster-stricken areas. I am an employee of ).

This Shinkin Bank has its main branch in Noto Town, and its business areas include Wajima City and Suzu City.

Rooted in the local community, we have provided financing and management support to individual business owners and small and medium-sized enterprises.

Immediately after the earthquake, we began visiting and interviewing people over the phone, and what became clear was the serious reality of the situation.

Of the more than 1,600 businesses that the two branches in Wajima City and one branch in Suzu City do business with, at least 70%, or more than 1,200, had their factories and other buildings damaged.

Furthermore, over 60%, or 980, answered that they were not in a situation where they could operate. (As of February 8)

Shinkin Bank Chairman Katsuhiro Tashiro first spoke about the harsh reality of not being able to think about restarting or rebuilding business even after more than a month has passed.

Kono Shinkin Bank Chairman Katsuhiro Tashiro

: ``I entered the Oku-Noto area a few days after the earthquake, and the situation was unlike anything I had ever seen before.Roads had collapsed, buildings had collapsed...In order to rebuild... I thought it would take a very long time.After a disaster occurs, the phases will change from emergency, restart, and reconstruction.However, the Oku-Noto area remains in a state of emergency.Business owner Some people have evacuated, so it's difficult to get a full picture of the damage.To be honest, we're not yet in a phase where we can resume business."

What is needed to revive the industry?

As the word is still in the "emergency" stage, many business operators are continuing to live as evacuees.

Damage to buildings and prolonged water outages are major obstacles standing in the way.

Some of them decide to quit their jobs due to age.

Mr. Ta says that what is important now is whether the management can maintain the mindset of business continuity.

This Shinkin Bank offers "disaster recovery loans" with a loan period of up to 15 years and a maximum of 10 million yen as funds for rebuilding lives for disaster victims.

We intend to support business operators by providing repayment moratoriums on loans that have already been disbursed.

Chairman Katsuhiro Tashiro

: ``Earthquakes occur every year, and in a situation where we have to repair or repair, I think it's important to see how much motivation we can provide.The prolonged corona virus, the rising cost of raw materials, etc. It is an extremely difficult situation to have to add to the burden of this disaster on top of the burdens that come from outside the scope of management.We need to carefully consider the combination of procurement through loans and subsidies. I think so.”

After that, we believe that once the infrastructure is restored and we enter the restart/recovery stage, we will be able to provide support that is more typical of a Shinkin Bank.

We are able to provide management advice and secure sales channels through the nationwide network of credit unions because we understand the strengths of individual businesses based on our close ties to the local community.

We believe that revitalizing the industry through these efforts will lead to the revitalization of the region.

Chairman Katsuhiro Tashiro

: ``The two cities and two towns of Oku-Noto have very attractive resources, and these resources support the productivity of the region.What brings out the charm of Noto is the local business. I think it will be difficult to revitalize and rebuild the region unless the business operators themselves revitalize themselves. Not all business operators will give up. ``I want to get it back somehow'' ``I want to continue somehow'' We believe that our mission is to provide as much support as possible to those who feel that way.Of course there are concerns, but we also believe that this is a region that has hope."

A vision for recovery

There is another credit union in this area.

"Noto Kyoei Shinkin Bank"

has its main branch in Nanao City.

Since Wakura Onsen is nearby, many of our customers are in the lodging and food and beverage industries.

One-third of our business partners are small businesses.

This Shinkin Bank also has a loan system for individuals to rebuild their lives with a maximum of 10 million yen, and a special loan line of up to 30 million yen for businesses affected by the disaster.

Chairman Masatoshi Suzuki also stated that it is important for businesses affected by the disaster to be able to move forward, and said that the key to achieving this is to create and share a vision for the future of the region.

Noto Kyoei Shinkin Bank Chairman Masatoshi Suzuki

: ``It's fine when you're going about your daily life, but gradually you start to wonder what's going to happen to you and what will happen to your work.We need to show a recovery vision as soon as possible.'' , managers may lose their motivation.I think it is important to show a vision and share it with the community.Furthermore, rather than simply returning to the original state, we should add value. It may take some time, but we would like to be able to demonstrate a sustainable recovery based on a new concept.To that end, we will also come up with ideas and fulfill our mission as a financial institution. I want to fulfill this goal.”

Shinkin banks in the disaster area join hands

In fact, these two presidents have been in touch almost every day since the earthquake.

Normally we would be rivals, but in the face of this unprecedented situation, we share the same desire to work together to energize the region.

Kono Shinkin Bank Chairman Katsuhiro Tashiro: ``

It is important that financial institutions, the Chamber of Commerce and Industry, and the government work together to provide support.There are limits to what we can do, but we want them to use it as much as possible. Because we exist in

Masatoshi Suzuki, Chairman of Noto Kyoei Shinkin Bank

: ``We want to firmly convey to our customers that we have a system in place to support them so that they can continue to live and work in this area, as well as being an economic pillar for our customers.'' ”

Some of the Shinkin Bank branches we visited for this interview had damaged buildings and were dealing with problems by setting up counseling spaces in corners of employee dormitories.

Some employees come to work from their evacuation sites and work in plain clothes instead of uniforms.

I strongly felt what Kono Shinkin Bank's Chairman Tadori said: ``Because we are in close contact with customers on a daily basis, we have a sense of duty to respond.''

On the other hand, the full extent of the damage to business operators is not yet known, and if business partners are in such a difficult situation, it is inevitable that the management of credit unions themselves will be affected.

I would like to continue reporting on how the industry in the disaster-stricken areas will be revitalized, and how local credit unions will play a role.

(Broadcast on “News 7” etc. on February 12th)

Economic Affairs Department reporter

Airi Enoshima

Joined the Economic Department in

2017 after working at the Hiroshima Bureau.

She is in charge of the financial field.

Kanazawa Broadcasting Station reporter

Masashi Takemura

Joined the station in 2019.

Responsible for the economic field at the Kanazawa station.

Immediately after the Noto Peninsula Earthquake, he continued to travel to the affected areas every day to conduct interviews.