- Montero responds to Ayuso.For a dialogue on honest and loyal regional financing

- Taxes. Isabel Díaz Ayuso's letter to Minister Montero: Stop euphemisms for your intervention in Madrid

The increase in personal income tax to the highest income planned by the Government will only contribute funds to the State as a whole. And of the final figure, at least half, will be borne by the taxpayers of the Community of Madrid. This is what the simulations that José Félix Sanz Sanz and Desiderio Romero Jordán, director and researcher, respectively, of the tax studies department of Funcas have concluded, and in which they have started from two hypotheses.

The first contemplates the assumption that there is no reaction from the taxpayers to the increase, an “unrealistic” scenario and in which the total collection would be 662 million. Of that figure, the Community of Madrid would contribute 325 million, that is, 49% of the total .

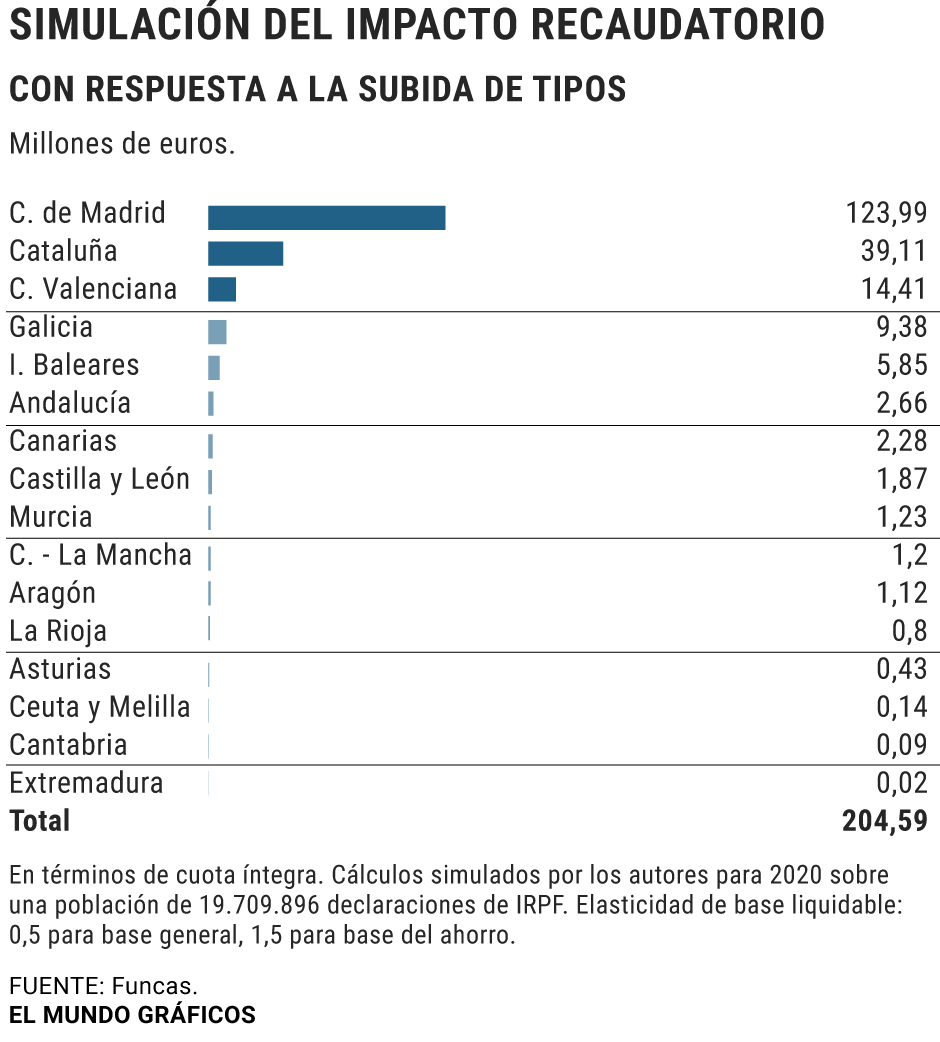

The second, however, estimates that "a more realistic scenario in which, as empirical evidence recognizes, taxpayers adjust their behavior to the new marginal types." The result of this exercise is a much lower collection of just 204 million, a figure that is well below the 332 million that, according to the Budget Plan sent to Brussels last October, would contribute this increase to the public coffers. And in this case, the Madrid region supports an even higher proportion: 124 million, just over 60% of the global figure .

The next community in both simulations would be, “at a distance”, Catalonia, which in the first case would contribute 151 million and in the second case less than 40. In the other regions, the authors of the document defend, “there would be hardly any collection performance, even being negative for the general taxable base ».

Given these data, Funcas concludes that, "as with the recently approved taxes on certain digital services and financial transactions, this rise in marginal rates to high incomes will not help to resolve the deterioration of the public deficit." And so, they ask the Executive to implement tax reforms " well designed, far from improvisation and political marketing ."

These conclusions on the result and consequences for Madrid of the increase in two points of the marginal rate from 130,000 euros, and four in the case of income exceeding 300,000 euros, occur at a time of great tension between the minister of Hacienda, María Jesús Montero, and the president of the Community, Isabel Diaz Ayuso. The confrontation is not new at all, but it has intensified after Montero presented the lines of action of his Ministry last week before the commission of the Congress and made it clear that he will carry out a "harmonization" tax between CCAA.

The intervention caused that Ayuso, through an open letter published in THE WORLD, answered the minister asking him to respect the fiscal autonomy of the region and accusing him of hiding in that "harmonization" an " unjustified intervention to raise taxes ." The minister, on the other hand, and also through this newspaper, responded this Monday by asking for an "honest and loyal debate on regional financing" and affirmed that the figures and conclusions provided by the president of Madrid are false .

According to the criteria of The Trust Project

Know more- Madrid's community

- Personal income tax

- Maria Jesus Montero

- Taxes

Taxes The communities of the PP explode against the tax roll of the Government while privileging its members

Council of Ministers The Government lowers its growth forecast by two tenths, raises spending and softens the deficit target

Economy The Board will take the Government to court for the 'VAT war'