In the future, developers should put products and services more importantly.

Don't focus too much on returns to scale and financial data

Path autonomy in transforming housing enterprises

Reporter / He Bin, China News Weekly

Issued in China News Weekly 936, February 24, 2020

Under the impact of the new crown pneumonia epidemic, few companies can survive on their own. For real estate companies that rely heavily on cash flow, it is a catastrophic blow-all sales offices in various places have been closed, and development and construction have been repeatedly postponed due to the difficulty of resuming work. Under the general tone of housing and real estate speculation, real estate companies that were already in trouble due to policy tightening will face new tests of survival.

Data Map: Aerial photography of a real estate in Hexi, Nanjing. Photo by China News Agency reporter Bo Bo

Recently, Nanjing, Shanghai, Wuxi, Xi'an and other places have introduced rescue or relief policies for housing companies, including allowing delayed payment of land prices, extension of tax payments, moderate relaxation of pre-sale conditions, promotion of online approval services, credit support, etc. In order to cope with the financial pressure of the industry under the impact of the epidemic, mitigate the risk of developers' cash flow.

Is the support policy for the property market promulgated in various places to help enterprises overcome the current short-term difficulties, or to release a loose policy signal? Will China's real estate market continue to decline or usher in a turnaround? In the eyes of the industry, everything is full of uncertainty.

Self-help

The company started a new round of self-help. On February 10, Evergrande first began to implement a comprehensive online house purchase attempt nationwide, providing one-stop services such as online house viewing, online house selection, and online house purchase. Buyers only need to pay a 5,000 yuan deposit online through Evergrande's Hengfangtong platform to book a house. Evergrande also introduced two major policies for buyers to enjoy the lowest price before May 10 and no reason to check out. And multiple benefits such as home purchases and referral rewards.

Behind the innovation is the "last resort" of real estate companies to suspend offline business. Starting from the end of January this year, affected by the epidemic, the offline sales of housing companies across the country have come to a temporary standstill, and thousands of projects and sales offices of Evergrande have also come to a standstill. According to Kerer data, in January 2020, the total monthly sales of TOP100 real estate companies was only 509.705 billion yuan, a decrease of nearly 12% year-on-year. Many housing companies have begun to try to buy houses online and broaden their sales channels in order to deal with the impact of epidemic prevention on project sales.

"After the epidemic, the market returned to normalization, bringing the first wave of sales dividends or sales rebound after the epidemic. Whoever can catch it will be able to grab more customers in the stock market." Ren Yang is now leading the analysis to China News Weekly. At present, major real estate companies are doing online sales offices, but in fact they are only "storing customers" and it is difficult to have practical results. Evergrande's online house purchase has broken through the concept of pure online sales office in the past, and started to do online promotions and online discounts, pushing the industry to a new level, because of the fierce competition, it is necessary to It takes substantial action to grab this sales bonus.

"Actually, as usual, due to the Spring Festival holiday, January and February were also a relatively cold period for the real estate industry." An industry insider who asked not to be named told China News Weekly, but this epidemic brought various Uncertainty, companies have to deal with it in advance.

In Yang Xianling's view, in addition to the uncertainties brought about by the epidemic, factors that reduce market fundamentals are also the pressure on real estate companies in the short term. In recent years, China's real estate market has experienced rapid development. The real estate transaction value in the past five years was 65 trillion yuan, and it reached 16 trillion yuan in 2019 alone, a very rapid growth rate.

Until November and December of last year, real estate companies began to face greater downward pressure, developers' sales pace slowed, and their turnover rate declined. "Even if there is no epidemic situation, the difficulty of real estate sales is obvious to all. Compared with the short-term impact of the epidemic situation, changes in market fundamentals may affect developers' growth rate and cash flow recovery ability for a longer period of time." Yang Xianling said.

Therefore, in recent years, real estate companies have begun to seek diversified transformation. Evergrande has laid out areas such as health and technology. In recent years, it has been more frequent in new energy vehicles. Country Garden has invested in agriculture and robotics. As early as 2012, Vanke, which predicts that the Chinese real estate market has entered the silver age, will return to the main real estate industry one year ago after six years of transformation.

