The global super commodity cycle continues to ferment.

After returning from the May Day holiday, commodities ushered in another surge.

Aluminum prices stand above the US$2,500 mark.

Lun Copper broke through US$10,000 and hit a record high in one fell swoop, which is more than 100% higher than the low point in March last year.

The performance of the black series was the strongest, with thermal coal futures prices rising by 9.7% in the two trading days after May Day, closing at 863 yuan.

Iron ore rose 10.65% and coking coal rose 9.55%, both hitting record highs.

What has been overlooked is that agricultural products are the absolute king this year.

Since the beginning of the year, the price of corn has risen by 56%, which can be described as the "king of the bulk".

Wheat prices have also risen and are now approaching their April highs, while soybean prices have also risen 21%.

Right now, the price hike shows no signs of abating.

Goldman Sachs recently raised its target price again. For example, it raised the target price of Brent crude oil to US$80/barrel and the target price of LME copper to US$11,000/ton.

This wave of price increases also has its own particularities-in the global industrial chain, in the field of bulk commodities, resource countries are all countries that are relatively backward in economy and vaccine popularization, while consumer countries are concentrated in developed countries that are benefiting from vaccine popularization. The price increase of commodities is expected to remain high.

For example, in the global copper mine output, Chile's output accounts for a quarter.

In this round of global price hikes, the structural differentiation among enterprises has intensified. The position in the industrial chain and their own bargaining power are the real decisive factors.

Year-to-date growth of some commodities (%)

Black colored keeps rising

This may be a super commodity cycle that has been brewing for 10 years, with not only a recovery in demand, but also an unprecedented supply bottleneck.

Copper, which has always been the most popular variety, is still rising recently.

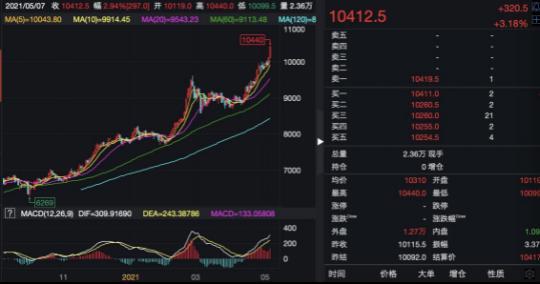

The price of 3-month copper futures (the most active contract) on the London Stock Exchange (LME) broke through the $10,000 per ton mark in the last week of April. In the two trading days after the May Day holiday, the price has reached 10412.5. USD/ton, breaking through the record high of USD 10,190 set in February 2011.

So far this year, copper prices have risen by more than 20%.

On the supply side, the strike issue in Chile is still disrupting the market recently, and the recovery on the demand side is also progressing smoothly.

For example, the demand for bulk commodities in China has recovered well, and the year-on-year growth of copper imports has accelerated again after a few months of deceleration.

Although copper rebounded more than 100% from the low point in March last year, it should be noted that between December 2008 and February 2011, the price of copper rose by more than 250%.

"In the eyes of many old traders, the commodity market is still only in the midfield. For them, those novice investors who think commodities are expensive now may just have not seen a real commodity bull market." Senior US stock trader Situ Jie According to CBN, once the market starts, it will generally last for more than a year, and it has lasted for more than half a year.

For example, after the 2008 crisis, the first round of quantitative easing was launched in 2009, when the market even expected hyperinflation.

Although core inflation has not risen, under the conditions of a weak US dollar, economic recovery, and loose liquidity, the wave of commodities has risen by 100% to 200%.

Now new demands are beginning to emerge.

Matt Simpson, a senior analyst at Jiasheng Group, told reporters that under the low-carbon transition and the upsurge of electric vehicles, the demand for copper is expected to continue to increase.

An electric car uses about 4 to 5 times as much copper as a traditional car, while a hybrid car uses about twice as much copper as a traditional car.

Even if aluminum, which is usually considered "not valuable", has a bright future in the near future. The aluminum concept stocks lead the rise of A shares, and the carbon neutral strategy has become the driving force.

