Felix Cerezo

Updated Wednesday, April 3, 2024-00:06

«The private car is the enemy of the big city;

It pollutes it, steals space from pedestrians and cyclists. "We must expel him from it," one hears people say more and more.

Well, some politician is going to regret it.

In 2023 alone,

Madrid

obtained more than 60 million for regulated parking, and another

200 million in 2022 with fines

, according to a study by the motorist advocacy company DVuelta.

The goose that lays the golden eggs

Now, one of its counterparts, Associated European Motorists (AEA) has focused

on the goose that lays the golden eggs for City Councils: the ITVM (Tax on Mechanical Traction Vehicles),

a tax created 34 years ago to replace the Tax of Circulation, also known as 'the little number'.

When this year ends,

AEA estimates that this tax -

to which the owners of the 37.8 million vehicles registered in Spain are obliged, whether they circulate with them or not -

will have increased the municipal coffers by 3.9 billion euros.

Different strategies

Although beyond such a large number, AEA emphasizes

the strategies that municipalities use to manage it,

from those who choose to charge the maximum allowed; to those who are in the middle and ending with those who create tax havens and register tens of thousands of cars, even if their population is a few hundred inhabitants.

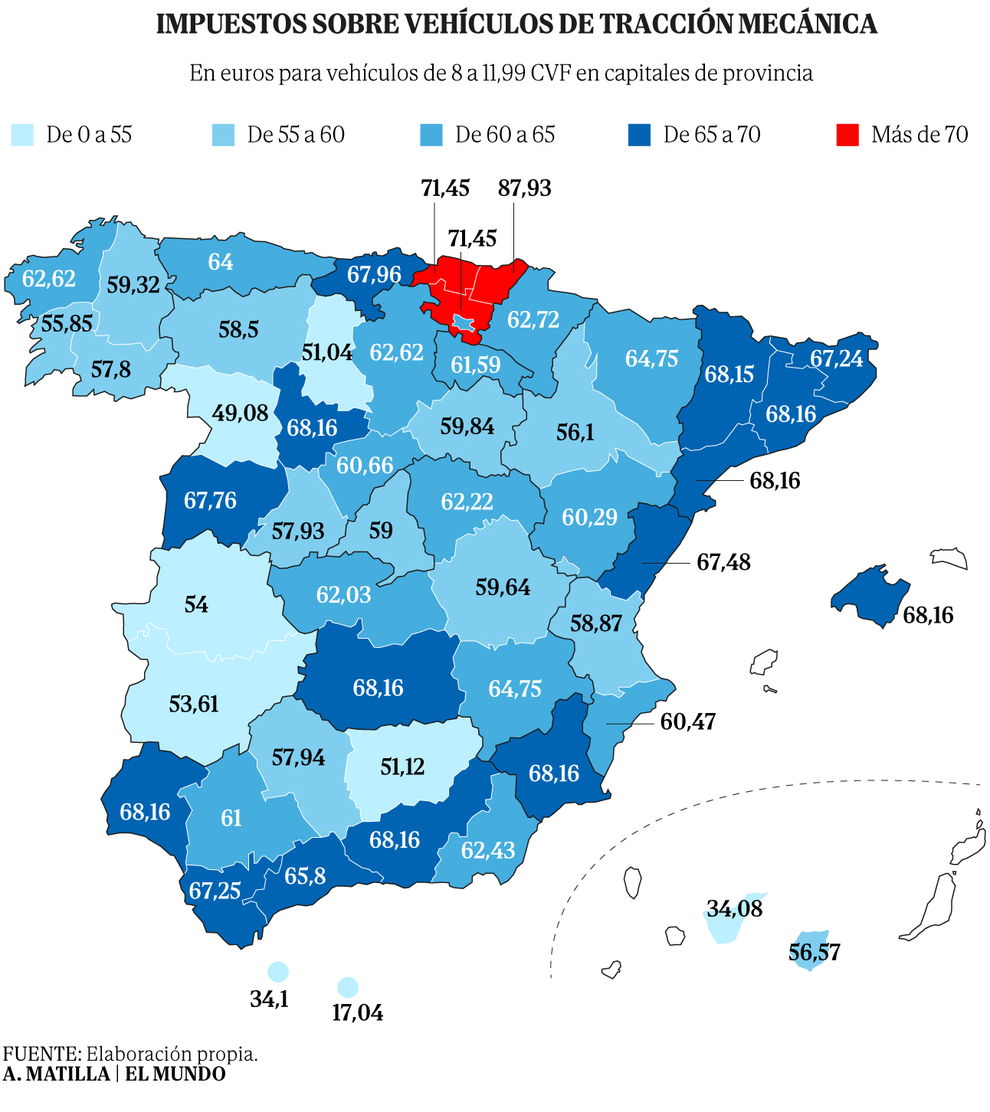

For example, in

Melilla the amount corresponding to an average car

- between eight and 11.99 CVF (fiscal horsepower, not to be confused with what the brand says) - is

17.04 euros, in Santa Cruz de Tenerife doubles to 34.88 euros

and in

San Sebastián it multiplies by five,

reaching 87.93 euros.

Madrid and Barcelona, differences of up to 900%

And if we make the comparison within the same province we find that

in Barcelona there are towns that earn eight times less than the capital (8.52 euros compared to 68.16);

and seven times less if the province studied is Madrid.

To begin with, the tax has a minimum rate that is paid based on the tax power if it is a passenger car; according to the displacement in motorcycles and according to the weight or seats in trucks and buses. But, then,

the law allows you to increase these fees at your discretion, discount them up to 75% depending on the propulsion of the vehicle and even exempt it if it is historic.

More than 37 cars per inhabitant

This, together with the fact that

since 2000 the registration system has not contained a provincial identifier, with the problems that this entailed,

ends up "by distorting the local tax system, giving rise to true tax havens," denounces AEA. And these municipalities, with better taxation, attract

rental and leasing companies that open branches to register thousands of vehicles

that will never set foot on their streets. "But the town councils have the 'little number' lottery." An individual could do the same, but it is not worth registering just for that.

The 27 tax havens

Specifically,

up to 27 municipalities have been identified that follow this strategy. Ten

(nine in Madrid and another in Gran Canaria)

accounted for 40% of company car registrations in 2023,

almost 250,000 units. As an example, a button:

in Rozas de Puerto Real

(Madrid), it is as if each of its

578 inhabitants had 'bought' more than 37 cars, 21,464 in total.

That is, a motorization rate that is unthinkable for countries like the US or Japan.

Almost 38,000 million in taxes

One last note to return to the beginning of this article. Being important, the circulation tax

is the chocolate of the parrot of what the State collects in general thanks to the automobile.

According to the latest report from the manufacturers' association Anfac, the fees and taxes linked to this sector contributed public income of

39,177 million euros in 2022, 13.2% more than a year before.

Of that figure, the bulk

was the 24,248 million from VAT and special taxes linked to fuel,

which ended up in the pockets of the State. The City Councils took their pinch with the IVTM and even the CCAA made cash: 578 million thanks to the Registration tax.

THE CHEAPEST CITIES

Dropdown

The vehicle owners who pay the least are those in Santa Cruz de Tenerife, Melilla, Ceuta, Zamora, Palencia, Badajoz, Cáceres and Jaén. They are between €17 and €54.

THE MASKS

Dropdown

In addition to San Sebastián, the report indicates that the cities that charge the most are Vitoria, Bilbao, Barcelona, Tarragona, Lleida, Palma, Ciudad Real, Valladolid, Huelva, Granada and Murcia. They are around €70.