Oil, record increase after the attacks. New splash for Atlantia

2019-09-16T10:32:20.431Z

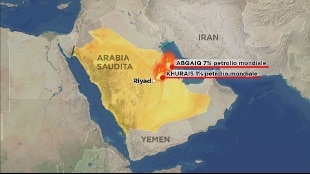

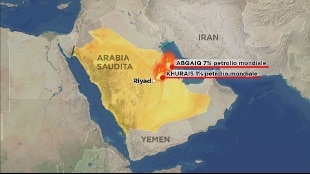

The impact on the oil price of the attacks in Saudi Arabia, which damaged the two main oil plants and halved the daily production, from almost 10 to about 5 million barrels per day, was immediate and very strong. Brent, the crude oil of the North Sea, started to rise by 19 and a half percent, the largest daily increase since oil futures were introduced in 1988. Now the rise is 9.15%, at $ 65.72 per barrel. The WTI, the reference crude for the American market, almost touches 60 dollars, + 8.60%. The price had fallen and stabilized in recent months after the peak of $ 74 in April. Now the question is how long this surge will last. Saudi Aramco said that one third of the interrupted production will be restored today. Among the effects, there is the race for safe havens, such as gold, which rises by around 1%, to $ 1,511 per ounce. The Milan stock exchange loses 1.15%, the worst in Europe where, however, all the squares are down. On the Ftse Mib only three titles out of 40 are positive: Tenaris (+ 3.47%), Eni and Saipem, all linked to the oils. Less 7.12% for Atlantia, after -7% on Friday, following an investigation into alleged false reports on the status of viaducts. The Btp Bund spread is rising after the descent of the past few days following the measures taken by the ECB. It is now at 137 basis points. The macroeconomic data arrived today, starting with the public debt, which touched the new highs do not help: in July the government debt, informs the Bank of Italy, saw its value increase by 23.5 billion compared to the previous month , amounting to 2.409.9 billion. And again in July, the tax revenues recorded in the state budget saw a 5.9% contraction, compared to the same month in 2018, reaching 46.5 billion. Finally, inflation is below expectations: + 0.4% the annual change recorded in August, against the + 0.5% expected. Also positive signs did not arrive from China: industrial production in August increased by 4.4% compared to the same month of the previous year: it is the lowest increase since 2002.

Share

by Fabrizio Patti 16 September 2019Immediate and very strong impact on the price of oil of the attacks in Saudi Arabia that damaged the two main oil plants and halved the daily production, from almost 10 to about 5 million barrels a day. Brent, the crude oil of the North Sea, started to rise by 19 and a half percent, the largest daily increase since oil futures were introduced in 1988. Now the rise is 9.15%, at $ 65.72 a barrel. The WTI, the reference crude for the American market, almost touches 60 dollars, + 8.60%. The price had fallen and stabilized in recent months after the peak of $ 74 in April. Now the question is how long this surge will last. Saudi Aramco said that one third of the interrupted production will be restored today. Among the effects, there is the race for safe havens, such as gold, which rises by around 1%, to $ 1,511 per ounce. The Milan stock exchange loses 1.15%, the worst in Europe where, however, all the squares are down. On the Ftse Mib only three titles out of 40 are positive: Tenaris (+ 3.47%), Eni and Saipem, all linked to the oils. Less 7.12% for Atlantia, after -7% on Friday, following an investigation into alleged false reports on the status of viaducts. The Btp Bund spread is rising after the descent of the past few days following the measures taken by the ECB. It is now at 137 basis points. The macroeconomic data arrived today, starting with the public debt, which touched the new highs do not help: in July the government debt, informs the Bank of Italy, saw its value increase by 23.5 billion compared to the previous month , amounting to 2.409.9 billion. And again in July, the tax revenues recorded in the state budget saw a 5.9% contraction, compared to the same month in 2018, reaching 46.5 billion. Finally, inflation is below expectations: + 0.4% the annual change recorded in August, against the + 0.5% expected. Also positive signs did not arrive from China: industrial production in August increased by 4.4% compared to the same month of the previous year: it is the lowest increase since 2002.