The economy in 2023 seen by the top management of the company is January 6, 15:08

What will happen to the economy this year?

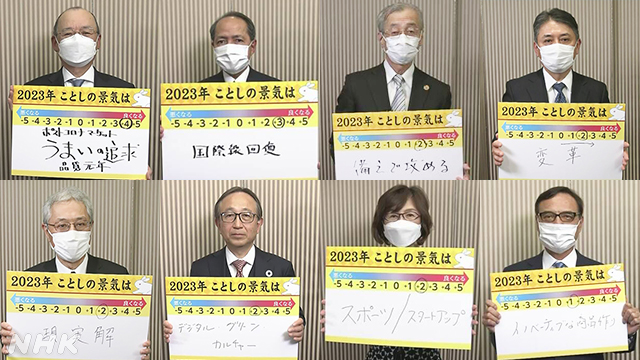

At the New Year celebrations of the three economic organizations, we asked eight top management about their outlook.

In 2022, there were a series of developments that had a major impact on the Japanese economy and corporate performance, such as Russia's invasion of Ukraine, price increases at historical levels, and the rapid depreciation of the yen.

The reasons for the forecasts given by the managers also show their individuality and characteristics.

(Economics Department reporter Tomokazu Katsuki)

Economic average is "2.3"

This time, NHK gave "+1" to "+5" to the top management of eight companies if the economy will improve in 2023.

When it gets worse, I was asked to indicate it with a number from "-1" to "-5".

The result.

The average of eight people is "2.3".

Since it is a New Year's celebration, there are many cases where upward figures are shown with expectations, but this year I get the impression that they are a little cautious.

+4) Skylark Holdings Chairman and President Tanima

The economy will recover gradually in the first half of this year, and inflation will basically peak out.

I believe that the Japanese economy will improve, centering on the manufacturing industry.

Under such circumstances, demand will expand significantly, and I think the economy will clearly improve in the second half of this year.

I think that the unavoidable inflation is continuing due to the cost push including imported ingredients, but I believe that companies will respond to wage increases including the spring labor offensive, so from that point on in the true sense of the word. In other words, prices rise as a result of increased demand.

I believe that this kind of period will become the driving force for the upward trend of the Japanese economy from the second half of the fiscal year to the fourth quarter (=next year).

+3) ANA Holdings Koji Shibata, President

In response to the after-coronavirus, the global economy has regained its composure.

Demand trends in the air transportation business are steadily recovering for both domestic and international flights, and I feel that business demand is particularly strong.

I expect that the Japanese economy will recover steadily towards the end of the year in the second half of this year.

I feel that demand for inbound tourists to Japan will undoubtedly regain momentum.

South Korea, Taiwan, and Australia are steadily growing.

Sometime this year, it may grow to the point where it will last even before the corona crisis.

China, which accounted for about 30% of the total before COVID-19, is close to zero.

+2) IHI Chairman Jiro Mitsuoka

A recession is a hot topic, especially in the United States.

We do not know what will happen to Europe and the United States, or to China, which has distanced itself from its zero-corona policy.

In contrast, he hoped that the Japanese economy would be able to achieve solid growth if it worked hard.

"Attack with preparation".

Over the past year, or even the last few years, so many things have happened that you can't even imagine.

In the future, it is necessary to know how to prepare for such things and how to deal with them positively.

I believe that this will be a year in which we prepare creatively and seriously work on how to develop investments where necessary.

+2) Yoshinori Hirai, President of AGC

We expect a stronger recovery in the second half.

The point is when the three factors, namely, the Russia-Ukraine problem and related raw material prices, inflation and high interest rates centered on the United States, and the turmoil accompanying the shift from China's zero-corona policy, will start to recover.

At the very least, we expect trends in the US and China to recover in the second half.

If these two superpowers recover economically, I think the Japanese economy will also benefit.

+2) Kenichi Hori, President of Mitsui & Co., Ltd.

I am a little cautious about rising prices, but there is still room to capture the recovery demand from the new corona, and Japan will appear later than Europe and the United States, so I have high hopes for this year.

Since it is necessary to promote business development and research investment for the low-carbon society of the future, it is extremely important to be conscious of the time axis and provide a "realistic solution" while looking at both the present and the future. is.

I think that the energy supply and demand relationship will continue to be highly uncertain, so we will need to take measures to keep aside this year as well.

Anyway, the important thing is how to decentralize procurement and build a backup supply chain.

+2) Hironori Kamezawa, President of Mitsubishi UFJ Financial Group

Basically, it will recover gradually.

Personal consumption is strong, especially in services, corporate performance is moderate, and capital investment is strong.

In addition, there are recovery of inbound and economic measures of the government, so I took this view.

I think the exchange rate will still fluctuate, but since it moved that much last year, I think it will move within a certain range.

Basically, stable movements are better than big fluctuations.

I'm not too pessimistic about stock prices.

Japan is expected to grow moderately, and the US economy may not collapse so badly either.

Speaking of risks, one risk is that inflation in the United States will be prolonged and difficult to control.

+2) DeNA Chairman Tomoko Namba

In the post-corona era, it may be a year in which things that have been suppressed, such as inbound tourism, will make a strong comeback.

Although there are risks in overseas economies, there is a high possibility that Japan, which is rare, will have a good economy driven by domestic demand without relying on overseas economies.

(Regarding the development of start-up companies in Japan) The government has created a five-year plan, and the private sector must work harder than that.

DeNA has yet to win big in the world, so we want to increase our competitiveness by aiming for a ceiling ten times higher.

The biggest medium- to long-term risk to the Japanese economy is the lack of economic dynamism.

Japan's economy will lose its competitiveness unless we create a foundation for new heroes to emerge.

+1.5) Suntory Holdings Takeshi Niinami, President

I think inflation will continue.

In the first half of the year, the situation will be extremely difficult due to price hikes in the supply chain and other areas, but I think things will gradually improve in the second half.

Already, there is a trend toward private brands and cheap products.

Among them, wages will gradually increase, mainly in April, and people will want to buy good and interesting things little by little.

Inflation is lowering the standard of living of employees.

I think that it is necessary for management to support it.

In order to bring about innovation, it must be a dynamic company.

Raising wages for that purpose is a very important “investment in people” as a manager.

Managers have a heavy responsibility for economic recovery

One after another, the top management talked about "overseas developments" such as economic and price trends in the United States and China, as well as the situation in Russia and Ukraine.

Of course, these external factors will have a major impact on the Japanese economy.

However, even so, it is an important key whether the managers of Japanese companies act proactively.

From the words of the executives this time, I got the impression that they did not have a strong desire to improve the domestic economy.

In order for the Japanese economy to return to a virtuous cycle, this year will depend on how far wage increases will progress and how widespread they will be in the midst of rising prices.

Under these circumstances, it is somewhat worrisome that few respondents cited "increased wage increases and increased domestic consumption" as factors for an economic upturn.

Furthermore, unless the movement to raise wages spreads to the small and medium-sized enterprises that make up about 70% of the workforce in Japan, a virtuous circle of consumption expansion and the economy will never materialize.

The responsibility of the management is heavier than ever, and I would like to expect the spread of positive movements.

Economic Department Reporter

Tomokazu Katsuki Joined the Bureau in

2007

After working in the Economic Department and the Osaka Bureau, he is currently

in charge of reporting on the business world and trading companies.