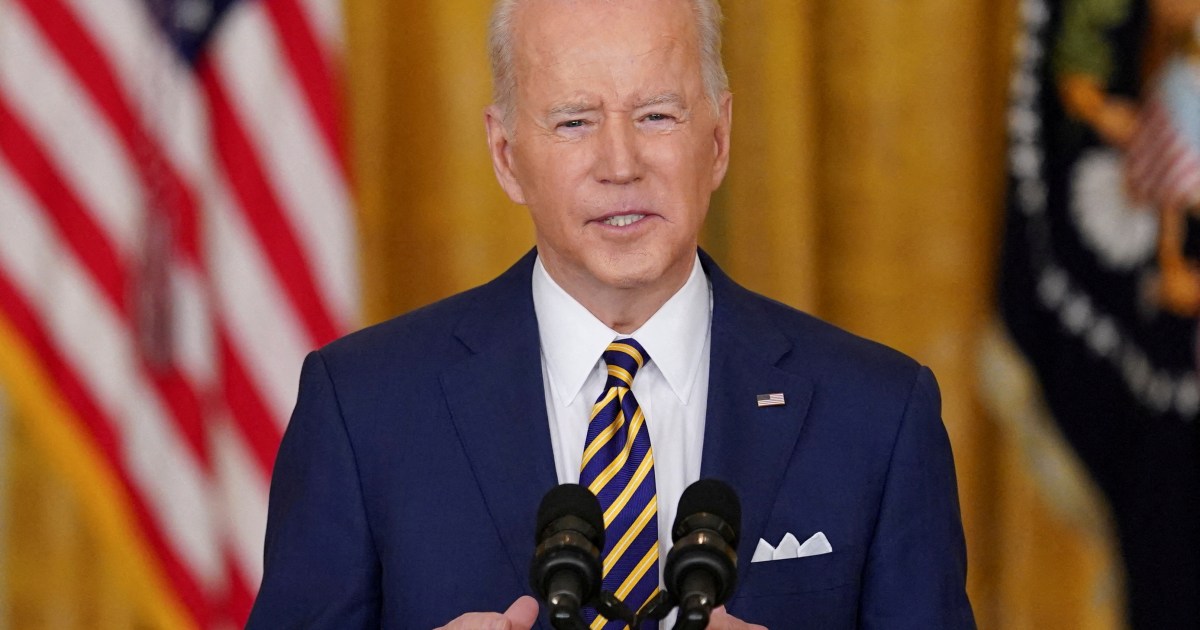

Reuters quoted US sources as saying that President Joe Biden signed a decree today, Friday, allowing the disposal of half of the financial deposits of the Afghan state frozen in American banks, estimated at seven billion dollars, and Biden wants to allocate half of it to compensate the families of the victims of the September 11, 2001 bombings.

The sources pointed out that President Biden's decree provides for the use of $3.5 billion from the Afghan Central Bank's funds to fund humanitarian aid programs for the Afghan people, without enabling the Taliban government to dispose of it.

Under the decree, half of Afghan deposits in US banks will be held to settle legal disputes related to compensation for the families of the victims of the September 11, 2001 attacks.

The White House explained that President Biden used "special economic powers" granted to him by law dating back to 1977, and intends to transfer the assets of the Afghan Central to a frozen account of the Federal Reserve in New York, which is a public institution.

complicated procedure

A senior White House official acknowledged at a press conference that the Biden administration's handling of Afghan funds is "legally complex," and said today's announcement was just the beginning of a process that could last months.

This path chosen by President Biden will raise a lot of controversy at a time when Afghanistan is experiencing a serious humanitarian crisis.

The total reserves of the Central Bank of Afghanistan at the end of last April amounted to 9.4 billion dollars, according to the International Monetary Fund. About 7 billion dollars are in the United States, and the rest is distributed to countries such as Germany, Switzerland, the UAE and Qatar.

White House officials explained that the Central Bank of Afghanistan's reserves are partly due to the international aid the country received, especially from the United States, which was the largest foreign donor to the Afghan government before the Taliban movement seized power in August 2021.

Last November, the Taliban called on the US Congress to release the assets of the Afghan Central Bank to face the difficult humanitarian and economic situation in the country, and Russia urged the United States in particular to release these assets.

The United States froze billions of dollars of Afghan foreign assets after the Taliban seized power in Afghanistan, and the flow of foreign financial aid to the country was also stopped. International banks fear that the sanctions imposed by the United Nations and the United States on the Taliban, who are listed on the US and UN terrorism list, will extend to them.

international plan

In a related context, an internal memo to the United Nations, seen by Reuters, showed that the international organization aims this month to create a system for the exchange of aid in millions of dollars in the Afghan currency, in a plan aimed at alleviating the humanitarian and economic crises, while not passing money through the Taliban and its leaders. Blacklisted.

The UN explanatory note, written last month, outlines the so-called humanitarian exchange programme, which it describes as a "much needed" mechanism.

The program will allow the United Nations and humanitarian organizations to access large sums of local Afghani currency, which are held by private companies in the country.

In return, the United Nations will use the aid money, valued at tens of millions of dollars, to pay off those Afghan companies' debts to foreign creditors, thus supporting the ailing private sector and bringing in vital imports.

The United Nations warns that more than half of Afghanistan's 39 million people suffer from severe hunger, and that the economy, education and social services are on the verge of collapse.