Analysis What car do I buy or am I most interested in?

Pros and cons of each technology

The desire to travel returns, in Spain or abroad. Planes, trains and highways are filled

with people willing to spend a vacation with skyrocketing prices.

So the new car will have to keep waiting, because the economy is not enough for more.

And it is that, traditionally, July was the one chosen by many Spaniards to change cars, who could already roll (and show off) taking advantage of the holidays.

In 2019, for example, almost 117,000 units were registered in July.

In this 2022, there were only 73,378 cars and 4x4.

It represents a new setback, now 12.5% and it is the lowest figure this month since the 2012 crisis, when 65,325 units were recorded.

With this result, the accumulated figure for the year stands at 481,135 vehicles, 11% less.

More used than 15 years old than new

Behind this result is,

according to the large associations in the sector -Anfac, Ganvam and Faconauto-

that perfect storm in which the lack of supply due to the semiconductor crisis and the bad economic situation converge, aggravated by inflation (also in the own cars- and the rise in energy and fuels. Factors that are delaying the purchase decision in some cases and canceling it in others, with customers switching to the second-hand market.

"Since January, almost the same units have been sold of passenger cars over 15 years old than of new vehicles" point out from Anfac.

In fact, the decline has been caused

by sales to individuals, whose channel lost 12.1%

(a fall of only 1% in the accumulated, with 208,462 cars).

The companies bought 2.7% more

(+2.3% in the year, 202,625 units)

and the renters continue to yearn for those cars that do not reach them,

since they are the least profitable channel for distribution.

Its operations plummeted 39% in the month and lost 47% in the year (70,048 vehicles).

Registrations by technologies

Far from what they want in Europe and the Government that we buy now (100% electric, above all), the customer continues to opt for gasoline combustion models, with

43.4% of sales accumulated in the year.

Another 17.5% had a diesel engine and the remaining 39.1% were alternative models.

That is, battery-powered, hybrids of all kinds and gas.

In July, the percentages were similar and left the average emissions of the vehicles sold at 122.4 grams of CO2 per kilometer traveled, according to the WLTP approval cycle.

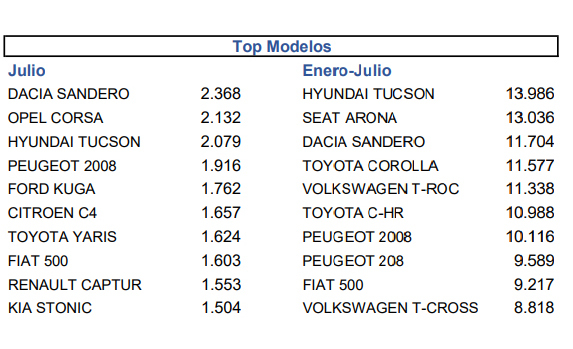

Toyota and Dacia, leaders of the month

Toyota (6,446 cars) and the Dacia Sandero (2,368 registrations) led the sales figures by make and model in July.

If we take the data

from January,

the Japanese firm widens its advantage

over Volkswagen, the second classified (43,634 vs 36,738 units).

And the same goes for the Hyundai Tucson, which already has more than 900 units out of the Seat Arona.

For the total of the year,

the last forecast made by the sector spoke of registering between 800,000 and 830,000 passenger cars and 4x4s.

That is, only above the records of 2012 and 2013, but below the registrations of 2020, when the market was closed tight for several weeks.

Conforms to The Trust Project criteria

Know more

motor industry