The cost of CO2 shoots the electricity bill to its highest level in 31 months

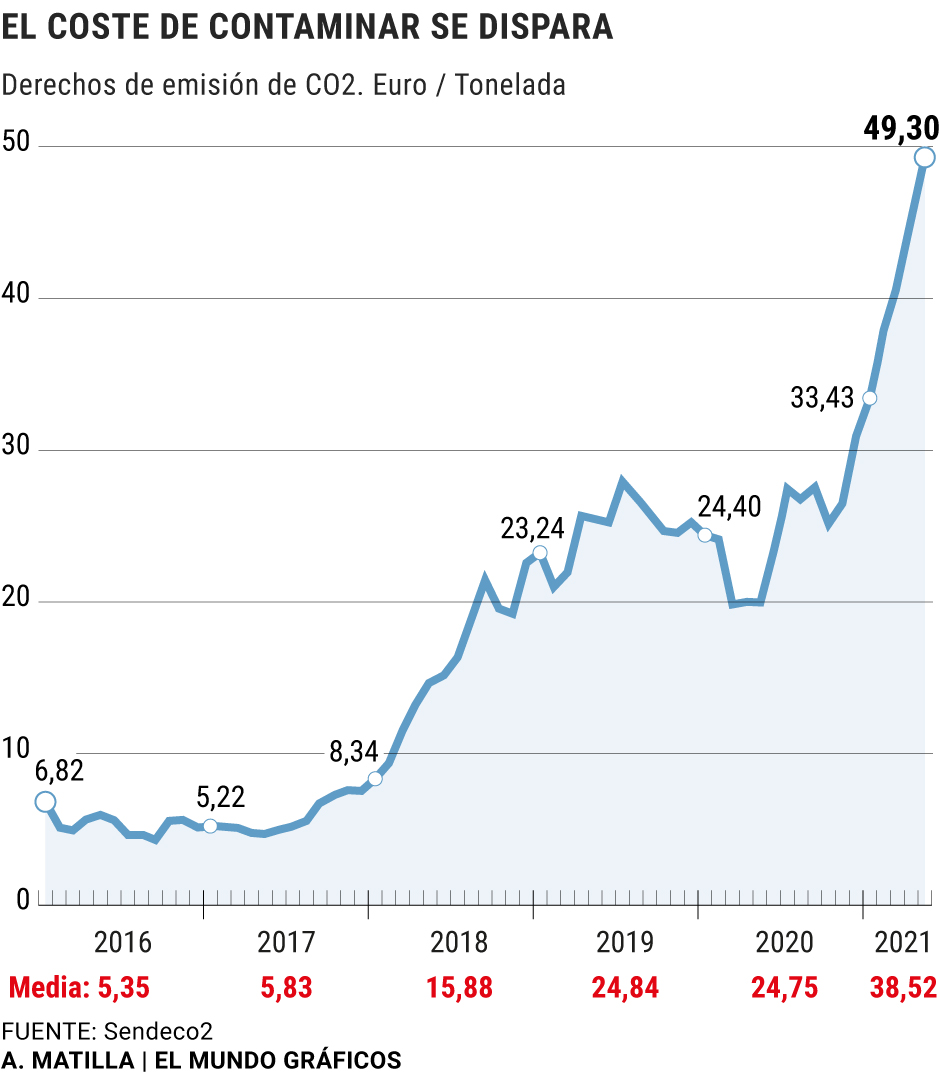

The polluter pays principle is making its way in a rush in Europe and has caught millions of businesses and households off the mark. In just one year, the cost of emission rights per ton of CO2 has doubled, going from 20 euros to what it was trading in May 2020 to the

historical record of 50 euros

reached yesterday. This increase has already had a first reflection on the electricity bill - which closed in April at its most expensive level in the last 31 months - and the competitiveness of the industry, which needs to incorporate these rights into its production processes. But why this rapid rise in CO2 and what is its ceiling?

There are two factors behind this bubble: a political base that pursues an increasingly less polluting world and a high speculative component that ends up distorting prices. The first is the result of the European Union's climate ambition for countries to reduce their polluting emissions before 2030, as stated in the

Paris Agreement.

