SVT's review of the fund industry's fee system has shown that the online banks' exceptional profit margins have become increasingly dependent on so-called kickbacks.

The system means that the fund companies normally return about half the fund fee to the online bank when the customer buys a fund.

The approach has been criticized by, among others, Finansinspektionen because it can lead to fund sellers recommending expensive funds to the customer instead of cheap ones.

Online banks have repeatedly communicated that they do not market expensive funds over cheap ones - on the contrary.

In the newspaper Dagens Industri's TV broadcast, Avanza's CEO Rikard Josefson said on Tuesday that "We highlight cheap funds for our customers" and "We put the customer first".

Avanza: "We never market funds like that"

In an interview with SVT in early February, Rikard Josefson said that “We never market funds in that way.

That you should buy an expensive one.

We pretty much market our own fund, Avanza Zero, which has a zero fee. ”

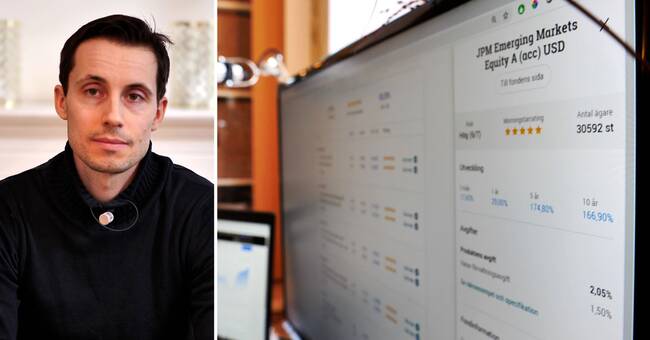

But Avanza's customers who visit the company's website or Avanza's private financial advisory site Placera encounter a slightly different picture.

Each month, Placera recommends 12 funds that Placera considers to be worth buying.

For February, ten of the funds are equity funds.

Three of them have a fund fee of over two percent, the most expensive is 2.75.

The average fee for the ten funds is 1.76 percent.

This is significantly higher than the average fee for all equity funds in the Swedish fund market, which according to AMF's annual fund fee report was 1.55 percent in 2019.

"Can not have lavish offices on Stureplan with only index funds"

Avanza's IR manager writes in an email to SVT that the company does not recommend any funds.

Avanza also writes that "Placera is a completely independent subsidiary of Avanza, where journalistic freedom prevails and where Avanza has no influence or transparency in what is written".

Patrick Siegbahn also reacts to the fact that Avanza customers who log in and use Avanza's so-called fund portfolio generator receive a list of, among other things, several funds with fees well above average.

According to Avanza, this is not an "advisory tool" but a "filtering tool".

- I do not think Avanza or Nordnet would get their business together if they only invested in index funds.

The industry could not live on such margins with lavish offices on Stureplan, says Patrick Siegbahn.