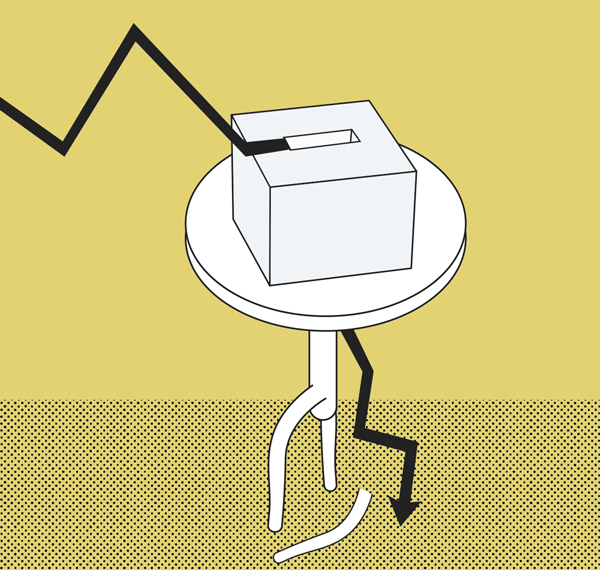

There is little doubt that the most advanced countries are suffering from a significant slowdown in the growth of their productions , which could soon lead to an open recession or, which is less likely for now, to a major crisis . The reports of the International Monetary Fund, the OECD and the European Central Bank have been announcing these possibilities lately. For our country, they estimate growth rates in 2019 that are still higher than those of most developed countries, although significantly lower than those achieved in 2018. In this context, the most frequent forecasts for Spain point to a growth of just under 2%. in this year and at lower rates for 2020 . But some add that the slowdown of our economy is being faster than that of the countries around us. They are not warnings to forget, although these forecasts are strongly conditioned by what may happen with the trade conflicts between the United States and China ; with the unknown consequences of Brexit ; with the evolution of oil prices and, of course, although little commented, with the negative influence that some measures for the protection of the environment are having on important industrial sectors and exporters such as the automotive industry. A positive change in these conditions could perhaps improve these negative forecasts somewhat, although there is hardly any time left to achieve it not only in 2019 but also in 2020.

Therefore, the economic outlook that opens in Spain before the general elections on the 10th is a sharp slowdown although some do not want to openly acknowledge it. The reasons may be many, but perhaps two circumstances are holding that optimistic assessment of the current moment. The first, although perhaps of little quantitative importance, may have its origin in that the slower rate of creation of new jobs in recent quarters has been partially compensated, at least, by the creation of public employment . According to the latest Active Population Survey between the third quarter of 2018 and the same period of 2019, total jobs have increased by 346.3 thousand compared to the 492.5 thousand increase in annual average counting since 2014. It is evident, by therefore, the loss of dynamism of employment in the last 12 months (146.2 thousand fewer jobs per year) as a result of the appreciable slowdown in the economy and perhaps also of the increase in the minimum wage. Within the figure of new employment in the last 12 months (346.3 thousand, as indicated above) that of public nature has been 61.2 thousand, higher than the 47.8 thousand new public jobs that, On average, they had been generating since 2014 with an expanding economy. The creation of public employment has accelerated in recent times, because in the third quarter of 2019, compared to the previous quarter, total employment increased by only 69.4 thousand jobs and, of them, almost half ( 49.3%) were created in the public sector . We are not only facing a lower creation of total employment, but surely to compensate for it, there has been a more intense creation of public employment. Perhaps the lucky beneficiaries of this greater public employment - which may not be many in themselves, but much more if they join those who, for different reasons, do not want to admit this negative situation - have not yet perceived the obvious economic slowdown Spanish

The second possible reason why some do not perceive or do not want to perceive the slowdown in our economy may be due to the sowing of greater public expenditures that the Government has been carrying out with evident prodigality for months. To the new expenses already made, we must add the promises of other important increases after the elections . All this abundant generosity has also been able to contribute to the benefit of the groups benefited or those simply in favor of such increases, neither to perceive the change of situation that is taking place.

The risks of this policy of increasing public spending are so significant that the European Commission has just warned us of its dangers. Its impact also questions the fulfillment of the public deficit objective. On the other hand, the Government has not explained how it will obtain the necessary fiscal income to finance them, perhaps for fear of its immediate electoral consequences. Increasing public spending above what is already committed and putting at risk the amount of the deficit in an economy that suffers from very high public debt (98.9% of GDP in the second quarter of 2019) does not seem the most appropriate policy. However, it is possible that once the electoral process has been passed, these increases constitute sufficient justification for a parallel increase in personal direct taxes, which is the tax reform claimed by some of our most significant political forces under the false under the pretext that in this way a better distribution of income and wealth is achieved, obviating that to improve this distribution, taxes do little good and that the fastest and most effective is to reduce unemployment.

However, an increase in direct personal taxation could receive the approval of European organizations because, once the deficit limit was saved, there would be little objection to the instruments to finance spending increases. But do not forget that the growth potential of the Spanish economy could be seriously resented if the new expenses were financed through direct taxes of a personal nature such as personal income tax, Societies, Successions, Equity, Social Security fees and the like. Much of this tax reform has already been announced by the acting finance minister, although it is difficult to believe that these increases will not adversely affect those who make fundamental decisions in any market economy. The Autonomous Communities that keep these taxes at moderate levels are generally the ones that grow the most and generate the most jobs .

In the current situation of the Spanish economy, with a GDP growth that is weakening in the eyes , with a significant loss of strength in job creation and with a public debt that almost already exceeds the amount of our production, Any item of public expenditure should undergo a careful examination before deciding its increase. If, finally, this increase is essential, the simultaneous decrease of any other with which to cover its financing should be sought without resorting to higher taxes. Only if they still fail to achieve sufficient coverage, can the taxes with which the new resources be collected be carefully chosen. In this sense, increasing progressive direct taxes only by applying such increases to the upper reaches of their tariffs would not provide resources for almost anything, nor would it improve the personal distribution of income and wealth. If, on the contrary, the fiscal changes also affect those who are in the middle tranches of the rates, the collection could be greater but its effects would be even more catastrophic, without appreciable positive redistribution and generating strong distrust in the middle classes, which they would not forget for years neither that reform nor its authors. These measures would have a very negative impact on private savings , discourage investments , aggravate business projects that implied the assumption of greater risks and, even, would flee to fiscally more prudent horizons who are driving growth in any market economy every day.

That is why it should be taken into account that, when raising taxes is inevitable, it is best to resort to indirect taxation of a general nature and neutral sectoral effects . In a world where inflation seems not to exist it would not be a bad solution. In any case it would be better than to increase direct taxation, although those increases are those that, as in the fifties and sixties of the last century, continue to appeal to many of our politicians. For them nothing seems to have changed since then.

Manuel Lagares is Professor of Public Finance and member of the Editorial Board of EL MUNDO.

According to the criteria of The Trust Project

Know more- GDP

- Spain

- Social Security

- OECD

- Personal income tax

- IMF

- U.S

- European Comission

- China

- Taxes

- Macroeconomy

TribunaTrump and the one-eyed tale

Fresh money End of cycle: the economy will return for years at the pace of 2014

Fresh money Montero bingo: breaches 9 of 9 objectives in the Stability Law since 2018