Sales quota abolished!

Has the Shoko Chukin changed?

January 20, 18:58

There are financial institutions that have increased their presence by supporting the financing of small and medium-sized enterprises suffering from the corona disaster.

"The Shoko Chukin".

It has been positioned as a national policy implementation unit by government-affiliated financial institutions, but it is also considering full privatization.

However, in 2017, a large-scale fraudulent loan was discovered in this Shoko Chukin Bank.

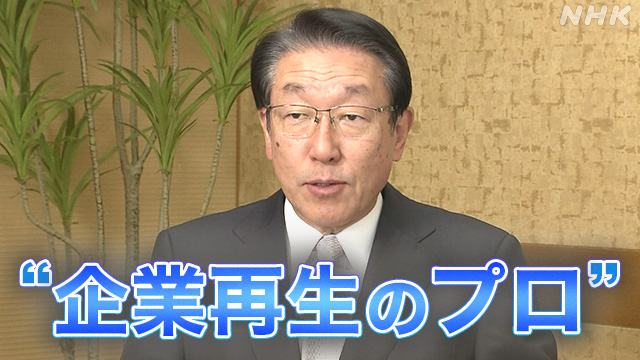

The top management has changed from a former big bureaucrat of Amakudari to a "professional of corporate revitalization" from the private sector.

It has been about four years since the president declared "dismantling and re-starting."

We have abolished the sales quota, but have we been able to reborn?

(Akihiro Shiraishi, Reporter, Ministry of Economic Affairs)

Unprecedented scandal

"Since the new Corona began to make noise in China, we have set up consultation desks in each district and started our own support. We provided a loan of 2 trillion yen or more, which was fully useful for supporting financing. think"

Mr. Masahiro Sekine, President of The Shoko Chukin Bank, looks back on the new corona support.

I took office in March 2018.

At that time, the Shoko Chukin Bank was found to be fraudulent in excess of 200 billion yen under the government's loan system "crisis response loan."

At 97 of the 100 stores in Japan, more than 400 employees were found to have been involved in fraudulent loans and received two business improvement orders.

It was an "unprecedented scandal" as a government-affiliated financial institution, as it was pointed out that the performance of the loan system had become a de facto quota.

As a result, the president, who was a former administrative vice minister of the Ministry of Economy, Trade and Industry, was forced to resign.

Corporate revitalization professional "dismantling and re-starting"

Mr. Sekine joined Dai-Ichi Kangyo Bank in 1981, was involved in internal reforms after the case of providing profits to the general assembly shop, and then served as the director of the public relations office of Mizuho Bank.

In 2005, he changed to Seibu Railway (currently Seibu Holdings), which was shaken by the problem of false statements in securities reports, and served as a director of the General Planning Division and a director of Prince Hotel under its umbrella.

Based on this background, he was entrusted with the reconstruction of the Shoko Chukin Bank as a "professional in corporate revitalization."

At the president's inauguration press conference, Mr. Sekine advocated a dismantling re-start.

President Sekine

"While business was the top priority, legal compliance was left behind. It was the pressure on the private sector that used the national loan system to support small and medium-sized enterprises to attack at low interest rates. The Shoko Chukin Bank is a business. While responding to the needs of small and medium-sized enterprises such as reorganization, we will aim for a new business model that will lead to the revitalization of the local economy, and aim for a dismantling re-start. "

What about the four-year reforms?

Then about 4 years.

President Sekine replied that he felt a response to the results of the reforms so far.

Q Has the reform of the Shoko Chukin Bank progressed?

President Sekine

"We have been focusing on these three pillars for four years: ▽ Establishment of a new business model ▽ Rationalization of business and management ▽ Reform of governance because it is truly useful for customers of small and medium-sized enterprises. The results are numerical. Has also appeared, and the consciousness of the staff has changed. In that sense, I feel that a certain response is coming out. "

Q Illegal loans at 97 of 100 stores.

It has been pointed out that reforms of the entire organization, including the functions of the headquarters and the board of directors, are necessary. What kind of reforms should be done?

President Sekine

"Of the seven directors, four were asked to become outside experts. We reviewed the personnel system of staff and completely abolished the quota of sales staff, for example. The business plan of each sales office was also changed from the headquarters to the store. Instead of allocating, we asked on-site staff who are familiar with the local situation to participate, and we made it all participatory. "

What is the "crisis response loan" of the cause?

It was the financial support of small and medium-sized enterprises that was required to play the role of the Shoko Chukin Bank in the Corona disaster.

The means is the same "crisis response loan" that was once a hotbed of fraud.

Q In the past, crisis response loans have become a hotbed of fraud.

The number of loan projects has increased enormously in Corona, but can we say that there are no buds that lead to fraud?

President Sekine

"For this crisis response loan, we have firmly certified the requirements. By checking all the cases at the headquarters, we have responded firmly at the entrance to see if the requirements of the system are met. We have also worked to change the mindset of our staff by not causing any fraudulent cases. Finally, as a result of monitoring, no such fraudulent cases have occurred. "

What about complete privatization?

The Shoko Chukin Bank is a special company based on the law. Currently, the government is the largest shareholder and holds nearly half of the shares, and the rest is held by the commercial and industrial associations in each region. The policy has been set out.

The final year of the business improvement plan will end in 2021, and discussions on complete privatization are expected to become more active in the future.

President Sekine

"There are voices saying that they are providing crisis response loans because they are government-affiliated, but not because they are government-affiliated, but because we are doing it as our mission, we will naturally continue even if we privatize. In order to meet the needs of SMEs that are becoming more and more important, it is significant to secure the degree of management freedom through privatization. Banks can create regional trading companies, human resources dispatch companies, and so on. While it has become possible to meet the needs of customers, the work that can be done under the Commerce and Industry Chukin Law is limited. We would like to create a business system that can meet the needs of our customers without such restrictions. "

On the other hand, there is still a strong sense of caution from regional banks and other regional financial institutions that they are "pressing on the private sector."

Local bank executives

"I'm worried about re-initiating low interest rate competition to become the main bank of our business partners."

Another regional bank executive

"I would be grateful if the attitude of helping local banks revitalize together with the regional banks, such as the attitude of supporting the management support of regional banks in the Corona disaster, would continue and be strengthened."

As in the case of the Corona Sorrow, the “crisis response loan” provided by the Shoko Chukin Bank continues to be utilized, so the policy for complete privatization has been stated, but the specific time has not been decided.

In the future, dealing with the excess debt of small and medium-sized enterprises, which is difficult to recover from the influence of Corona, will become an issue.

For that reason, the future of the Shoko Chukin Bank will be a touchstone for predicting the ideal way of management support for Japanese SMEs.

Reference: Reform of the Shoko Chukin Bank in numbers

Reporter of the Ministry of Economic Affairs

Akihiro Shiraishi Joined

the Matsue Bureau in

2015. After

working in charge of the steel industry and the Financial Services Agency, he has

been interviewing the Bank of Japan and major banks since November last year.