Last year, Swedish households' total mortgages increased by 5.7 percent.

In the spring of 2020, there was talk of a Corona effect and that the pandemic would slow down price developments, partly due to rising unemployment.

- Unemployment rose per se, but it did not get so bad for all groups.

There were very many who could afford to get housing.

And not least because of the pandemic, there was a need to move to villas, says Cecilia Hermansson, researcher at KTH.

In January 2021, households' total mortgages were SEK 3,658 billion.

- It sounds a bit drastic, but yes, it is the highest debt figure we have had, says Nathalie Persson-Linde, who works with economic statistics at Statistics Sweden.

"A sensitivity in the system"

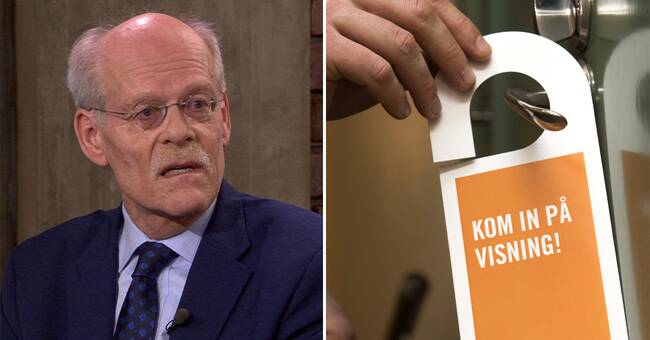

Finansinspektionen's director general Erik Thedéen tells Ekonomibyrån that household debt has risen for many years and according to him it is not a problem as long as the economy is otherwise stable, interest rates are low and employment is fairly good.

- Then we can live with these debts, but we have built a sensitivity into the system.

If you lose your job, if interest rates go up or prices go down, nothing happens to the debts, says Erik Thedéen.

Other measures are needed

At the same time as housing prices, and mortgages, have risen, interest rates have fallen for many years.

The question is whether higher interest rates can dampen the rise in prices.

- If we look at other countries with low interest rates, prices have not risen as much.

There are concerns regarding the supply of housing, there are concerns regarding the regulations in Sweden in the housing market, says Stefan Ingves.

Cecilia Hermansson believes that political measures are needed to reduce debt.

- Using the interest rate is a bit like using a hammer when you have to operate on a brain tumor, it will contribute to the whole economy getting into trouble.

Other measures are needed here.