- We have a need to bring down inflation in Sweden and then we raise the interest rate.

If you then start to compensate for that by changing the amortizations at the same time, it counteracts the monetary policy and then you are almost asking for even higher interest rate increases, he says for 30 minutes.

So you mean that if the amortization requirement is dropped, the interest rate will rise?

- At least it points in that direction.

But it is not entirely unusual that in all possible economies you want to do something that you shouldn't.

There is always an aspiration to seek a free lunch here and now.

This usually leads to greater problems later on.

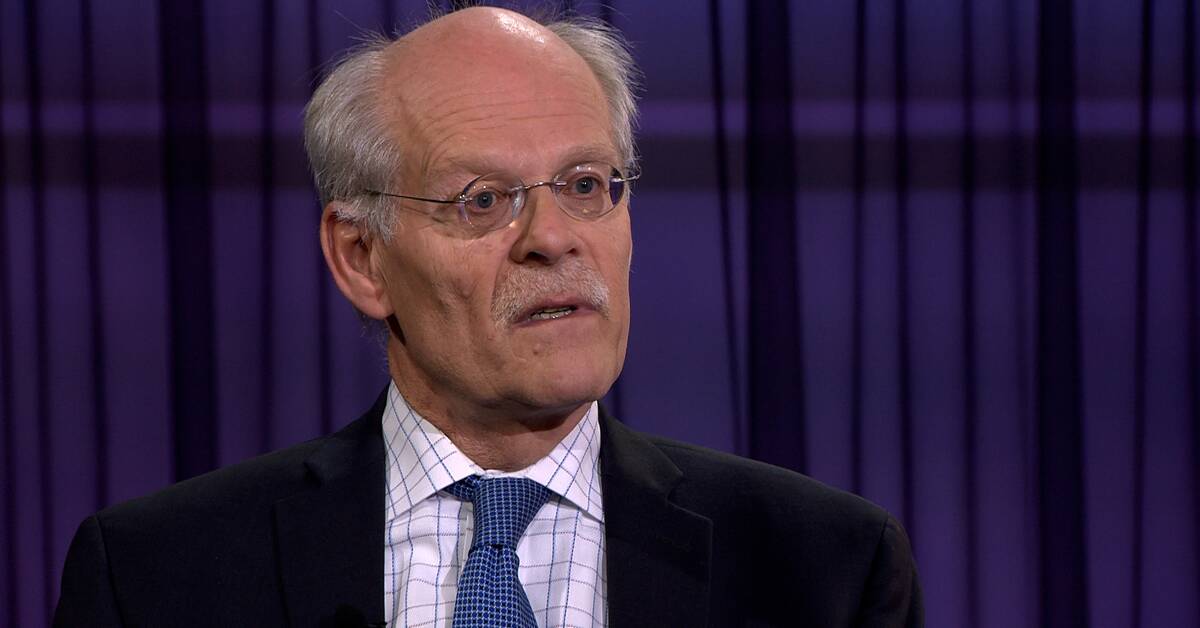

Here you can see the entire interview with Stefan Ingves.