All walks of life believe that the electrolytic aluminum industry has ushered in the secondary reform of the supply side.

Galaxy Securities mentioned that in the short term, Inner Mongolia’s “dual control” triggered reductions in electrolytic aluminum production in East Inner Mongolia and West Inner Mongolia, affecting nearly 300,000 tons of production capacity, and new capacity was less than expected. Downstream demand entered the peak season, and social inventories of the industry accelerated in the second quarter. Library, driving aluminum prices to continue to rise.

Yude Investment Fund Manager Feng Chao previously told China Business News that electrolytic aluminum is a more sustainable investment concept under the theme of carbon neutrality. The original thermal power aluminum will gradually be converted to hydropower aluminum.

In the past few years, the most thorough supply-side reform has been coal and steel, but electrolytic aluminum has not been so in place in terms of capacity reduction.

At present, Inner Mongolia is strictly controlling the energy consumption during the 14th Five-Year Plan period, and further suppressing the aluminum production capacity of thermal power in the region. “The domestic leading electrolytic aluminum enterprises are moving to Yunnan, carrying out reduction replacements, and turning coal-fired aluminum into hydropower aluminum, which is the price of electricity in Yunnan. The cost is also lower (approximately from 0.3 yuan per kilowatt-hour to 0.2 yuan). For leading companies, the overall production capacity will not change significantly, but the decline in electricity prices and the increase in aluminum prices may increase profit margins, so the supply of coal and steel in the early years The logic of side reform may be deduced in the aluminum industry."

Compared with internationally priced copper, iron ore and other black products are more relevant to China's demand.

On April 27th, the Platts 62% iron ore index reported $193.65, a record high.

Even with this skyrocketing increase, the downstream iron ore, namely the steel plant, is still actively restocking.

"During the period after the Spring Festival, the downstream latte ore was still a bit hesitant because the price at that time exceeded the budget price, but it was later discovered that it would not work if you didn’t take it. Overseas demand for steel remains high, and automobiles are also the main demand side." A head of a resource company told reporters.

Even under China’s actions to control production to reduce pollution, China’s crude steel output continued to increase, with a year-on-year increase of 15.6% in the first quarter, which greatly drove the upstream demand for medium and high-grade iron ore. The increase in export demand and the huge profit contributed to the increase. The main reason for steel enterprises to replenish inventory.

S&P Iron Ore Index Manager Wang Yangwen told reporters that into the second quarter, steel inventories continued to decline, which shows that domestic and export steel demand is strong.

It is not surprising that the output of steel producers is so high, their profit margins are soaring, currently between 130 and 160 US dollars per ton.

The global macroeconomic recovery has also boosted demand for steel outside of China, increasing total steel production and iron ore consumption.

This is evident from the strong stock price and performance of "Iron Man".

For example, the performance forecast of Chongqing Iron and Steel can be described as "bright and blind." The net profit attributable to shareholders of listed companies in the first quarter is expected to increase by about 1.08 billion yuan, a year-on-year increase of nearly 260 times.

Agricultural product rally is king

Although the price increase of industrial products is very eye-catching, agricultural products are the "price increase king" this year.

The Food and Agriculture Organization of the United Nations Food Price Index has risen for the 10th consecutive month, the highest level since June 2014.

Among them, corn ranked first in growth this year.

Since the beginning of the year, corn prices have risen by nearly 56%.

On May 7, the July corn futures contract reached a new high, surpassing 7.2.

Traders believe that a number of reasons indicate that the cereal product may usher in a further rise.

Joe Perry, a senior analyst at Jiasheng Group, told reporters that the future momentum includes: as the economies reopen after the new crown epidemic, the overall demand is heating up; due to insufficient rainfall in Brazil and low corn inventory levels, supply In China, due to the reduction in the number of pigs caused by swine flu last season, China is working hard to rebuild the pig herd, which has also brought additional demand; as the dollar continues to fall, other countries can make it cheaper Buy bulk commodities at a price.

