The Riksbank, the National Institute of Economic Research, the social partners.

Almost every time there have been new monthly figures on rising inflation in the past year, the comment has been that, among other things, high electricity and fuel prices are temporarily high.

And that there is therefore no reason to adjust either the interest rate or the salaries.

But this can now change after February's record high inflation rate figure.

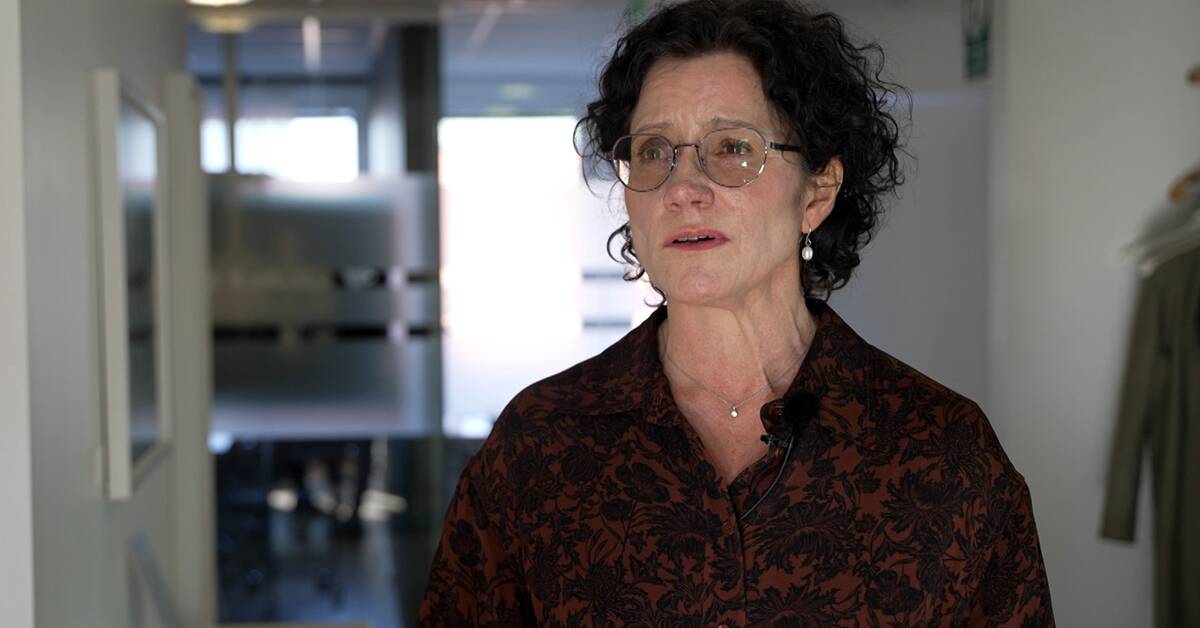

- We have said so before, but temporary effects that remain for a long time and surprise all the time it makes you start to expect that this may remain.

And what matters is what companies and individuals like you and I think about future inflation.

Then it can be self-fulfilling, says Ylva Hedén Westerdahl.

Can it be so now?

- Yes, I think so.

There is a risk that right now the stars are a little right.

Companies have long felt pressured by rising prices, declining margins, and you are here talking.

This means that there will be an increased awareness of and greater acceptance that prices will rise.

And that is what we will see.

Then it can be easier to send through the prices, says Ylva Hedén Westerdahl.

She also points out the fact that Sweden currently also has a weak krona, which also makes imported goods more expensive.