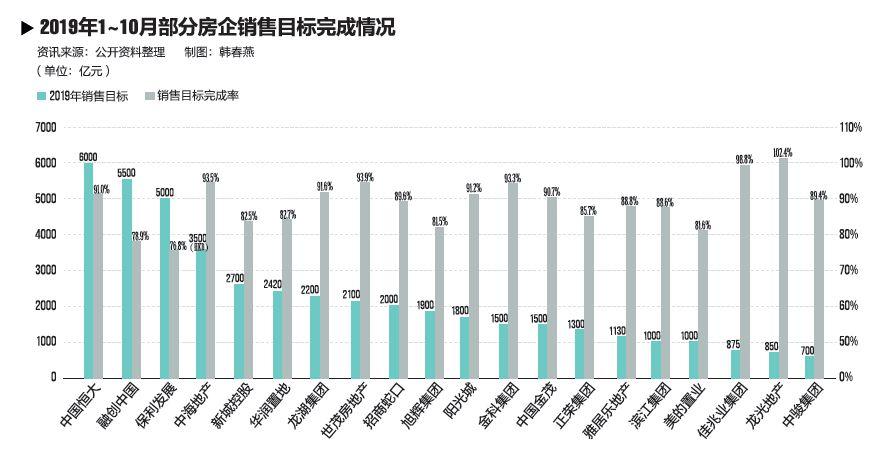

It seems that there is no answer to which transformation method is more successful. Judging from the company's financial report, the "sideline" of these head real estate companies does not seem to have brought considerable profits. According to the "main industry", according to According to the "2019 China Real Estate Enterprise Monitoring Report" released by the Middle Finger Research Institute on January 17, in 2019, Vanke ranked first in China's real estate enterprises with a sales volume of 630.83 billion yuan. China Evergrande and Country Garden respectively accounted for 601.06 billion yuan and 552.2 billion yuan. Followed by.

From the current point of view, the transition seems to have brought more uncertainty to the development of real estate companies.

Transformation

Leading a new round of transformation is Vanke, which has always been known as a sense of crisis. In 2012, just when China's real estate market was in the "golden period", Yu Liang, chairman of the board of directors of Vanke, believed that the real estate industry had entered the silver age, and based on this judgment, he launched the "five-in-one" strategy, mechanism, culture, organization and people Change.

Also in this year, Vanke put forward the strategy of "urban supporting service providers", which is to expand to commercial real estate, logistics real estate, education, pension, sports and other fields around the needs of customer consumption upgrade and urban supporting development. In April 2014, Vanke officially started the transformation, first introducing the business partner system. At the founding conference of business partners held on April 23, a total of 1,320 employees voluntarily became the company's first business partners, including serving in the company. All 8 directors, supervisors and senior management staff.

The establishment of the business partner system not only gives employees the enthusiasm for market development, but also gives certain regions a certain degree of autonomy. With the transformation in mind, Vanke's regional and city teams, while basing themselves on the real estate business, have opened up “new businesses” outside the real estate business. They are at the forefront of the market, understand the pain points and needs of customers, and can flexibly launch new businesses. Education, retirement, long-term rental apartments and other business sectors have developed from the region.

In 2014, Xiamen Vanke attempted to "use the space" in its own-owned commercial project Golden Land Washington. After creating a children's education camp and community business, it transformed the remaining 2,000 square meters of space into a youth hostel model. A community of young people with shared space, named "Bedroom Apartment", and rented to young people nearby.

Attempts like this have also started in Vanke teams in other cities, and there have been long-term rental apartment projects such as Vanke Post and Vanke School. In May 2016, the Vanke Group unified the long-term rental apartment projects in various regions into the "Boyu" brand, forming a specialized business unit (BU).

"These attempts have been carried out by front-line companies from the bottom up. Even after the establishment of BU, Bo Yu has implemented a rotating partner system after entering more than 20 cities, and it is rotated every six months, instead of the head of the headquarters to manage it. "An unnamed employee at the headquarters of Vanke Group introduced to China News Weekly.

Not all projects are bottom-up. From the group level, through acquisitions or cooperation, it is also a way for Vanke to enter new business areas. Two years after the establishment of Wanwei Logistics, with the help of participating in the acquisition of global logistics giant ProLogis and becoming its major shareholder, the cold chain and warehousing business only gained tremendous improvement. And the commercial real estate project has also developed rapidly through the introduction of the influential Group of South China, as a commercial development and operation platform.

For these new businesses of Vanke, the outside world is used to describe "diversity." In recent years, Chinese real estate companies have tried to diversify in order to balance cyclical fluctuations and operating risks. "Industry + Real Estate" has become the direction of transformation of many real estate companies. And the big health industry, entertainment tourism industry, new energy automobile industry, and smart community industry empowered by technology are often the choices for real estate companies to expand new business.

