The International Energy Agency (IEA) has revised its forecast for oil demand in 2020.

According to the organization's report published on Tuesday, September 15, at the end of the year, the consumption of energy raw materials in the world can be reduced by 8.4 million barrels per day - to 91.7 million barrels per day.

Earlier, the IEA had expected a decline of 8.1 million.

The agency downgraded its forecast for the second time in a row.

According to the experts of the organization, the recovery in global oil demand has slowed as a result of the increase in the incidence of coronavirus in many countries.

According to Johns Hopkins University, since the beginning of autumn, the number of COVID-19 infected in the world has increased by more than 14% and now exceeds 29.1 million.

“It is becoming increasingly clear that COVID-19 will stay with us for a while.

For example, the number of coronavirus cases continued to rise in India, leading to the largest drop in oil demand in the region since April in August.

In this report, we have revised down our forecasts for global demand growth in the second half of this year, ”- says the IEA study.

As Vitaly Gromadin, senior analyst at BCS, noted in a conversation with RT, a weak recovery in oil demand has led to a noticeable reduction in the cost of energy resources in recent days.

Thus, in the first two weeks of September, quotations of Brent crude oil and the American WTI grade fell by almost 12% and are currently near $ 39-40 and $ 37-38 per barrel, respectively.

“The volume of air travel is still 40-50% behind last year.

The demand for gasoline and diesel is also 10-20% below the norm.

If vehicles can return to normal next year, the restoration of the aviation industry may take from two to three years.

At the same time, the countries participating in the OPEC + deal began to increase production, which gives rise to fears of a possible oversaturation of the market with oil and overflow of storage facilities, ”explained Gromadin.

The observed stagnation of oil prices most noticeably affects the activities of US shale companies, said Alexey Kirienko, managing partner of EXANTE.

According to him, at the current level of quotations, shale oil production is unprofitable for the majority of American enterprises.

As a result, a significant part of production facilities are still unable to resume work.

Note that since the beginning of 2020, the number of active oil rigs in the United States has decreased by almost four times and reached 172 in mid-August. The value has become the lowest for all the time of official observations - since the 1940s.

At the moment, the indicator has recovered to 180, however, drilling activity in the country is still close to historical lows.

This is evidenced by the latest data from Baker Hughes and the US Energy Information Administration (EIA).

“The current price level remains too low for US shale producers to start returning to work en masse.

Earlier, in 2016, drilling activity in the United States began to grow rapidly, only a few months after prices crossed the $ 50 mark per barrel.

This level is likely to remain the current watershed between the active resumption of shale production and maintaining the minimum required capacity utilization, ”Kiriyenko said.

Against the backdrop of the downtime of enterprises, many shale producers had nothing to pay off their loans, which provoked a wave of bankruptcies in the industry.

This is evidenced by the materials of Haynes & Boone.

So, since the beginning of 2020, 36 energy companies have already gone bankrupt in North America.

Their total debt amounted to almost $ 51 billion. Of this amount, $ 27.5 billion fell on unsecured loans.

By the end of 2020, the number of ruined producers of raw materials is expected to only increase.

“In the absence of any hope of improving economic conditions for US oil companies in the near future, there is reason to expect that a significant number of companies will continue to resort to bankruptcy as a tool to protect against creditors by the end of this year,” Haynes & Boone said.

Democratic response

It is noteworthy that Joe Biden's victory in the presidential elections in the United States in November could additionally bring down the production of shale oil in the United States.

This is the conclusion reached by the specialists of the S&P Global Platts agency.

According to the organization's report, the environmental policy of the Democratic candidate calls for tougher working conditions for oil companies.

As Vitaly Gromadin explained, such actions may lead to a reduction in shale production and an even greater drop in drilling activity.

“The Democratic presidential candidate has promised to ban the issuance of permits for the development of deposits in federal lands.

This will have a negative impact on the oil industry.

On the eve of the elections, oilmen even began to apply for permits in reserve.

The number of permits received in the last three months has grown by 80% in the main production regions in the United States, ”added Gromadin.

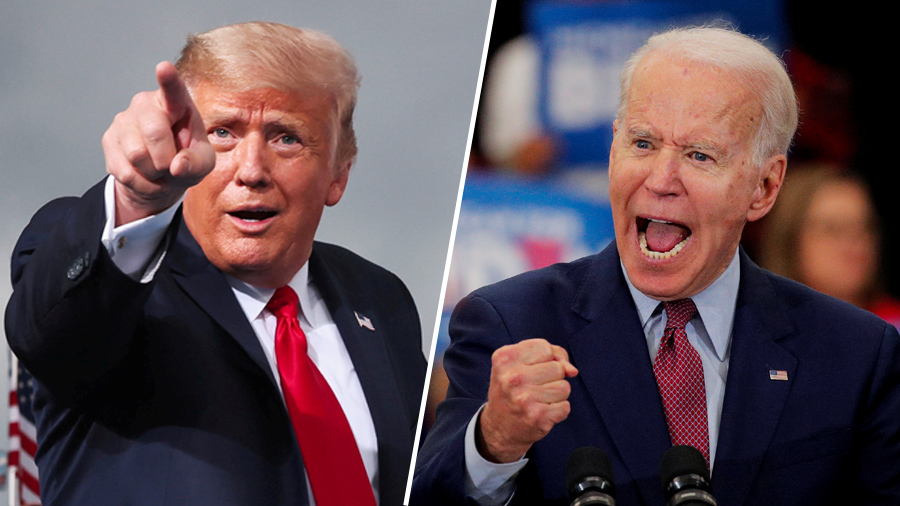

According to a survey from the University of Monmouth, at the moment Joe Biden is noticeably ahead of his rival, Donald Trump.

Thus, the Democratic Party candidate is preferred by 51% of registered voters, and the incumbent head of the White House is preferred by 42%.

Reuters

However, according to analysts at S&P Global Platts, the actions of Senator Kamala Harris, which Biden nominated as a candidate for the post of Vice President of the United States, can cause even greater damage to the shale industry.

Previously, she advocated a complete ban on hydraulic fracturing (fracking) - the main method of producing shale oil.

As Aleksey Kiriyenko explained, this method of extracting raw materials is considered hazardous to the environment.

“The Republican Party is often presented as a lobbyist for the oil industry.

Trump categorically dismissed environmental issues, so the coming to power of the Democrats can not only swing the political pendulum in the other direction, but also finally put an end to the shale revolution.

As a result, the United States will have to return to the role of a major oil buyer, ”Kiriyenko concluded.