- Restructuring: Santander agrees with the unions a staff cut of 3,223 employees and the closure of 1,150 offices

- Finance: The last closures of Banco Santander

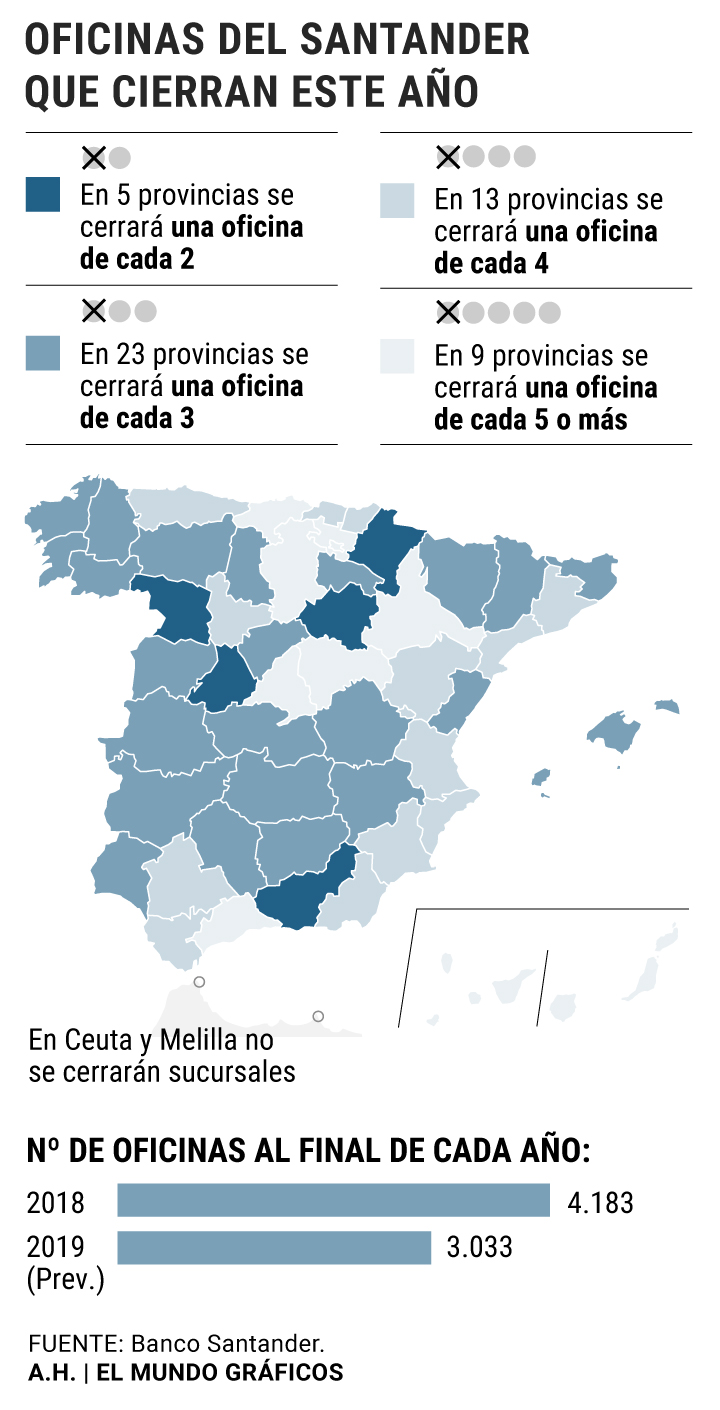

The closure of branches carried out by Banco Santander throughout Spain will further concentrate the business of the first Spanish bank in the two large urban centers of Madrid and Barcelona . This follows from the figures of closures planned by the group in a process that is expected to culminate on November 22 with a final final traffic of 211 closures.

The adjustment will keep Madrid as the province with the highest number of offices despite having closed 134 to avoid the duplication generated after the absorption of the Popular Bank. There will be 551 operational branches , almost one in five of those that the entity will maintain throughout the country after completing the process. The weight on the total of branches will grow by 10%, since although the closing in gross numbers is greater, at a percentage level other regions suffer a greater cut.

Something similar happens in Barcelona. The bank includes in its plan a total of 93 closures on the 373 offices it had open at the end of 2018. This will reduce its presence in this province by 25%, but nevertheless the weight of Barcelona will increase in the group's total business up to 9.2%.

Adding the figures of both provinces, 28% of the bank's branches will be concentrated in the two main population centers of the country, where the number of offices will be at the end of this year higher than the figure prior to the absorption operation.

Depopulation

On the contrary, the adjustment figures agreed by the bank and the unions dilute the presence of the entity in the regions most affected by depopulation . In a total of 10 provinces, the bank will leave less than 20 branches open, while for example in Teruel or Soria, fewer offices will be opened than there were even before integrating those of the Popular.

The group argues that the closures are aimed at reducing the duplicities generated after the integration of Santander Bank in June 2017. Last Friday the entity lowered the blind in a total of 175 offices, most of them concentrated in Catalonia and Galicia.

The closing of branches is a common process for the entire financial sector at a time when interest rates - its main business path - are in negative ranges in the euro zone. The banks have been immersed in a race for years to reduce their costs by reducing the excesses committed in the installation of branches before the last economic crisis. The last ones to execute closures have been Santander and CaixaBank itself, although from the Bank of Spain they continue to push the sector to improve its profitability by way of expenses and believe that there is still room to reduce the rate of branches at European levels.

The adjustment in Santander has been coupled with a cut of 3,223 jobs in the group. The latest figures provided by the unions figure at 43% the number of work extinctions that have already occurred through early retirement and incentive withdrawals . The entity also assumed the commitment to relocate 100% of those who want to continue working, as has happened on other occasions. In the ERE carried out in 2016, this objective was achieved, while in the adjustment made in 2018 the success so far has been 73%, with a forecast of reaching 100% in the second half of the year.

According to the criteria of The Trust Project

Know more- economy

- Graphics

Companies Santander Bank closes these 175 offices today

Economy Santander will reflect a deterioration of 1.5 billion in its subsidiary in the United Kingdom by Brexit

CampusOnce years of support for science in Alfonso X the Wise