In Russia, the possibility of legislative consolidation in the Criminal Code of responsibility for "tax fraud" is being discussed. This was reported to RIA Novosti by Deputy Chairman of the Investigative Committee of Russia, Colonel-General of Justice Elena Leonenko.

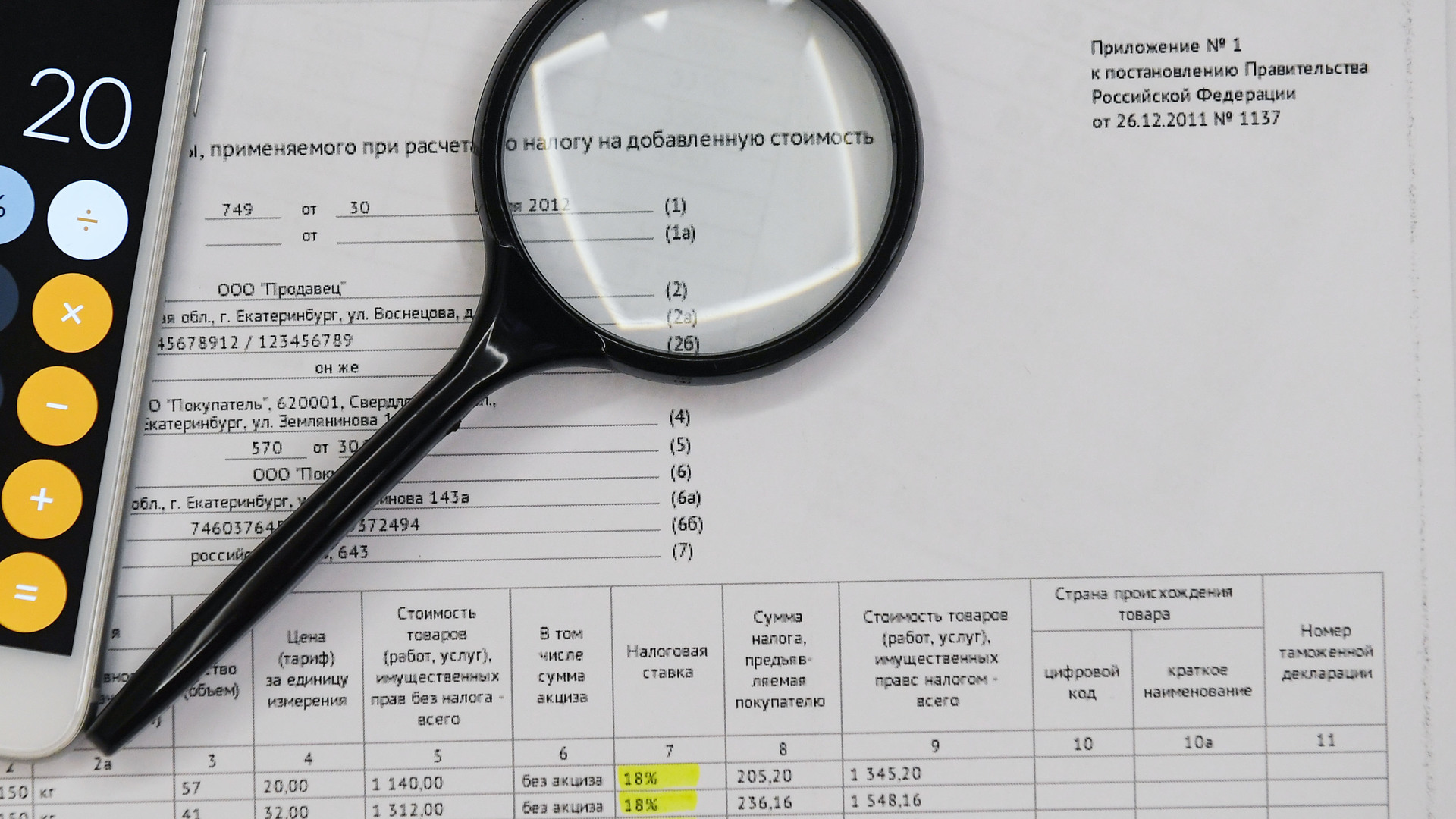

She recalled that traditionally four articles of the Criminal Code belong to tax crimes: from 198 to 199.2, as well as article 159 (“Fraud”). According to Leonenko, usually we are talking about illegal reimbursement of value added tax (VAT) from the budget.

