For the tax reform next year, the Local Finance Council, an advisory body to the Minister of Internal Affairs and Communications, considers property tax to be a valuable source of local revenue, and will end the current mitigation measures as planned and return to the normal tax amount. We have put together a written opinion requesting such things.

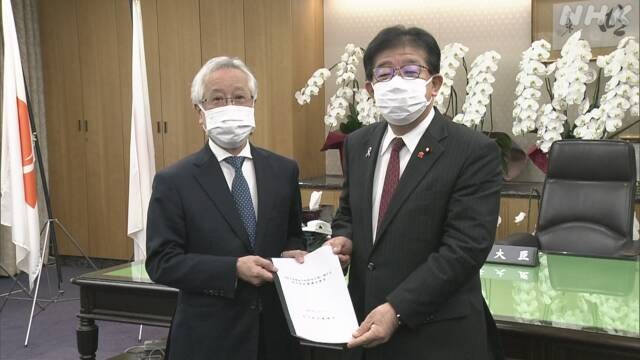

Before the discussion on tax reform for the next fiscal year begins in earnest, the Local Finance Council has compiled a written opinion on local taxes, and Chairman Isao Horiba submitted it to Minister of Internal Affairs and Communications Kaneko.

Among them, property tax is a valuable financial resource for municipalities, and it is becoming more and more important to secure it in a stable manner in order to support social security.

And, in order to mitigate the effects of the new coronavirus, we are requesting that the property tax burden reduction measures that are being implemented only this year be completed as planned and that the tax amount will be returned to the normal tax amount from next year.

In addition, it is necessary to further promote the digitization of tax payment procedures to improve convenience, and to change the operation in line with the original purpose of supporting local governments rather than competing for hometown tax payments with rewards. I point out that.

The Ministry of Internal Affairs and Communications will consider how to respond to the tax reform next year based on the written opinion.