The Federal Reserve Board of Governors, the central bank of the United States, said on the 24th that the current zero interest rate policy, which is being carried out to support the depressed economy due to the new coronavirus, may continue after 2024. Suggested.

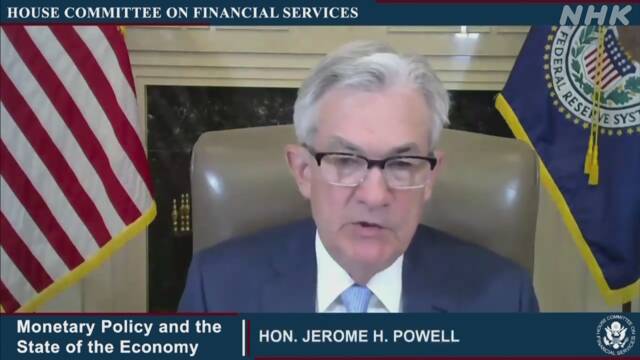

This was stated at a committee of the House of Representatives held on the 24th.

In this, Chair Powell said, "I think we can reach the target, but it may take three years or more," regarding the timing of achieving a sustainable price increase of 2%, which is a prerequisite for ending the current zero interest rate policy. Said.

The Fed has announced that it will introduce a zero interest rate policy last year to support the depressed economy with the new coronavirus and maintain it until the end of 2023, but Powell's statement this time must meet price targets. For example, it suggests that it may continue after 2024.

Powell also said that quantitative easing measures such as the purchase of government bonds introduced along with the zero interest rate policy "will purchase assets at least at the current pace until major progress is made toward achieving the policy objectives." Said.

In the United States, some speculate that the Fed may begin to curtail current monetary easing as vaccination progresses and economic activity returns to normal, but Powell said the outlook for the economy remains uncertain. However, he emphasized the attitude of continuing the current monetary easing.