“A tax crime, if we take Article 199 of the Criminal Code of the Russian Federation, which speaks of tax evasion from a legal entity on an especially large scale, provides for up to six years in prison, while Article 159 of the Criminal Code of the Russian Federation, which qualifies embezzlement by deception in particular on a large scale, provides for up to 10 years in prison, that is, the penalties are different. However, in practice, there are cases when the same actions committed by certain persons may be qualified in different ways, under Article 159 and Article 199, ”said Leonenko.

According to her, in this regard, the question arose about improving the criminal legislation.

“We are having a discussion with colleagues to propose to the legislator to introduce a new corpus delicti -“ Tax fraud ”. But this issue is still being discussed, and it is too early to say something concretely about it, ”the Deputy Head of the Investigative Committee emphasized.

According to RIA Novosti, work on the bill was carried out by the Prosecutor General's Office, the Federal Tax Service, the Ministry of Internal Affairs and the Investigative Committee.

- © Nina Zotina / RIA Novosti

As noted by the lawyer, specialist in international law Maria Yarmush, the Russian budget annually loses billions due to non-payment of taxes and other crimes in the field of tax legislation. According to her, the proposal of the security forces will make it possible to more clearly identify the corpus delicti and attract the perpetrators.

“I think it will help. This will be a preventive measure, the fact that enterprise managers will be afraid to carry out tax maneuvers and such actions that fall under the new article, and at the same time tax collection will immediately increase, which is generally in the interests of the whole society, "said the interlocutor of RT.

Meanwhile, Yuri Sinelshchikov, First Deputy Chairman of the State Duma Committee on State Construction and Legislation, Honored Lawyer of the Russian Federation, expressed doubts about the need for a new article in the Criminal Code on fraud.

“We are producing too many new compositions and too many innovations aimed at strengthening criminal liability, although we talk a lot about what should be unified and liberalized. Therefore, probably, there is still no point in this, ”the Moskva 24 TV channel quotes Sinelshchikov.

Damage from tax crimes

The Colonel-General of Justice also said that VAT and income tax are most often avoided in Russia. According to Leonenko, the standard scheme for this type of crime is the creation of an artificial document flow - costs are overestimated, profits are underestimated.

“In addition, VAT deductions are set in tax returns for the amount of overstated expenses as a result of artificial document circulation. And since the taxpayer actually did not incur expenses and did not pay VAT when calculating with imaginary counterparties, he did not have the right to deductions and, accordingly, did not have the right to indicate them in the declarations, thereby he avoided paying VAT for the amount of deductions. Illegal VAT refunds from the budget are also widespread, ”explained the Deputy Chairman of the Investigative Committee.

The corresponding crimes are most often committed by the heads of legal entities and business owners in the areas of construction, trade, including the wholesale, financial and credit system, and transport.

She also pointed out that in the first half of 2020 alone, the damage to the budget from tax crimes amounted to more than 47 billion rubles.

At the same time, compared to the same period in 2019, the number of tax crimes decreased by 17% (to 3,062). At the moment, 1,730 criminal cases have been preliminary investigated, 728 proceedings have been sent to court, 562 criminals have been identified.

"As a result of the joint activities of law enforcement agencies, by the end of the first half of 2020, it was already possible to reimburse about 30 billion rubles, of which, to put it mildly, the so-called unscrupulous taxpayers who fell into the orbit of criminal prosecution voluntarily paid more than 17.1 billion rubles to the budget," - added Leonenko.

Also, property, money and valuables worth over 419 million rubles were seized, while the arrest was imposed on property, the value of which exceeds 12.4 billion rubles.

In addition, the Colonel-General of Justice named the regions leading in non-payment of taxes.

“It largely depends on the population and economic potential, therefore, large economic regions will always be the leader here. So, in terms of the number of criminal cases initiated in 2019, the leaders were Moscow (228), Moscow Region (152), Krasnodar Territory (133), Stavropol Territory (108), Rostov Region (96). Approximately the same regions are leading in the number of criminal cases sent to court and in the amount of damage caused, ”stated the Deputy Head of the Investigative Committee.