Current location of the Japanese economy as seen from a survey of 100 companies (1) -When is the economic recovery?

August 11, 17:40

The Tokyo Olympics are over.

The recovery of the Japanese economy should have become more powerful as it became a "proof of overcoming the virus."

But now, with the proliferation of mutant virus infections, the situation is only getting worse every day.

When will the Japanese economy return to pre-corona levels?

NHK conducted a survey of 100 major domestic companies to find out their current location.

(Economics Department Reporter Yosuke Ikegawa)

[Questionnaire of 100 major companies]

-Implementation period July 21-August 4, 2021

-Implementation method WEB questionnaire

-Target 100 domestic companies (answers were received from all companies)

More than 70% of economic recovery is "after next year"

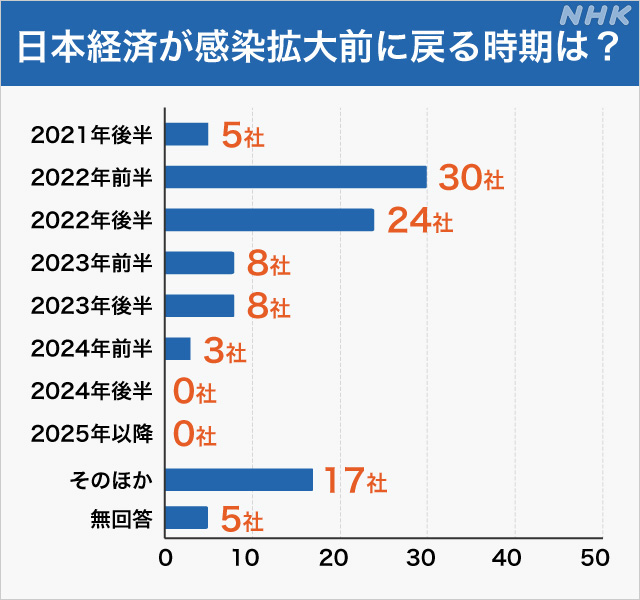

Q When do you expect the Japanese economy to recover to pre-corona levels?

The most common answer was 30 companies in the first half of 2022.

This was followed by 24 companies in the latter half of 2022.

In addition, there are 16 companies in "2023" and 3 companies in "2024", and it can be seen that more than 70% of the companies think that the full-scale economic recovery will be "next year or later".

The government has indicated that the economic recovery will begin in earnest as vaccination progresses, and that GDP will return to pre-corona levels during this time.

However, it can be seen that companies are taking a strict view of economic recovery due to the rapid spread of infection by mutant viruses and the delay in vaccination.

Economic recovery Personal consumption is the key

Q What are the necessary things and challenges for the recovery of the Japanese economy?

The most common answer was "recovery of personal consumption" at 82 companies.

This was followed by 26 companies for "large-scale government economic measures," 23 companies for "increased capital investment," and 19 companies for "responding to decarbonization."

This is a voice from a company.

"It is necessary to advance vaccination of the working generation and normalize the flow of people"

(first half of 2022, trading company)

"It is important to restore personal consumption by relaxing restrictions on economic activities"

(2022) First half, manufacturer)

"Amid concerns about a decline in the labor force due to the declining birthrate and aging population, it is necessary to increase productivity through the progress of national DX conversion"

(second half of 2022, finance)

While there were many voices saying that it was necessary to return the flow of people to the front of Corona due to the spread of vaccines, there were also voices calling for the need to solve the problems of the Japanese economy that had been pointed out before Corona.

Achievement "polarization" clearly in Corona

On the other hand, I asked about the current perception of the domestic economy.

The most common was "flat" with 54 companies.

"Expansion" was 1 company, "gradual expansion" was 39 companies, and "gradual retreat" was 3 companies.

We asked the companies that answered "flat" why.

Reasons for "flattening" (multiple answers)

Restrictions on economic activities due to declarations of emergency, etc. 85.2% Slow

growth in personal consumption 83.3%

Delayed vaccination 48.1%

On the other hand, this is the reason for companies that answered "expansion" and "gradual expansion."

Reasons for "expansion" and "moderate expansion" (multiple answers)

Recovery of the US economy 72.5%

Spread of vaccination 55%

Recovery of the Chinese economy 50%

Why did the opinions differ so much between "flat" and "gradual expansion"?

As the effects of the Corona disaster continue for a long time, there is a clear polarization between industries that have been affected by the increase in demand due to the economic recovery of the United States and China and those that have been affected by refraining from going out. It is.

As announced by Toyota Motor Corporation, the Group's financial results from April to June reached a record high of 897.8 billion yen, which is about 5.6 times the same period of the previous year.

