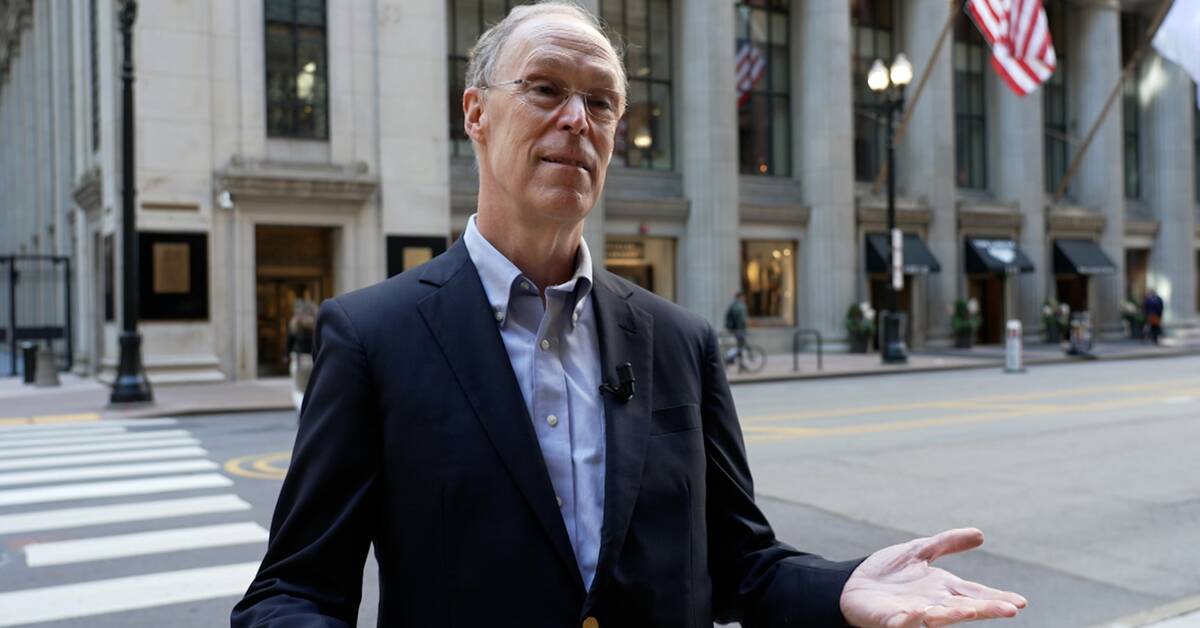

Ben Bernanke, perhaps best known as the head of the US central bank during the 2007-2009 financial crisis, is awarded for his economic-historical research on why the Great Depression of the 1930s became so deep and long-lasting.

He believes that it was largely due to the fact that so many banks failed at the time, and the granting of credit with them.

- People did not trust the banks, they preferred to bury the money in the ground.

It became difficult to borrow and that worsened the economic downturn, says Bernanke.

The crypto exchange modern example

But a bank run doesn't have to be of the traditional kind, like the ones we saw in the 1930s or in connection with the financial crisis.

It is not only traditional banks that are at risk of failure when trust fails.

Recently, we have seen other examples of financial giants on the ropes showing that their research is constantly relevant.

The fall of the crypto exchange FTX is a recent example of a bank run.

A rumor arose that it was insolvent, and customers rushed to save their money before the marketplace shut down.

In this case, irregularities appear to be behind it and about $8 billion of customer money is still missing.

But it can just as easily affect an actor who is both liquid and solid.

If everyone has to withdraw their money at the same time, and it is not available at such short notice, the withdrawals can lead to the company falling.

If it is a major financial player, it can drag many others into the case.

- The self-fulfilling prophecy that a bank run represents can lead to the collapse of the financial system, says Diamond.

It's not that it's formally a "bank", it's that the financial institution lends money short-term (which customers can demand back at short notice) and lends money long-term (where it's difficult to get it back quickly ).

Today, private customers are protected by the government's deposit guarantee at regular banks.

But there are many other actors who can experience a rush.

In the video, you will hear which industries Professor Diamond believes are at risk in today's economic climate.