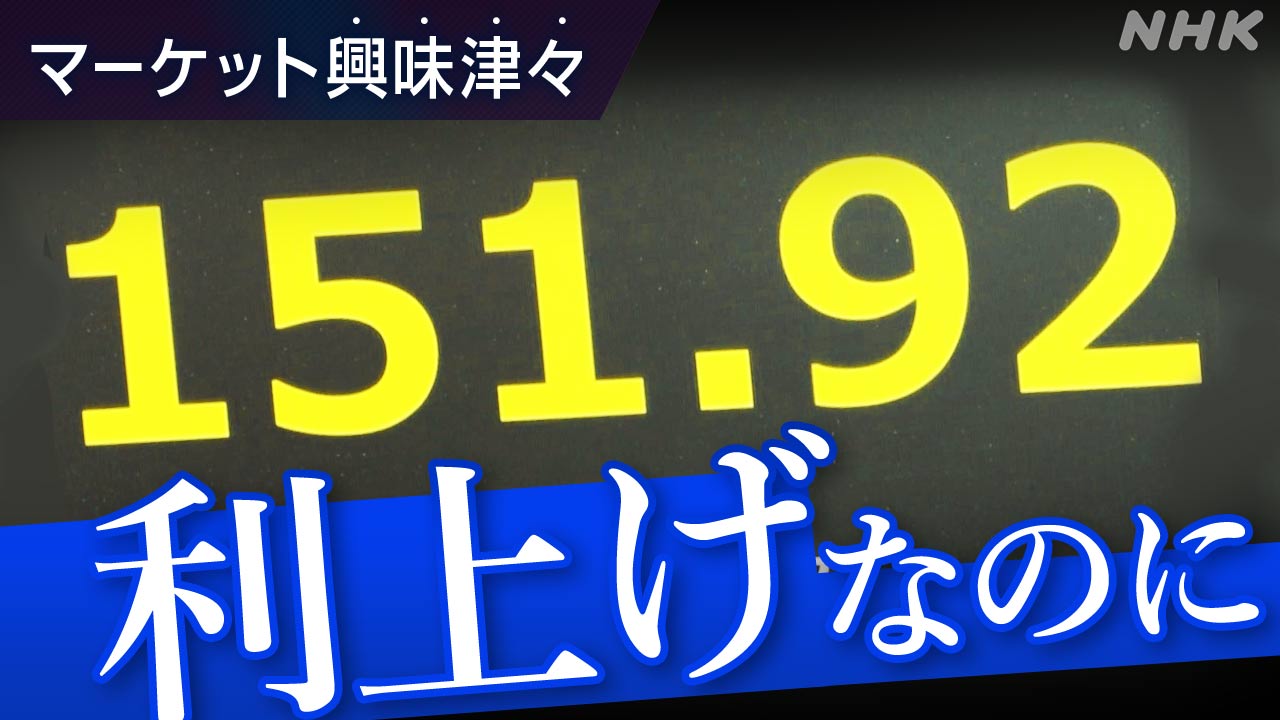

The depreciation of the yen accelerates in the foreign exchange market. Despite the Bank of Japan's first interest rate hike in 17 years, on March 27th, the yen approached the 152 yen level, marking the first time in 33 years and 8 months since July 1990 that the yen had weakened to the dollar. Ta.

Why is the yen depreciating at the same time as interest rates are being raised? An investigation into the background reveals a situation that could be called a dilemma for the Bank of Japan.

(Economy Department reporter Koki Nishizono)

The trigger for acceleration of yen depreciation is “slow”

The trigger for the historic depreciation of the yen was a statement made in a lecture in Aomori by a member of the Bank of Japan who decides on monetary policy.

The speaker was Naoki Tamura, a member of the deliberation committee who used to work at a mega bank.

Council member Naoki Tamura (left) giving a lecture

Since he was early to point out the side effects of the Bank of Japan's large-scale monetary easing measures and the need to normalize monetary policy, he has been perceived by the market as a hawk who is proactive about raising interest rates.

With the market's attention already focused on the timing of the Bank of Japan's additional interest rate hike, Commissioner Tamura made the following comments regarding future monetary policy.

Naoki Tamura, Council Member: ``

While the major premise is that it will be done in accordance with economic, price, and financial conditions, we will slowly but steadily normalize monetary policy and skillfully end the unprecedented large-scale monetary easing.'' I believe that controlling the reins of monetary policy going forward will be extremely important."

Although I felt that the statement showed a stance of continuing to normalize monetary policy, the market reacted strongly to the word "slowly."

Committee member Tamura, who has the image of a hawk, did not make any in-depth statements about further interest rate hikes and instead used the word "slowly", leading to the perception that there was a long way to go before raising interest rates.

Following the lecture, the yen's exchange rate plummeted.

The government and the Bank of Japan have been forced to hold a tripartite meeting to put a check on the yen's depreciation.

At a press conference after his speech, Commissioner Tamura was asked what he meant by ``slowly'', and he said, ``Based on the current economic price outlook, I don't think we'll see an interest rate hike of 5% in a year like in the United States.'' No,” he said.

The yen remains weak even after raising interest rates due to the Bank of Japan's easing stance

Although Commissioner Tamura's remarks triggered a rapid depreciation of the yen, the yen had been depreciating in the foreign exchange market even before that.

