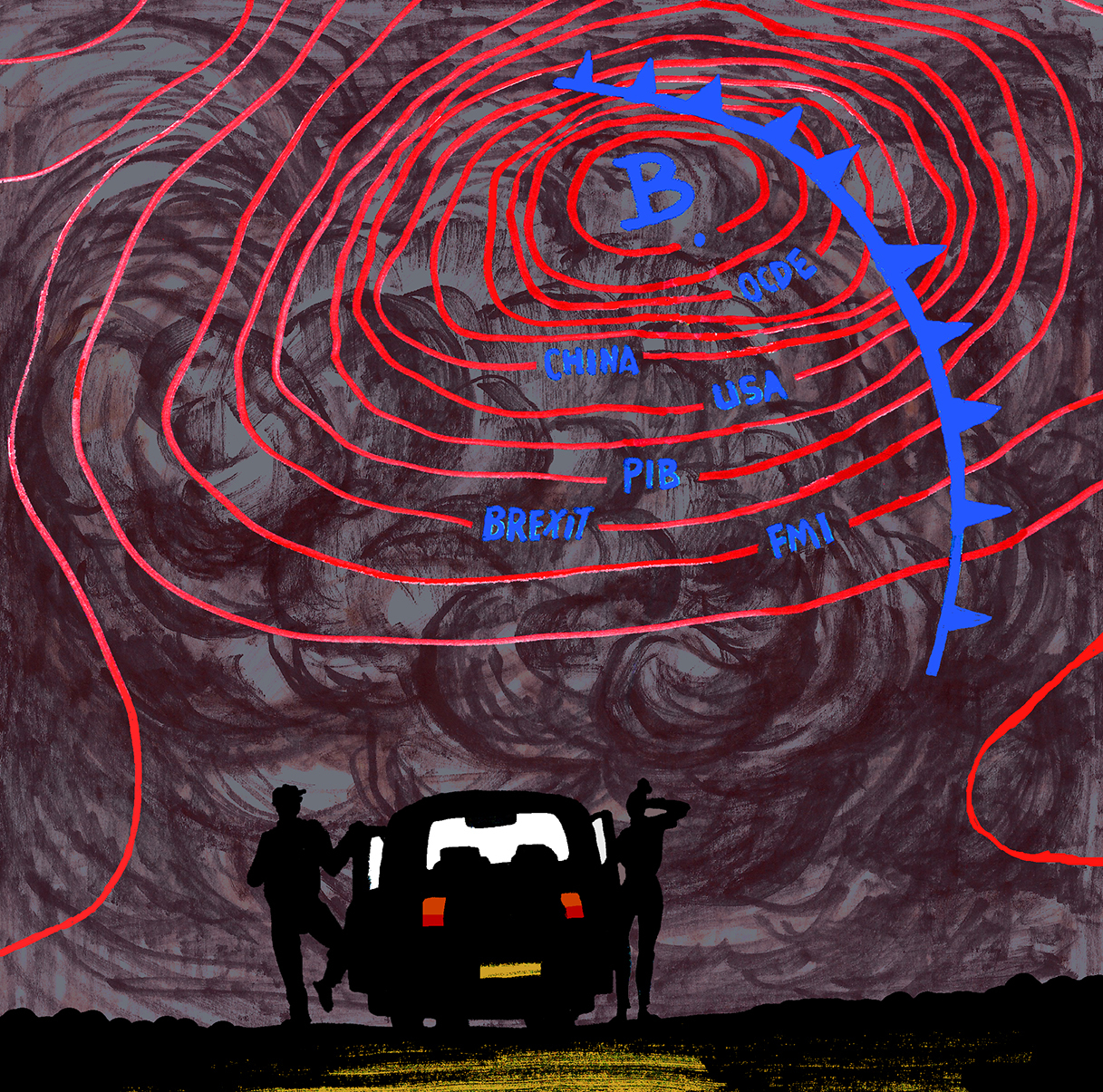

At least since last November my readers know that bad economic prospects are approaching us. I have never tried to formulate prophecies about the immediate future, because economists are bad prophets, but only to make mere conditioned predictions. The conditioning of these predictions were, among others, the possible increase in oil prices, which has not occurred for now with the feared virulence; the China-United States trade war that was merely aimed at that time and that today is almost an open reality, although the emergence of an in extremis agreement cannot yet be ruled out; the possible crisis of the economies of China, Turkey and, less pronounced, of Italy, the United Kingdom and Germany , which can now be clearly identified; the possibilities of a Brexit without agreement , which then - the time of May as prime minister - seemed remote and now they are much more probable and fearsome; the effects of the new environmental regulations on domestic consumption and exports, which began with diesel in the automotive industry and are already being extended to other sectors and consumption; the strong budgetary tensions in Italy and the somewhat less pronounced in Spain due in our case not to a rationally defined government policy but because we live with extended budgets; the imbalances that began to appear in the capital markets and that are expanding now week after week ... It seems obvious, then, that most of the conditioning of that time is already acting strongly and pushing the economy of the large countries towards a significant slowdown . Perhaps, at the limit, towards a new crisis.