This objective reduces year by year 'the rights to pollute' granted to the different companies to favor a clean transition of their business without losing competitiveness compared to other large markets such as the US or Asia. The problem for many of them is that, if they do not reduce their emissions at the established rate, they need to buy these rights in auctions carried out by Brussels or acquire them in the secondary market at a price that does not stop increasing.

The second component after the CO2 bubble is purely speculative and coincides with the

entry of banks and investment funds into this lucrative market.

"Between 70% and 80% of the rights auctioned each day are acquired by financial agents who trust in their revaluation", explains

Ismael Romeo

, CEO of Sendeco2, a company dedicated to the purchase and sale of emission rights on its own account and advising technical and administrative of industrial clients. If to this is added the abundant level of current liquidity due to the expansive monetary policies implemented by central banks in response to the coronavirus and the search for investment alternatives that serve as a refuge in the midst of the economic storm, the mess is guaranteed.

The result is that the price of CO2 so far this year is

39.52 euros per ton,

59% more expensive than the average for 2020. And the gap has not just grown, since in the last bids the cost has already touched 50 euros. This increase in prices has a clear impact on the day-to-day life of homes and companies.

The first reflex occurs through the rise in electricity and gas bills. Much of the electricity consumed by households is linked to generation sources with emissions such as gas thermal power plants, which end up transferring this cost to the wholesale market price. The rest of the 'clean' sources end up benefiting from this increase since, being a marginal market, all agents charge the price of the most expensive offer that manages to be married. "Every euro that the cost of CO2 rises, we will see the price of electricity rise by 0.3-0.5 euros per megawatt hour. Very soon, if it is not happening already, the cost of emissions will be the main cost of a thermal power plant. European, higher than even the raw material itself (gas or coal) ", highlights

Juan Carlos Martínez, energy markets analyst at Grupo ASE.

The second blow is indirect and comes through the products manufactured by the companies affected by the increase in cost of their production processes, since they end up internalizing the cost of CO2 and the very expense of an increase in their energy bill.

Without going any further, the

CPI shot up to 2.2% last April

due to energy prices, as the economy is still in recession and consumption has barely been reactivated.

Brake on recovery

In this sense, the sharp rise in CO2 prices is positioned as a short-term threat to economic recovery. The question is: To what price level can it go up? "The latest forecasts, published in early April by Carbon Pulse, estimate that the duty could average above 41 euros per tonne until the end of 2021, reaching or approaching 100 euros before the end of the decade." , explain

Iker Larrea and Eric Bernard, from Factor.

"Nobody knows, but the market assumes that it will continue to rise and that in 2021 it will reach and remain above 50 euros per ton. Probably, in the medium term its price will be set much higher," adds Martínez, from the ASE group. .

This analyst believes that the market works properly because it gives an effective price signal on the cost of polluting, which is what it was really created for. In any case, he recalls that the EU could intervene if it considers that the price has gone out of control due to "excessive speculation" that goes beyond providing liquidity and flexibility to the market, although in its opinion we are still far from this.

However, Romeo warns of the collateral impact that this market heat may have on the industry at a time of economic fragility like the current one.

"The price right now is skyrocketing and has caused problems for industrial groups. A doubling cost is very difficult to bear on a budget, and paradoxically it could lead to the company being more focused on surviving than investing in technology and renewables. to reduce their emissions ", he emphasizes.

According to the criteria of The Trust Project

Know more

Coronavirus

Europe

Asia

USA

Paris

European Union

Tourism Spain, among the 80% of countries in the world to which the United States recommends not traveling

Economy The Government will allow exceptionally the entry of travelers from the US and China to support the Mobile of Barcelona

ResultsMercadona earns 17% more in the year of the pandemic and creates 5,000 new jobs

See links of interest

Elections Madrid

Pablo Iglesias

Work calendar

Home THE WORLD TODAY

Anadolu Efes Istanbul - Real Madrid

Olimpia Milan - FC Bayern Munich

Barça - Zenit Saint Petersburg

Manchester City - PSG, live