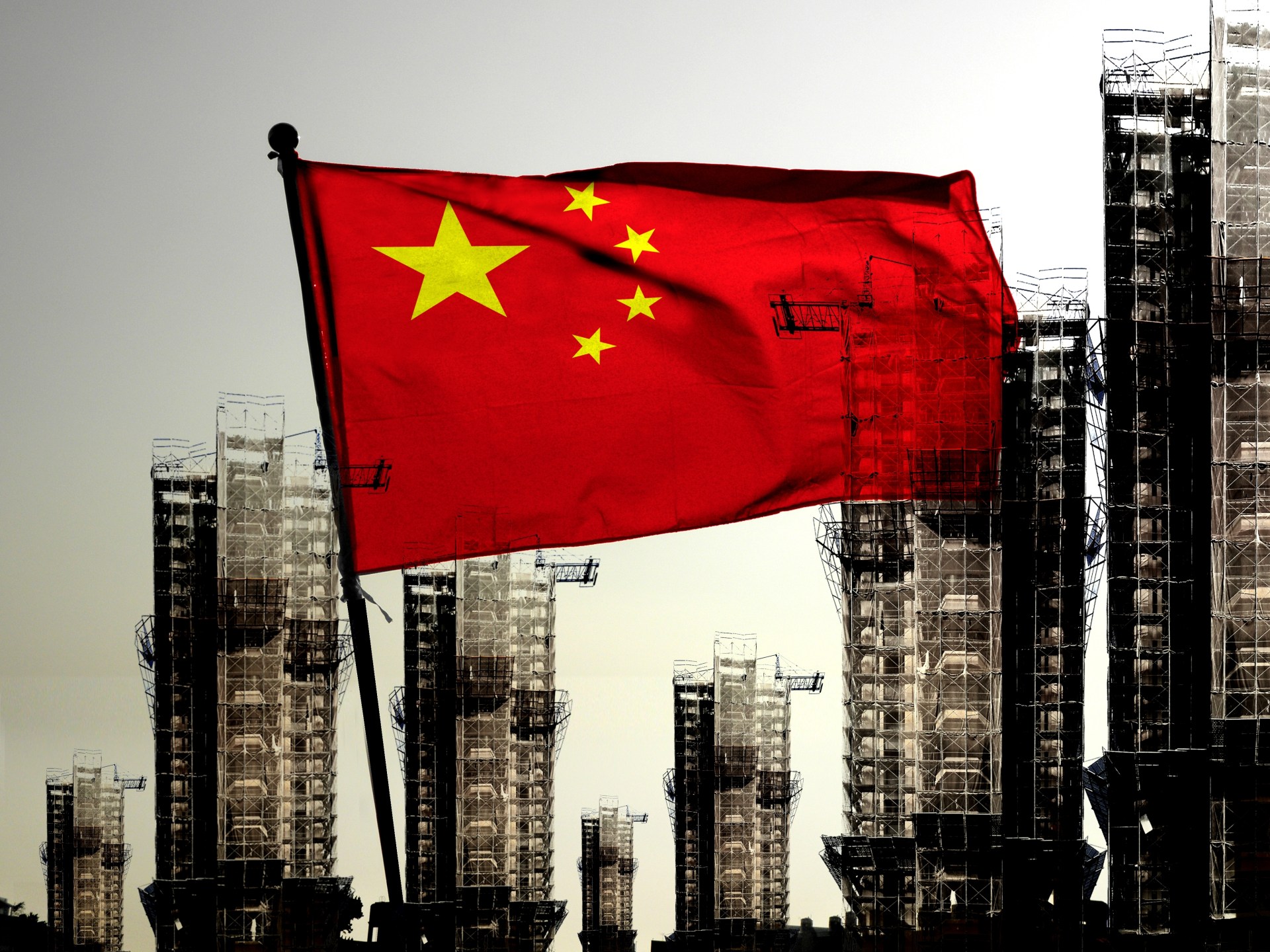

Reducing the interest rate on loans in China will help stabilize confidence and boost investment and consumption (Shutterstock)

China lowered the reference rate for real estate loans - today, Tuesday - more than expected, as the authorities intensify their efforts to stimulate demand for credit and revive the real estate market.

The increase in net interest earnings for commercial banks - after recent cuts in deposit interest rates and the reduction of

banks' mandatory reserves this month - paved the way for lenders to reduce borrowing costs to support the economy.

The key interest rate on the 5-year loan was reduced by 25 basis points (0.25%) to 3.95% from 4.20%, while the 1-year loan was unchanged at 3.45%.

In a Reuters poll of 27 market observers this week, 25 of them expected a cut in the interest rate on 5-year loans, but they expected a cut of 5 to 15 basis points.

The biggest cut since 2019

This is the largest reduction in the interest rate on loans since China updated the loan pricing mechanism in 2019.

The last time China lowered the interest rate on 5-year loans was in June 2023 by 10 basis points.

The yuan fell to its lowest level since last November 20, while real estate stocks rose.

Most new and outstanding loans in China are based on the one-year loan interest rate, while the five-year rate affects mortgage pricing.

The Financial News newspaper, which is supported by the Chinese Central Bank, said - through its official account on the “WeChat” application - that “reducing the interest rate on 5-year loans will help stabilize confidence, enhance investment and consumption, and support the stable and healthy development of the real estate market.”

Efforts to support the real estate sector

While the new reference mortgage interest rate takes effect immediately, existing mortgage holders will not benefit from any reduction in loan repayments until next year, as mortgage interest is repriced on an annual basis.

China has intensified its efforts to rescue the faltering real estate sector. Government-backed media reported last week that government banks had boosted lending to housing projects under a “white list” mechanism aimed at injecting liquidity into the sector affected by the crisis.

20 commercial banks set the key interest rate by submitting proposed rates to the central bank every month.

Last January, a court in Hong Kong ordered the liquidation of China Evergrande, the world's most indebted real estate developer, which constituted a decisive chapter in China's attempts to address the worsening crisis within its real estate sector.

China Evergrande, founded by Hui Ka Yan in the mid-1990s, found itself embroiled in a financial quagmire, as its liabilities exceeded $300 billion against $240 billion in assets.

China is looking at the development of the real estate market, as it shifts from speculative demand to basic demand, which affects future sales, according to what the British Economist magazine reported earlier.

The Economist said at the time that although there was a belief that there was saturation in the real estate sector, assessments indicated that there could be an opportunity for market growth due to the difference in standards related to people’s living space, with the possibility that initiatives - such as the regeneration of village areas and urban areas - would help property developers.

However, real estate market declines reveal financial challenges for local governments, calling for a comprehensive re-evaluation of fiscal policies to prevent default, the magazine adds.

Supportive measures

Last month, China announced a number of measures to support its economy and the faltering real estate sector, the most important of which are:

Real estate facilitation: Guangzhou, one of the largest Chinese cities, has eased restrictions on purchasing homes in an attempt to stop the decline in prices, and Beijing, Shanghai and Shenzhen have reduced down payment requirements since last November.

Aid for real estate developers: by providing a list of housing projects eligible for financing support.

Developing the rental housing market: The People's Bank of China (the central bank) and the Chinese National Public Relations Authority published guidelines for financial support for the development of the rental housing market. This included a policy to encourage banks to provide loans to developers, industrial zones, and some rural organizations and companies, to build new homes for long-term rental. .

Source: Economist + Reuters