This is because the Bank of Japan said, ``We believe that the accommodative financial environment will continue for the time being,'' indicating that even if negative interest rates are lifted, the financial environment will remain accommodative.

When the results of the meeting on March 19th, when the Bank of Japan decided to raise interest rates for the first time in 17 years, were announced, the yen fell to the mid-150 yen level to the dollar, and the yen subsequently depreciated to the high-151 yen level in overseas markets as well. progressed.

President Ueda at a press conference (March 19)

Although the Bank of Japan has expressed the view that the accommodative environment will continue, why is the yen's depreciation accelerating so much?

``The foreign exchange market is looking not only at the interest rate differential between Japan and the United States, but also at how long that gap will last,'' points out Akira Moroga, chief market strategist at Aozora Bank.

Although the Bank of Japan has lifted its negative interest rate policy, the policy interest rate is still low at 0.0% to 0.1%.

On the other hand, the difference in interest rates in the United States is 5.25% to 5.50%, which is overwhelming.

Currencies with high interest rates are more attractive to investors, and given the current interest rate differential, many people would want to hold dollar assets.

Furthermore, under these circumstances, it becomes easier to engage in a transaction known as the ``yen carry trade,'' in which funds are borrowed in yen, which has a low interest rate, and invested in currencies such as the dollar, which have a higher interest rate, in order to earn a profit.

In that case, there will be an increase in the number of people selling yen and buying dollars, which will cause the yen to weaken.

On the other hand, the biggest risk for investors who profit from this transaction is a sudden appreciation of the yen.

This is because they earn profit margins by investing in dollar assets, so if the exchange rate moves significantly toward the yen's appreciation, they could suddenly incur valuation losses.

For this reason, it is important that the interest rate differential between Japan and the United States remains wide and stable.

Mr. Moroga believes that unless the Bank of Japan and the Federal Reserve change their stance, the current situation will continue.

Akira Moriga, Chief Market Strategist

: ``Concerns about inflation are deep-rooted in the United States, and there is a strong view that interest rates will not be cut anytime soon.Amid this, the Bank of Japan has announced that ``the accommodative environment will continue'' for the time being, and the market is People are becoming less wary of the interest rate gap between Japan and the US closing all at once.Therefore, unless one of the two parties moves, the popularity of dollar assets will continue to increase, leading to a weaker yen. become"

The Bank of Japan's dilemma?

The reason behind the Bank of Japan's explanation that the accommodative environment will continue appears to be to prevent long-term interest rates from rising sharply by emphasizing policy continuity.

This is because if long-term interest rates rise sharply, it could lead to negative effects such as a cooling of the real economy.

Perhaps this explanation was successful, as the bond market remained calm even after the Bank of Japan announced the lifting of negative interest rates.

On the other hand, such explanations have become a factor in accelerating the depreciation of the yen in the foreign exchange market, with some within the Bank of Japan expressing confusion, saying, ``It is impossible to predict the future of exchange rates,'' and ``We have no choice but to suppress the shock to the economy.'' "This is an explanation, but I am worried about how it will affect the people's livelihood."

It has also been pointed out that the more the Bank of Japan tries to communicate carefully about further interest rate hikes, the sooner the timing could be brought forward.

Tetsuhei Ino, Chief Analyst, Bank of Mitsubishi UFJ

: ``If we say too much that the accommodative environment will continue for the time being, it will be easier for the yen to depreciate.Currently, import prices are rising due to the depreciation of the yen, and if the depreciation of the yen continues in the future. , there is a possibility that consumer prices will rise upward through a rise in import prices. If that happens, the Bank of Japan will be forced to raise its price outlook, and additional interest rate hikes in the not-too-distant future will come into view."

In fact, import prices have been rising recently.

A rise in import prices becomes a factor in upward swings in consumer prices over time.

What it will be? Bank of Japan's additional interest rate hike

So when will the Bank of Japan move to raise interest rates further?

When we asked multiple market participants about their estimates of the timing, some said they were not confident yet, but most of them said it would be July or October this year.

The rationale for each of these points was that the final tally of the spring labor labor unions would be compiled in July, and that the Tankan and branch manager meetings would be held in October, allowing data on the economy and prices to be collected.

How should we proceed with the normalization of monetary policy while keeping an eye on the stability of foreign exchange and bond markets?

One Bank of Japan official said, ``Policy decisions are difficult. It's difficult, but that's the Bank of Japan's job. We don't have any scenarios. We look at the data and move interest rates. We just do that.'' talk.

The Bank of Japan's narrow pass continues.

I would like to continue reporting and see what happens in the future.

Normalization is yet to come.

Featured plans

On April 1st, the results of the Bank of Japan's Tankan (short-term economic observation survey on enterprises) will be released.

According to private forecasts, the economic outlook for large companies and manufacturers is expected to worsen for the first time in four quarters due to factors such as the suspension of shipments by some automakers. It will be interesting to see if there are any results.

Additionally, the Bank of Japan's branch manager meeting will be held on April 4th.

The Bank of Japan has lifted its negative interest rate policy and decided to raise interest rates for the first time in 17 years, but it will be interesting to see what kind of voices are being voiced about the wage increases and price pass-through situation of local small and medium-sized enterprises.