In the United States and China, where the economy is recovering steadily due to the progress of vaccination, the demand for cars is increasing, and the recovery is clear, exceeding the level before the spread of infection.

In addition, the Sony Group is also seeing strong sales of music distribution due to so-called “needing demand”.

Operating income, which indicates the profit of the main business, increased by more than 26% from the same period of the previous year to 280 billion yen, which was also the highest ever for this period.

On the other hand, the financial results of the entire group from April to June, which are the major airlines ANA Holdings and Japan Airlines, are both in the red with a final profit or loss of over 50 billion yen.

Isetan Mitsukoshi Holdings, a major department store, is also in a difficult situation with a final loss of 8.6 billion yen due to the closure of the sales floor following the declaration of emergency.

Due to repeated refraining from going out due to repeated declarations of emergency, the movement of people has decreased significantly, and the decline in business performance in transportation and retail has not stopped.

Mutant virus causes economic recovery

What will happen to the economy in the future?

Macroeconomic experts expect the economic recovery to begin in earnest early next year.

Mr. Yasuo Yamamoto, Research Department, Mizuho Research & Research Institute

"I think there is no doubt that the delay in vaccination compared to developed countries in Europe and the United States has had a major impact on business sentiment, and the economic recovery has been delayed compared to the initial expectations of companies. However, if the vaccine spreads and the infection is resolved, consumption activities will become active, and the economic recovery will start from October to November, and the full-scale recovery may be from January to March next year. Is high "

Furthermore, such an indication.

"If it takes time to lift restrictions on economic activity due to the spread of the mutant virus, the recovery period may be further delayed. The food and beverage and travel industries are already in a situation where their debts are swelling due to financial support. If the recovery of economic activity is delayed, the risk of bankruptcy and business closure will increase. "

Corporate expectations betrayed

We did a similar survey in March.

At that time, when asked what happened to the domestic economy six months later, that is, around September, more than 80% of the respondents answered that they would "expand" or "slowly expand."

However, the spread of the highly infectious mutant virus "Delta strain" has betrayed the expectations of companies.

Next time, we will ask Japanese companies about issues that are spreading worldwide, such as "semiconductor shortage," "decarbonization," and "human rights issues."

(Responding companies, in alphabetical order)

IHI, Asahi Kasei, Asahi Group Holdings, Ajinomoto, Aeon, Isuzu Motors, Idemitsu Kosan, ITOCHU, Internet Initiative, AGC, ANA Holdings, SG Holdings, ENEOS Holdings, Oji Holdings, Kao, Kashima Construction, Kawasaki Heavy Industries, Canon, Kyocera, Kirin Holdings, KDDI, Komatsu, Cyber Agent, JFE Holdings, JTB, J.K. Front Retailing, Shiseido, Shimizu Construction, Sharp, Shosen Mitsui, Sukairaku Holdings, Suzuki, SUBARU, Sumitomo Chemical, Sumitomo Metal Mine, Sumitomo Corporation, Seibu Holdings, Z Holdings, Seven & i Holdings, Zensho Holdings, Sony Group, Daiwa Securities Group Headquarters, Takeda Yakuhin Kogyo, Chubu Electric Power, Tsuruha Holdings, DNA, Denso, Tokai Passenger Railway, Tokio Marine Holdings, Tokyo Gas, Tokyo Electric Power Holdings, Toshiba, Toray, Letterpress Printing, Toyota Motor, Nissan Motor, Nippon Paper , Nippon Steel, Nippon Electric, Nippon Telecom, Nippon Airlines, Nippon Life Insurance Company, Nippon Densan, Nippon Unisys, Nintendo, Nomura Holdings, Hakuhodo, Panasonic, East Japan Passenger Railway, Hitachi Construction Machinery, Hitachi, Big Camera, First Retailing, Family Mart, Fujitsu, Fuji Film Holdings, Bridgestone, Mazda, Marelli, Mizuho Financial Group, Sumitomo Mitsui Financial Group, Mitsui & Co., Mitsui Real Estate, Mitsui Isetan Holdings, Mitsubishi Chemical Holdings, Mitsubishi Motors, Mitsubishi Heavy Industries, Mitsubishi Corporation, Mitsubishi Electric, Mitsubishi UFJ Financial Group, Murata Seisakusho, Meiji, Mercari, Mos Food Service, Yamato Holdings, Yamaha Motor, Uni Charm, Rakuten Group, Recruit Holdings, Lawson

Reporter of the Ministry of Economic Affairs

Yosuke Ikekawa

Joined in 2002

After working at the Sendai station and Yamagata station, he is currently affiliated.