Aimed Sustainable Benefit Application Substitute Posting What is the method? October 2, 17:55

Unauthorized receipts of "sustainable benefits" provided to businesses whose sales have fallen sharply due to the effects of the new coronavirus are occurring one after another nationwide.

On SNS, there are a series of suspicious solicitation posts that people who are not eligible to receive the benefits will be able to receive the benefits on their behalf, and the Small and Medium Business Administration is strengthening the measures, which is increasing the sense of crisis.

A man who received it illegally "Everyone says'it's a corona bubble'"

A man who actually received the benefits illegally revealed the method in response to an interview with NHK.

In June, a man living in the Kansai region was invited by an acquaintance to say, "If you apply for a benefit, you will get 1 million yen. The tax accountant will do all the procedures."

Men are not eligible for sustained benefits because they are not in business.

However, when I told my acquaintances about my past occupations on LINE, I received the sales ledger required for last year's final tax return, which was created by a tax accountant.

All the occupations, income, expenses, etc. listed in the sales ledger were false, but after filing a final tax return at the tax office, the man took a photo of the tax return and took a picture of the bankbook of the transfer destination account. I sent it to an acquaintance with a copy.

After that, it seems that an acquaintance submitted a tax return and a false document pretending that sales of this year had decreased and applied for a sustainability benefit, and one week later, 1 million yen was transferred to the account. ..

The man handed 300,000 yen as a commission to his acquaintances, and after that he introduced five or six acquaintances.

The man said, "I thought it would be better if I could get the money without doing anything. Last year's tax return was well adjusted so that it would not be in the red and tax would not be incurred. Sustainable benefits are loosely examined and everyone I'm saying, "It's a corona bubble." "

"Sustainable benefits" Less required documents, simple procedure, 4.4 trillion yen payment

"Sustainable benefits" support cash flow for businesses whose sales have dropped significantly due to the effects of the new coronavirus. Small and medium-sized enterprises can spend up to 2 million yen, and sole proprietors can spend up to 1 million yen. It will be provided.

Since January, we are accepting online payments in order to avoid congestion at the counter and to provide prompt payments on the condition that sales in a specific month have decreased by 50% or more from the same month of the previous year. ..

When applying, it is necessary to send documents such as a final tax return and a ledger showing that sales have decreased, a copy of the bankbook of the financial institution to which the transfer is made, and data on identity verification documents such as a driver's license.

However, compared to other grants and benefits, the required documents are less and the procedure is simplified, and it is also permitted to send photos of documents taken with a smartphone.

If your application is approved, cash will be transferred to your account in about two weeks.

According to the Small and Medium Business Administration, if there are no suspicious points in the application, in principle, we will not contact the applicant and will provide benefits, so by the 28th of last month, about 3.4 million cases, 4.4 trillion yen will be paid. It means that it was done.

Posting suspicious solicitations on SNS is also "up to 1 million yen commission is 10%"

There are a series of suspicious solicitation posts on SNS that suggest that you apply for a sustainable benefit on your behalf.

Sustainable benefits are provided to sole proprietors such as SMEs and freelancers.

However, on SNS, "Must-see for students, housewives, unemployed, office workers! This is a sustainable benefit project for Corona! The administrative scrivener teacher will take care of the procedure to get up to 1 million yen! The fee is 10% at the time of success You can check the posts as if you can receive the benefits even if you are not eligible to receive the benefits.

Also, in another post, along with an image of a wad of bills, it is written that "You can receive 100% benefits in a short period (about one week) with a simple procedure. It is okay in any situation" and can anyone receive the benefits? The content is misleading.

In response to this tweet, the Small and Medium Business Administration replied, "For those who are not doing business, it is a crime to support the application for sustainability benefits while knowing it, so please be careful." It was.

Cases in which college students and office workers are arrested

Consultations about "I was asked to receive unfair sustainability benefits" have been received one after another at consumer service centers nationwide.

According to the National Consumer Affairs Center of Japan, by September 30, there were about 690 consultations nationwide regarding problems such as "sustainable benefits" paid to businesses whose sales have fallen.

Recently, there have been many inquiries from students in their twenties and thirties, office workers, housewives, etc. who said that they were "proposed to illegally receive sustainable benefits" through SNS and LINE.

Among them, women in their thirties were told by a free calling app that "if you apply through a specific company, you can receive sustainable benefits even if you are a salaried worker or unemployed", and men in their twenties are attended by a person who claims to be a tax accountant from an acquaintance. He was invited to a group of messaging apps that he said, "Take a fictitious sales ledger to the tax office, file a tax return, and apply for it to receive benefits."

And both of them were requested to "pay a part of the benefit as a fee".

"Sustainable benefits" are not eligible for benefits to students and office workers who are not in business, and if you apply falsely as a business operator, you may be subject to criminal penalties, and university students and companies may be punished for actually deceiving the benefits. There have been a series of cases in which members have been arrested.

The National Consumer Affairs Center of Japan said, "Illegal receipts are likely to be accused of crimes, so please do not accept suspicious solicitations. Please do not tell me your account number or my number by phone." I am calling attention.

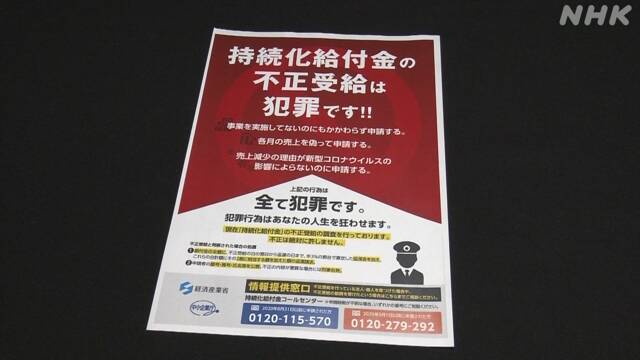

Small and Medium Business Administration Strengthening Measures Publicization of name and criminal accusation

The Small and Medium Business Administration is becoming more vulnerable to the situation of fraudulent receipt of sustainable benefits.

Since June, we have been strengthening measures such as assigning specialized staff to investigate fraudulent receipts, and the contractors who have been entrusted with the business also accumulate and list the methods of fraudulent receipts for examination. We are strengthening.

According to the Small and Medium Business Administration, students and office workers who are not eligible to receive benefits are solicited on SNS etc., and there are many cases where they falsely apply for "I am doing business individually", so Illegal solicitation We are also working on sending a warning message such as "Unauthorized receipt is a crime" to posts on SNS.

If you find fraudulent receipts, add a 3% annual delinquency charge to the payment amount, request a refund of the total amount plus 20%, announce your name, etc., and file a criminal accusation if it is malicious. There is a possibility.

A person in charge of the Small and Medium Business Administration said, "There are conspicuous cases of soliciting fraudulent receipts with a light feeling, but if fraud is found, it will be severely punished. The procedure is simplified for speedy payment, but fraud is absolutely forgiven. We must not do it, and we will carry out a thorough investigation in cooperation with the police. "

Expert "It's hard to spot fraud"

Kazuhiko Nemoto, a former national tax inspector, said, "Since the sustainability benefit is a remedy for the business operator, the procedures and documents have been simplified in order to provide it promptly, and last year's final tax return documents and sales. If you have a ledger, you can apply. When investigating fraud at the tax office, you will arrange tax returns for several years to see if there is any suspicious movement, but if the amount of information is small, it is difficult to detect fraud. " doing.

On top of that, "If you compare the history of past tax returns and the data that the government has such as business notifications, you can highlight suspicious applications. You need a sense of speed of benefits, but you should check after the fact properly. It is necessary to widely communicate and deter fraud. "