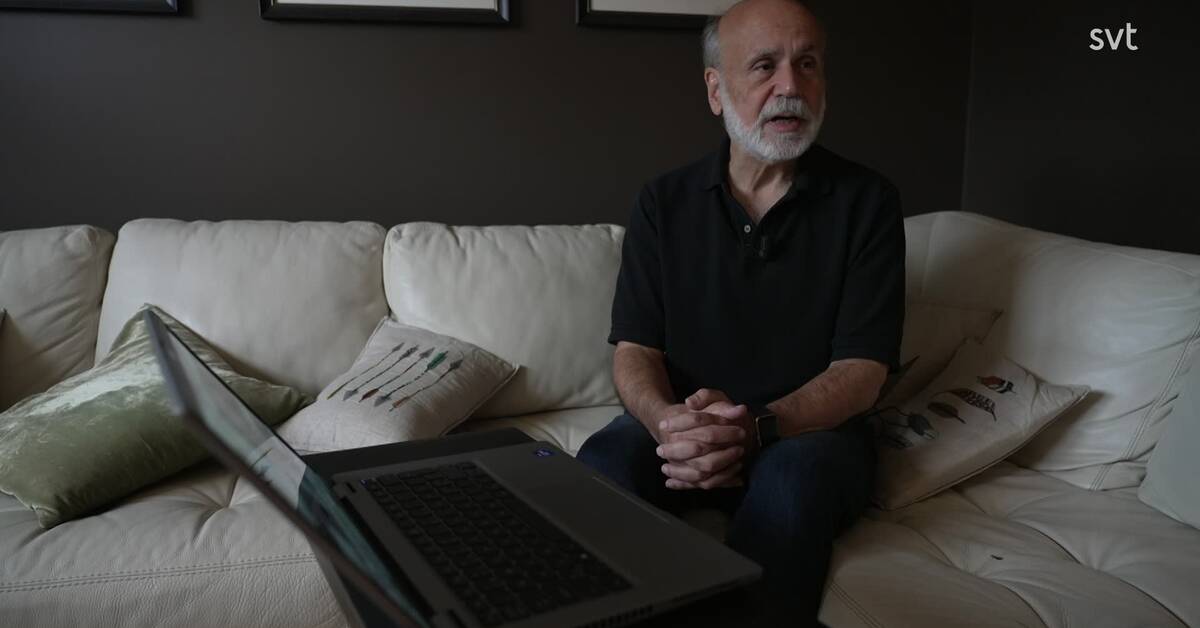

Ben Bernanke is awarded for his study of the role of banks in the Great Depression.

According to Bernanke, it was a mistake to let so many banks fail and keep interest rates too high.

When he was head of the US central bank during the fateful years surrounding the financial crisis of 2008, he was able to put his research into practice and was hailed by President Obama as a hero who helped avoid another crisis of the 1930s - by bailing out banks and keeping interest rates low .

Since then, low interest rates have been the new normal.

Other central banks, such as Sweden's Riksbank, followed suit.

Now the downsides of the low interest rate period are emerging.

Inflated housing prices made households burdened with debt and more sensitive to an interest rate that eventually rises.

The Financial Supervisory Authority recently warned that 14 percent of those who bought a home at the peak in 2021 will have greater expenses than income if the mortgage rate ends up above five percent.

Rejects the criticism

Financial historian Edward Chancellor, who has written several popular books on financial crises and the history of interest rates, believes that today's inflation is partly a consequence of the low interest rate period, which he calls "the biggest mistake in the history of monetary policy".

He places the blame on the central banks, which should have cared more about keeping inflation at two percent.

He therefore questions the choice of Bernanke as recipient of this year's prize in economic science in memory of Alfred Nobel.

- It was dumb.

Especially this year, when the monetary policy of low interest rates that Bernanke introduced is collapsing.

The laureate himself rejects the criticism by pointing out that inflation was rather too low than too high during and after his time in monetary policy power.

- And regardless of what one thinks of my efforts as central bank governor, I did not receive the award for that, but for my academic research, states Ben Bernanke.

The professor: Ignorance of what affects the interest rate

John Hassler, a professor of economics who sits on the price committee, thinks that among debaters there is a "striking ignorance" of what affects the interest rate in the long term.

- The trend is that more people are of saving age and that more money goes to high-income earners, which means that we get more savings.

At the same time, growth is lower with less investment in business.

When many people want to save and fewer people invest, interest rates are low, it is a market force that the central banks cannot rely on, concludes John Hassler.

Hear why the financial historian thinks it was the wrong prize winner in the clip above