However, Yu Liang does not agree with the term "diversity". In his opinion, what has been done around the improvement of urban software and hardware cannot be regarded as "diversity" for the real estate industry. Therefore, for a long time, in Vanke Internally, the word "diversity" is not used tacitly.

return

In 2018, Vanke upgraded its strategic positioning to “urban and rural construction and living service providers”. From supporting service providers to living service providers, means that Vanke must provide not only hardware but also software; not only space, but also content.

At that time, the development of new businesses in various regions was uneven. There were small but well-developed businesses such as vegetable markets and parking, and other businesses that were good in other regions but were not convinced locally, such as the hot old-age care industry in the south. It was cold in some northern cities. The aforementioned Vanke employees stated that Vanke has a set of fault tolerance mechanisms for new businesses, but Yu Liang also said that “we give up without effect in three years”. Therefore, at the enterprise level, it is necessary to sort out new business and make trade-offs.

In 2019, at the Vanke Group's goal and action communication meeting, Yu Liang made a report on the theme of "convergence and focus, consolidating and improving the basic disk." Complementing this strategic direction is strategic review, business review, organizational rebuilding, and business affairs. All-round change in matching people.

In that year, Vanke initiated an internal reform called "Early Summer Action". After 33 rounds of special meetings, numerous research discussions and report revisions, the principle of "organization for strategic services, management for business services" was officially established. BG and BU basically completed the reconstruction of the organization.

In terms of business structure, five major BGs (business groups) of "Four Regions + Property Services" and six BUs (business units) in commercial development and operation, logistics, long-term rental apartments, ice and snow, overseas, and education were identified. In terms of organizational structure, all departments of the headquarters are adjusted to form three major centers, namely a support center, a management center, and a career development center. In this way, the barriers between the original pyramid bureaucracy and departments were broken, making management smoother and more efficient.

This reform has been interpreted as returning to the real estate industry, but in Yu Liang ’s view, “urban and rural construction and living service providers” and “focus on convergence, consolidate and improve the basic market” are two sides of each other. Don't be partial, or even stand against each other. Vanke's "basic disk" does not only refer to "real estate development business", but all BUs and BGs must clarify their basic disks. "Vanke is not to converge other businesses, but to focus on converging the operation of each business. Management action. Focusing convergence is not cutting trees, but pruning leaves and branches. ”Yu Liang explained in an article in early 2019.

"Actually, the power of convergence and focus lies in the hands of the BUs and BGs." The Vanke employees said that each business unit and business segment will sort out their own business and return to the basic business management logic. "The headquarters will not Regarding what we should focus on and what to focus on, we are a service-oriented headquarters. "According to him, the BU and BG have basically completed the convergence and focus actions, and the business lines are relatively clear.

The China Real Estate TOP10 Research Group of the Middle Finger Research Institute pointed out in the "2019 China Top 100 Real Estate Enterprises Research Report" that there is still a lot of room for the real estate industry, and development business is still the core driving force for enterprise development, and the coordination of related multiple businesses is more beneficial to enterprises. Rapid growth, and some blind transformation and non-relevant diversified housing enterprises, due to unfamiliar business areas and low synergy, and other reasons, operating problems have emerged endlessly, resulting in tight funding chain affecting business development.

This seems to be more and more clear in Vanke's business structure. Commercial development and operations, long-term rental apartments, ice and snow are all real estate-related projects. Education is a project that is extended based on customer needs in property services. The main logistics provides services for its commercial real estate sector.

"Real estate companies should continue to focus on their main business and give play to the competitive advantages of products, resources and experience to help the company's long-term development." At the end of the report, such a conclusion was reached.

small profits

Regardless of extending real estate development to related businesses or opening up new industrial fields, in Yang Xianling's view, the transformation direction of major real estate companies is clear. The core is to change the current high turnover model of the real estate industry. The turnover mode is actually a process of continuously running and advancing to the places with the highest risks. Once the speed slows down, it will die, so real estate companies now want to change this model. "

Yang Xianling takes the Hong Kong model as an example. The debt ratio of Hong Kong real estate companies is almost the lowest among real estate companies in the world. The main reason is that they hold many operating properties and maintain good cash flow.

"This transformation from development to holding, from incremental to stock transformation, and from incremental development to asset operation, is still difficult for domestic developers." Yang Xianling further explained that not only There is a lot of destocking pressure, and because of the high turnover in the past five years, real estate companies have almost lost their ability to do other businesses. Therefore, real estate companies must build long boards and do another area that they are not good at. In the short term It is difficult to see the hope of a comprehensive transformation within.

