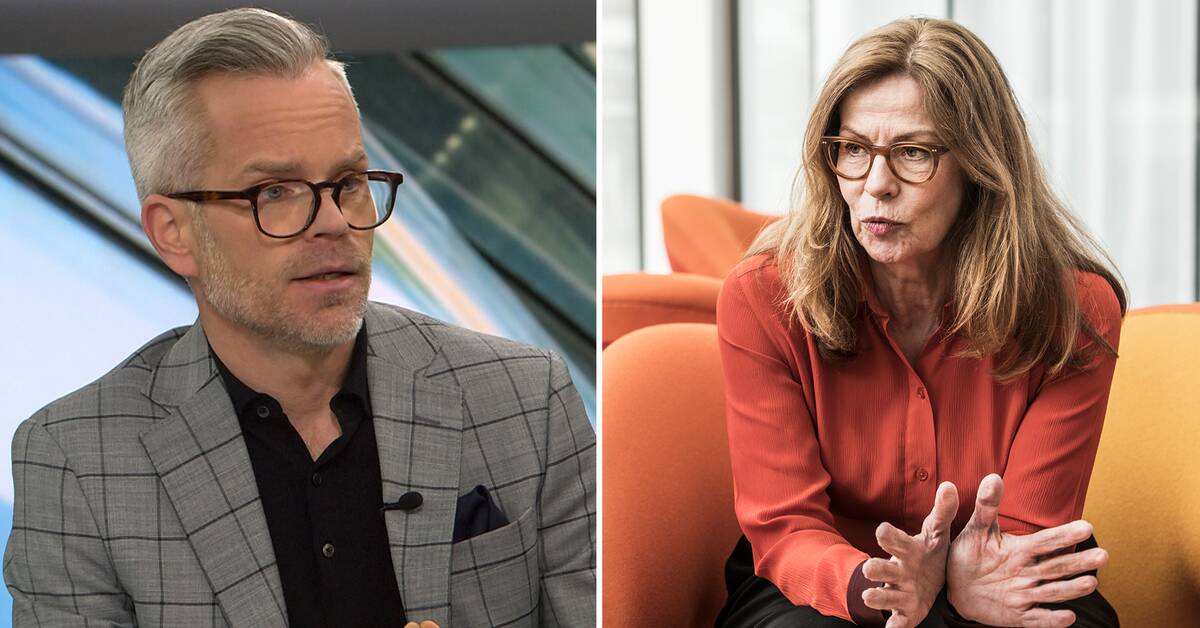

Why is she freed?

The district court judges based on what Bonnesen has said, not based on what reporters meant by their questions - which were not always specific enough - or what headlines were put on the interviews.

The district court believes that her answers were largely correct.

Sometimes unclear, confusing and in some cases "sliding", as they put it in the judgement.

But the dubious answers have not been, in the legal sense, specific enough, but too general to reach criminal liability in the matter of fraud.

In short, although some journalists and the prosecutors think she covered up that Swedbank had problems with money laundering work in Estonia, Bonnesen never said outright that they did not have problems with it.

And therefore she is not considered to have been deluded about it.

She has also mostly spoken in the present tense in her answers about how they handled the money laundering problem, when she was interviewed in 2018 and 2019, and thus she is not considered to have been misled about how the situation was before.

The choice of words and tense, as well as the lack of clarity when there was a slip in the answer, meant that, according to the district court, she stayed on the right side of the law in how she described the bank's actions in the Baltics.

As for the second charge, about unauthorized disclosure of insider information, the Stockholm district court believes that what she told the major shareholders about Uppdrag Granskning's upcoming program was too imprecise to qualify as insider information (such news that can affect the share price and all shareholders must be made aware of at the same time ).

What are the consequences of the verdict?

CEOs will blow their noses if the verdict is upheld.

If she had been convicted, the requirements would have been tightened on how to communicate as a stock exchange CEO.

Requirements that are already fairly strict in terms of what information such a person receives or should disclose.

Especially in the case of a bank, with money laundering and bank secrecy legislation already cutting their leeway quite a bit.

For journalists, this will be a textbook example of journalism college and interview courses, with the lesson: open questions in all their glory, but not for unspecific questions.

If you want a clear answer to a concrete question, it must be very specifically formulated, in any case if the answer is to hold up in court, so to speak.

What does this mean going forward for Bonnesen and Swedbank?

Obviously a relief for Bonnesen, and a triumph for the defense lawyer.

There are not many fraud cases in the past, and this is a real ten-pointer in the legal context: never before has a CEO of a major bank been prosecuted in this way.

But the question is whether this is not just the first act.

In part, it can be appealed by the prosecutor.

And then probably more fines await for Swedbank, which has already paid 4 billion to the Swedish Financial Supervisory Authority.

Around the corner lurks a multibillion-dollar bot in the US.

Danske Bank, which started it all, ended with that bank recently paying SEK 22 billion in a settlement with American and Danish authorities for its involvement in the money laundering scandal in the Baltics.