When I made those predictions, some friendly readers sent me their criticism for the pessimism that came from them. In the face of my apparent pessimism, they believed then that the Spanish economy would continue at a good pace the expansionary process that it had started in 2014, which gave them the impression that 2019 would close with a growth similar to that of 2018. Somewhat less optimistic in their forecasts were At that time the European Union , the IMF and the OECD , which have now deepened in the aforementioned circumstances and already admit a possible growth of Spanish GDP in 2019 of only 2.2% . However, at the end of this year this growth may end up being smaller, as the National Accounting and employment figures for the second quarter of this year that we have just known these days seem to announce.

In any case, to slow down before the slowdown that affects the world's largest economies is late, the European Central Bank has suspended, at least until 2020, the decision it had already taken to finalize asset purchases as a means of introducing liquidity in the European financial system . That backtracking while maintaining such purchases will mean new injections of liquidity into the system, which will help keep interest rates low. For its part, the Federal Reserve of the United States has also begun the reduction of its own rates , after almost a decade raising them every few months. These facts reinforce the idea that another crisis is probably coming upon us, although it is not yet sufficiently reflected in the economic magnitudes or its effects have transcended the population as a whole. And, perhaps for that reason, those who govern the most important banking systems in the world have begun to take measures to counteract it .

There is little doubt that the Spanish economy is undergoing a process of appreciable slowdown, within the bad economic outlook that affects all the great nations, which reinforces the feeling that we are witnessing the beginning of a new crisis . Faced with a sequence of growth of our GDP in real terms of 3.8% in 2015, 3.2% in 2016, 3% in 2017 and 2.7% in 2018, the growth of 2.2% For now, the aforementioned international organizations forecast, it can only be achieved if growth is maintained in the third and fourth quarter of 2019, which is the same as in the second quarter of this year (0.5%). However, that Spain achieves such an objective will not be easy, especially when the aforementioned conditions are rapidly moving from mere possibilities to unfortunate realities and when, in addition, our special political circumstances mean that there is no capacity to implement the structural reforms that would be needed to overcome this unfavorable situation. That is why the chances that the growth of the Spanish economy in 2019 is only around 2% are increasing .

Many will think that such a growth in Spanish production in 2019 may not be a bad result compared to the rates that can be achieved in other major European countries. But those who think in this way do not perceive the serious deficiencies that affect our economy with respect to the more advanced countries, since generally those countries have long had more sensible union systems than the Spaniards, who pretend at this point nothing less than end with the labor reform that has allowed the successes achieved during these years by the Spanish economy . They also have an updated tax structure that drives business efficiency against a tax system such as Spanish, governed by outdated principles and pending a fundamental reform to which no one, despite the existence of well-defined proposals, has been able to face so far. They also have a territorial organization that promotes more efficient public spending than Spanish, oriented today much more at the service of local political interests than that of authentic popular needs. Additionally, they have a less fragmented teaching and not so different by regions such as the Spanish, where perhaps there are theoretical elucubrations in the clouds and historical analyzes that provide little while missing both a greater assessment of new technologies and sensible approaches to needs of the market and companies. These countries, for the most part, have a well-founded pension system and not like the Spanish one, which has been in technical bankruptcy for years and, if it continues, will end up devouring the financing of many other important public expenditure items . Finally, and in order not to make this relationship of disadvantages endless, these countries usually have a supply of energy at lower prices than the Spanish and are usually much less indebted than Spain ... And so we could continue listing the many structural advantages of our partners , advantages already acquired and that, however, in the case of Spain should have been part of the most necessary government programs for years, because without them the growth of production, the basis of material well-being, cannot be maintained in the future.

If this new crisis that seems to be coming true comes true, it would surely reach us with an economy structurally pending major reforms and, therefore, similar to that of the beginning of the previous crisis but with significant disadvantages. At that time, the public debt did not reach 36% of GDP and the State had in its hands valuable business assets that, put on the market, had financed many public needs until then. Today these corporate public assets have already been sold mostly and, in addition, our public debt has a volume very close to 100% of GDP . We are done with our public assets, we are indebted to the eyebrows, our politicians love the idea of spending without caps or restraint and we have not done most of the structural reforms we need. Meanwhile, some of those politicians resurrect artificial territorial conflicts that were already old and meaningless in the high middle ages and that will never be solved by the way they now claim, others distract the staff with the accredited bread and circus formula and all they generously subsidize groups and organizations that long lost in the north. A panorama so that, if it is not about our great country and the well-being of those who inhabit it, they want to get off the ground.

Manuel Lagares is Professor of Public Finance and member of the Editorial Board of EL MUNDO.

According to the criteria of The Trust Project

Know more- Spain

- GDP

- China

- Italy

- U.S

- UK

- Federal Reserve

- European Union

- Turkey

- OECD

- IMF

- Europe

- European Central Bank

- Germany

- Economic News Opinion

- economy

Tribune University: myth and reality

Trade war and Europe in the back

EditorialDegovernment harms the economy