"The rapid momentum of corn since the summer of 2020 is clearly visible. The price has gone from 3.01 to around 7.30. Although corn may fall after the sharp rise, the subsequent price may be pushed up by the bulls." Joe Perry said .

The demand for agricultural products such as corn, soybeans and pork is likely to increase.

Schroder Agricultural Fund Manager said that demand from China will be the main driving factor.

In addition, export restrictions during the epidemic have disrupted the supply chain.

This situation has led some countries to launch long-term plans to increase strategic food reserves (especially wheat) to reduce their dependence on imported goods.

For commodities in the broad sense, insufficient investment usually heralds the arrival of a new round of commodity cycles.

Between 2013 and 2020, capital investment by major integrated oil and gas companies fell by 52%.

Between 2012 and 2020, capital expenditures in the copper industry have also fallen by 44%.

Rising prices are the only way to stimulate investment in these industries.

Business climate differentiation under the tide of price hikes

In this round of global price hikes, the survival status of enterprises is also different.

The overall profitability of the upstream raw material-related industries has been significantly improved. The machinery and equipment, construction industry, light manufacturing and automotive sectors in the midstream manufacturing industry are less affected by commodity prices, and their gross profit margins are relatively stable.

The profitability of downstream consumer goods industries, which are closer to terminal demand, is now declining. Typical examples are textiles and clothing and home appliances, where the ability to transfer costs in downstream industries is weak.

Within the industry, the increase in the price of upstream raw materials has different substantive effects on companies.

The increase in raw material costs is more lethal to small and medium-sized enterprises, and large enterprises, because of their advantages in procurement scale and supply chain management, can effectively transmit cost pressures to the upstream and downstream.

For example, for a giant in the consumer goods industry such as Coca-Cola, raw materials actually do not account for a large proportion of the total cost, and other channels, advertising, and transportation costs are the bulk.

At the same time, due to the existence of scale effect, large companies can increase their own performance by taking advantage of the rising prices of raw materials.

In addition, the market is currently paying close attention to the central bank's response to price increases.

The duration of the supply bottleneck seems to exceed previous expectations.

Brazil is considered a "sample" of emerging markets.

On May 5, local time, the Central Bank of Brazil announced that it would raise the benchmark interest rate by 75 basis points, from 2.75% to 3.5%. This is the second interest rate hike by the Central Bank of Brazil this year.

Brazil's epidemic situation is still severe and economic recovery is weak, but inflation has already risen.

The PPI rose from 28.5% to 33.5% in March, which is the highest level since the Brazilian National Institute of Geography and Statistics began to release data in January 2014.

The price increase on the production side has been transmitted to the consumer side.

In the year ending in mid-April, the CPI rose by 6.18%.

At present, the world is staring at the Fed.

The initial value of the US service industry PMI in April has reached 63.1, while market expectations are only 61.5.

The Fed may announce its future balance sheet reduction plan in the summer.

Fed Chairman Powell still has a balance in his mind, that is, the 75% vaccine penetration rate.

According to media reports, the number of people receiving two doses of the vaccine in the United States currently accounts for 34% of the total population, while those receiving at least one dose account for 46%.

In fact, China is also experiencing rising inflation.

In March, the year-on-year increase of PPl rose sharply by 2.7 percentage points to 4.4%, mainly due to the upstream oil industry chain and the price increase of non-ferrous and ferrous metals, which increased by 1.6% month-on-month, setting a new high.

Many institutions predict that PPI will reach a peak of 6% to 8% year-on-year growth in the second quarter.

Based on the changes in China's money supply data in the first quarter, the monetary policy is indeed gradually normalizing.

The year-on-year growth rate of the stock of social financing scale peaked in October last year and reached 13.7%, and then fell month by month. By March this year, it had fallen to 12.3%, and will fall to a normal level of 10% to 12% in the future; broad money M2 year-on-year growth It also dropped from 10.7% in November last year to 9.4% in March this year, which is basically close to normal.

(Author: Zhou Ailin)