"Three Challenges" Faced by Japanese Finance Interview with Financial Services Agency Secretary Nakajima August 25, 16:26

Population decline, corona stagnation, and prolonged ultra-low interest rates.

The harsh environment continues not only for local industries and small and medium-sized enterprises in each region, but also for the financial institutions in the regions that support them.

With the reorganization and integration of regional banks one after another, the new Secretary of State Junichi Nakajima was appointed as the top secretary of the financial administration and the Commissioner of the Financial Services Agency.

How to tackle the "three challenges" facing Japanese finance?

(Meiji University, Reporter, Ministry of Economic Affairs)

Issue 1 Support for financing for corona

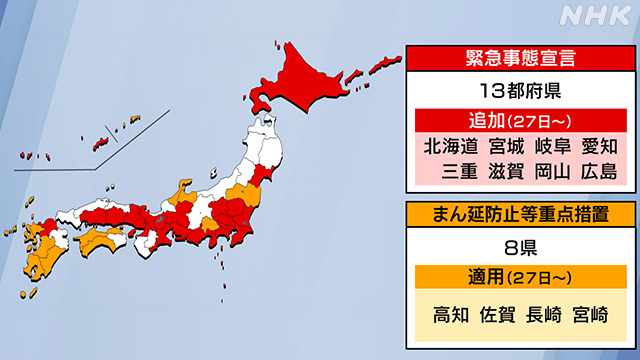

"The scope of the state of emergency has expanded and the time has extended. For financial institutions and the Financial Services Agency, responding to the new corona is still the biggest challenge in the past year."

While the medal rush of Japanese athletes continued at the Olympic Games, the infection was spreading rapidly on August 5.

In his first independent interview since taking office, Secretary Nakajima cut out the biggest themes to be tackled in the past year.

“Given that some companies are greatly affected by Corona, financial support will continue to be important. The Financial Services Agency will provide financial institutions with maximum flexibility regarding new loans and changes in terms and conditions. However, I would like you to continue to take all possible measures so that the financial management of the business operator will not be hindered. "

From a unique "science"

Secretary Nakajima is 58 years old from Kanagawa prefecture.

At the university, he is a unique "science" secretary for the Financial Services Agency, which was researching programming that performs graphic processing on a computer.

For one year before taking office, as the director of the General Policy Bureau, which is responsible for inspection functions for policies and financial institutions, he responds to cases of illegal withdrawal of deposits and savings through electronic payment services, and integrally manages inspections by the Financial Services Agency and examinations by the Bank of Japan for financial institutions. We worked on the construction of a monitoring system.

With the rapid progress of digitalization of finance, Secretary Nakajima, who is familiar with these fields, was entrusted with the steering of financial administration.

Issue 2 “Regional bank reorganization” to strengthen the management base

Secretary Nakajima attaches great importance to "regional financial institutions such as regional banks" as a measure against corona.

For that reason, there are also orders for regional banks.

Secretary Nakajima

"For businesses in a difficult situation in Corona, there are government-affiliated financial institutions, but I would like regional financial institutions to play a central role in support. However, it is important that the financial institution's own management base is solid. "

The Financial Services Agency has positioned "reorganization of regional banks" through mergers and integrations as one of the options for strengthening the management base of regional banks.

For this reason, we have prepared the following measures.

● Enforcement of a special law that excludes the application of the Antimonopoly Act for mergers and integrations of regional banks within the same region ●

Relaxation of business regulations of banks that allow regional businesses ●

Costs for mergers and integrations in collaboration with the Bank of Japan "Funding system" to partially subsidize

The regional banks themselves have created an environment in which they can easily decide to reorganize, so to speak, they are setting up.

In fact, in May this year, the same regional banks in Aomori Prefecture, "Aomori Bank" and "Michinoku Bank," reached a basic agreement on a business integration, and in July, "FIDEA Holdings" (under the umbrella of Yamagata / Shonai) in the Tohoku region. Bank, Aomori Bank, Hokuto Bank) and Tohoku Bank (Iwate) have reached a basic agreement to promote business integration across prefectures.

Secretary Nakajima

"Is there a management base that can respond firmly to corona? I want each financial institution to steadily proceed with necessary efforts on a time axis while utilizing these measures. As for each regional bank, I don't mean that it is completely drawn, so the Financial Services Agency wants to continue to have a polite dialogue with each financial institution. "

“The place to play” with an eye on the future

The Financial Services Agency focuses on strengthening its management base, including the reorganization of regional banks, because it has had a bitter experience in the past that the disposal of non-performing loans of banks that swelled after the burst of the bubble was delayed and regional financial institutions went bankrupt one after another. ..

Regarding the financial soundness of regional banks, Secretary Nakajima says that the non-performing loan ratio is generally low at this point and there is no problem.

On the other hand, Prime Minister Suga said in September last year that "there are too many regional banks in the future," and it became a hot topic.

There are 100 regional banks nationwide, and there is growing interest among industry insiders asking, "Where is the next reorganization? How many reorganizations will proceed?"

Regarding this, Secretary Nakajima emphasized, "I have no image of the number. It is important for each financial institution to make management decisions."

However, in addition to the environment such as "population decline" and "ultra-low interest rates", the so-called "post-corona", economic revitalization after the spread of infection has converged, and the future ahead, now is the "game". There is no doubt that you are catching it.

Issue 3 Mizuho Response to large-scale system failures

Two weeks after this interview, Mizuho Bank experienced its fifth system failure, which is another issue that the Financial Services Agency should address.

At Mizuho Bank, four system failures occurred in less than two weeks from February to March, and the Financial Services Agency began inspections to investigate the cause and prevent recurrence.

It has been almost half a year since then, but the inspection continues and it is an unusual length.

As of August 5, prior to the fifth trouble, Secretary Nakajima said:

Secretary Nakajima

"We will thoroughly investigate the cause and urge financial institutions to improve their operations based on the results. Even if there is a problem, how to minimize the impact of customers and users I would like you to properly address the risk management system as a management issue, including what to do and how to expedite recovery. "

Mizuho suffered a large-scale system failure in 2002 and 2011 after the group was established, and the Financial Services Agency has issued administrative sanctions at that time as well.

In the situation where large-scale troubles are repeated, some executives of the Financial Services Agency have pointed out that "the same thing will be repeated if the true cause is not determined", but this is the fifth system failure. Is a form in which that concern has become a reality.

The Financial Services Agency has issued an additional report request order to Mizuho, requested a report by the end of August, and is considering issuing an administrative punishment including a series of troubles.

Three issues are "support for financing for the new corona", "strengthening the management base of regional financial institutions including reorganization", and "finding the cause of Mizuho's system failure and preventing recurrence".

It will be a year in which the skill of Secretary Nakajima will be questioned.

Reporter of the Ministry of Economic Affairs

Meiji Shiraishi

Joined the

Bureau in

2015

After working in charge

of the

steel industry of the

Ministry of Economic Affairs

, interviewed the

Financial Services Agency and

regional banks

from September last year.