Looking back on the new business disclosed in the Vanke report in recent years, Wanwei Logistics was established in 2015. In 2016, several businesses including commercial real estate, skiing, long-term rental apartments, and pensions were added, and they were classified as expanding business with logistics real estate. Two new businesses, education and industrial office, will be added in this year. In 2018, standard office, industrial park and ice holiday will be included in other businesses in the main business. However, the diversified transformation driven by the sense of crisis does not seem to bring rich returns to Vanke.

Vanke's "First Half of 2019 Report" shows that in the first half of Vanke's total revenue, the settlement ratio from real estate business was as high as 95%. In the new business, there is not even a profit indicator that can meet the disclosure standard, that is, it accounts for more than 10% of the main business income or profit.

"No industry can make more money than real estate." Yu Liang said this many times within the company, but he also has his own understanding of the small profit of diversified products. In Yu Liang's opinion, Vanke is building an ecosystem around urban development. Because there is no shortage of houses as hardware, what is missing is software service content, so it needs to be filled with stuff to make it fuller.

From the interim financial report, Evergrande and Country Garden, which also carry out diversified layouts, did not disclose revenue data for industries other than real estate. Real estate development is still the main source of income for housing enterprises. Compared with the revenue, the three companies' asset-liability ratios are also quite high, being 85.26% from Vanke, 83.5% from Evergrande, and 89.3% from Country Garden.

"It's logical that such a high debt ratio requires a lot of investment?" An expert on industrial strategy asked China News Weekly. In his view, the so-called diversified transformation is not what some companies publicize. "It's strange that the transformation is like a pregnancy. I haven't seen a big belly for several years. Isn't it strange?"

The unnamed expert further explained that the so-called "belly" refers to the industrial structure, system structure, and product structure. It may not be appropriate to appear in the early stages of transformation, but if it has not changed in the past few years, it must not be changed. There is no doubt whether the transformation has really taken place. According to his analysis, some transformations are only under the banner of diversification, and in fact they are still real estate businesses, while others may be diversified by the local government's desire for new kinetic energy investment and gain other benefits.

From the data point of view, the housing companies seem to have maintained a rational attitude towards land acquisition. According to the data of "China Real Estate Market Research · 2019 Fourth Quarterly Report", the total value added of the top 100 housing companies in sales in 2019 reached 9.7 trillion yuan. Compared with 2018, it is down about 10%, and the sales ratio of land acquisition is 0.34. Maintain a cautious attitude. Among them, 49% of enterprises have reduced the amount of land acquisition compared with 2018.

The transformation of various housing enterprises has not seen obvious results. A sudden outbreak of a new type of coronavirus pneumonia swept the country, opened the "housing economy" model, and disrupted the business model and development rhythm of various industries. Regardless of whether eggs are placed in the real estate development basket or in a "diversified" basket, since real estate is still the main business, other businesses can't hedge against the impact of the real estate's main business, even if they have little impact. The more common situation is that the real estate-related business sector and the entertainment tourism sector are the first to bear the brunt of the epidemic, and the losses are heavy, making the business worse.

In this epidemic, the closed management of communities as a unit has highlighted the differences in property service levels of real estate developers. Some experts predict that the demand for housing after the epidemic will add a policy bonus, which may trigger a round of real estate sales. Little orgasm. However, Yang Xianling believes that the overall transaction volume and transaction amount may decline, while conventional housing demand and improvement demand are still there, and even if part of the demand is released, it may be more rational.

According to Yang Xianling, after the epidemic, real estate companies will put cash flow first and maintain a high turnover in the short term. However, after this, developers should put products and services more important instead of focusing too much. Returns to scale and financial data. "For a long time, Chinese real estate companies have taken a step back in this regard."

From a policy perspective, Yang Xianling is not optimistic. The tone of housing and property speculation will not change, and policies such as purchase restriction, visa limit, and price limit have basically been liberalized in 2019, so the space for administrative policy introduction in 2020 is not particularly large. At present, it is only an epidemic. Periodic time windows. Local government will make some targeted limited relaxation during this window period. Generally speaking, there will be no major loosening of policies. In the context of tight financial policies, credit policies are more inclined to small and micro enterprises and the real economy, and there is not much room for real estate and real estate enterprises.

"The risks brought by the epidemic cannot be avoided by any real estate company. In addition to relying on cash flow to carry it hard, they can only do some early response and seize the first wave of sales dividends after the epidemic." Yang Xianling said.

China News Weekly No. 6 2020

Disclaimer: Publication of "China News Weekly" manuscript is authorized in writing