Washington - The

countries of the "OPEC Plus" alliance have ignored the pressures of US President Joe Biden to increase production.

A few days ago, the group confirmed its plans to add an additional 400,000 barrels per day to the market until next December.

The Biden administration is deeply concerned about gasoline prices and broader inflationary pressures. The US Bureau of Labor Statistics revealed that US inflation rose 6.2% in one year;

at its highest level since 1990.

The news of rising inflation added to the pressure on the Biden administration and made it feel the need to act.

Like all previous US administrations, over several weeks;

The Biden administration blamed "OPEC Plus", and the White House tried to pressure Saudi Arabia, the UAE, and other OPEC countries to pump more oil.

So far, these countries are ignoring US pressure to raise production.

The “OPEC Plus” countries depend on the refusal to raise production for conservative expectations towards an increase in the supply of oil by 2022, and the increase in new supplies from outside OPEC expected next year.

Biden alternatives

The Biden administration says that it has many alternatives to deal with the continued rise in oil prices, which averaged today, Wednesday, to 82.9 dollars per barrel, according to the specialized Forex Bulletin.

It is worth noting that the idea of maintaining a strategic US oil reserve came as a response to the oil shock after the 1973 war, which resulted in the interruption of a large proportion of crude oil supplies.

The United States currently owns about 613 million barrels.

Usually, presidents authorize the supply of markets with a portion of the strategic reserve in response to global political turmoil;

Such as the first Gulf War in 1991, or unusual natural disasters such as Hurricane Katrina in 2005.

American consumers continue to suffer as the average price of gasoline at power stations has risen, and the gallon price has reached an average of $3.76 per gallon, up from $2.11 one year ago.

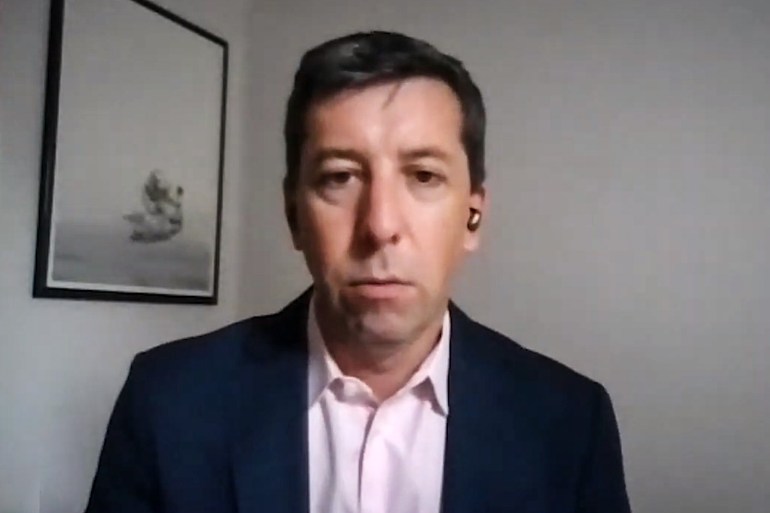

Al Jazeera Net interviewed Ben Cahill - the expert at the Center for Energy Security and Climate Change at the Center for Strategic and International Studies (CSIS) in Washington - about the current high oil price crisis, and its repercussions on the global energy market and on the American interior, with a review of the options available to Joe Biden in order to confront this the crisis.

Ben Cahill works as an expert in the oil markets, and previously held the position of Director of the Energy Information Research Group (communication sites)

Ben Cahill provides economic advice and studies political risks for many governmental and private agencies, and participated in the development of the strategy of a number of institutions, including Saudi Aramco and Abu Dhabi National Oil Company.

Speaking to Al Jazeera Net, Ben Cahill indicated that the recent rise in oil prices "is due to the rapid recovery in demand after the risks of the emergence of the Covid-19 virus have receded, and supply has recovered more slowly in the same period."

He said, "US production of crude oil has fallen by about two million barrels per day as of early 2020, and OPEC Plus has not reversed its cuts. Oil prices also reflect some kind of fear around the world, with growing concerns about broader energy prices, inflation, and supply chain constraints.

Limited options

Noting the limits of what President Biden can do to counter soaring prices for motor fuels and other energy sources, Ben Cahill said, "Biden has pressured OPEC Plus, publicly and repeatedly, to increase production faster than its current plans."

"So far, this public pressure is not working. It is normal for the White House to contact Saudi Arabia and other OPEC members and urge them to raise their production when prices rise. But I think the Biden administration could have done it in a more subtle and less overt way."

And about whether President Biden has enough tools to pressure Saudi Arabia to increase oil production, Ben Cahill responded by saying that the “OPEC Plus group is very happy with the current prices. In fact, the economies of these countries are recovering after more than 6 years of a relative decline in oil prices.” ".

And Ben Cahill continued, "OPEC Plus believes that market demand will decline next year, and this coincides with the arrival of new supplies from countries outside OPEC Plus, and at the same time it feels that it is adding many barrels to meet global demand, and does not see the rationale for exporting more."

strategic reserve

On the possibility of President Biden resorting to the option of putting the US strategic oil reserves in the markets as a way out of the current high oil price crisis, Ben Cahill saw that “putting part of the strategic oil reserves is an option, but these reserves are strategic stocks aimed at responding to major supply disruptions during disasters.” natural as hurricanes.

The American expert added, "It is not a great quick solution to adjust the markets in the short term, and in fact the decline in strategic reserves may increase concerns about low stocks that usually provide a buffer against any future disasters."

And he added, "It is easy to make a decision to put up part of the strategic reserve, but this option may be ineffective, and the Biden administration has lost the element of surprise at this stage."

A headache, not a crisis

On the impact of high oil prices on President Biden's popularity and internal political calculations, Ben Cahill replied, "No American president wants to see gasoline prices at this level, and it increases broader concerns about inflation, which is a real challenge for the White House."

However, he added, "But in fact it is a headache, not a crisis. This is not the first time that oil has risen to these levels, and it will not be the last. We have known these conditions before, and we should not exaggerate our reaction."