The opening of the Beijing Stock Exchange is approaching, and the supervision voices strict "entrance closed"

Our reporter Wu Xiaolu

The opening of the Beijing Stock Exchange is approaching.

A spokesperson for the China Securities Regulatory Commission recently stated that the Beijing Stock Exchange has completed the industrial and commercial registration, the main system and rules have been publicly solicited for comments, the technical system is basically in place, and various tasks are progressing in an orderly manner.

At the same time, the regulatory authorities have "voiced" the strict quality control of listed companies in advance.

Li Yongchun, deputy general manager of the Beijing Stock Exchange, said that the Beijing Stock Exchange will follow the exchange’s statutory regulatory responsibilities and vigorously improve the quality of listed companies.

Implement the pilot registration system, adhere to information disclosure as the center, and control the market "entry gate."

Market participants interviewed by a reporter from "Securities Daily" said that from the current select level listed companies and quasi-select level (issuing) companies, the company's overall quality is better and comes from the high-tech industry.

On the "entry side", it is expected that the regulatory authorities will be consistent with the Sci-tech Innovation Board and ChiNext in the review process, and will focus, supplement and improve according to the characteristics of small and medium-sized enterprises.

After listing, the supervision of the whole chain and the whole process will be strengthened to improve the quality of listed companies.

Selected and quasi-selected companies

Better texture

"Vigorously improving the quality of listed companies is the top priority of the Beijing Stock Exchange." On September 5, the relevant person in charge of the Beijing Stock Exchange said when answering a reporter's question.

According to the supervisory arrangement, the select layer companies and the projects under review at the select layer will all be moved to the Beijing Stock Exchange.

On October 25, Jinhao Medical was listed on the select floor. This is the first company to list on the select floor since the announcement of the establishment of the Beijing Stock Exchange.

So far, there are 67 selected enterprises.

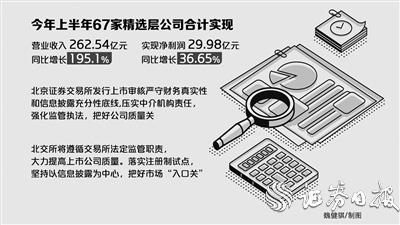

According to statistics from Eastern Fortune Choice, in the first half of this year, 67 selected layer companies achieved a total operating income of 26.254 billion yuan, a year-on-year increase of 195.1%, and a total net profit of 2.998 billion yuan, a year-on-year increase of 36.65%.

In addition, according to data from the official website of the share transfer company, as of October 25, there were 13 quasi-selected tier companies, of which 2 were issued, and 11 of them completed the issuance, but the listing date has not been determined.

According to statistics from Eastern Fortune Choice, the operating income of these 13 quasi-selected companies in the first half of the year increased by 31.14% year-on-year, and their net profit increased by 39.66% year-on-year.

“At present, select-tier companies and quasi-select-tier companies have better overall quality, and some companies have profitability close to or even surpassing ChiNext and Sci-tech Innovation Board companies.” Ren Lang, chief analyst of Kaiyuan Securities, accepts a reporter from Securities Daily According to the interview, according to statistics, the average gross profit margin of selected companies in 2020 is 27.67%, which is better than 21.14% on the ChiNext and slightly lower than 33.76% on the Sci-tech Innovation Board; the average ROE (return on equity) is 11.49%. It is better than 8.61% of the Sci-tech Innovation Board and slightly lower than 16.11% of the ChiNext.

At the same time, selected companies have also shown good growth, with a compound growth rate of 15.12% in net profit from 2018 to 2020.

"At present, the NEEQ selected companies mainly come from high-tech industries such as pharmaceuticals, biotechnology and life sciences, healthcare equipment and services, software and services, automobiles and auto parts." Wang Huiqing, a postdoctoral fellow at the Bank of China Research Institute, accepted the Securities Daily "The reporter said in an interview that, on the whole, select-tier companies have strong profitability, stable core business development, and high growth potential.

Zhang Bingwen, a senior researcher of the Zhixin Investment Research Institute, said in an interview with a reporter from the Securities Daily that the Beijing Stock Exchange is based on building a main position serving innovative small and medium-sized enterprises, and can better meet the financing needs of innovative small and medium-sized enterprises. Play an important role in the improvement and optimization of the market system.

Strictly control the "entrance gate"

Strengthen the supervision of the whole chain and the whole process

Compared with the Science and Technology Innovation Board and ChiNext, the Beijing Stock Exchange is more tolerant.

However, the increase in inclusiveness does not mean that the review is relaxed.

On October 22, Xu Ming, chairman of the National Equities Exchange and Quotations and Beijing Stock Exchange, stated at the 2021 Financial Street Forum annual meeting, “In practice, tolerance of market value, financial indicators, performance fluctuations, etc. does not mean relaxing the review. The Beijing Stock Exchange’s issuance and listing review strictly observes the bottom line of financial authenticity and adequacy of information disclosure, compacts the responsibilities of intermediary agencies, strengthens supervision and law enforcement, and controls the quality of the company."

“The pilot registration system of the Beijing Stock Exchange is also centered on the letter Phi.” Ren Lang said that on the one hand, regulators, brokerages and other intermediary agencies have undertaken part of the audit task; The mechanism determines that under the registration system, the market not only pays attention to the company's past operating results, but also pays more attention to the company's future growth.

Wang Huiqing said that in order to maintain market stability and policy continuity, it is expected that the main arrangements of the Beijing Stock Exchange on the "entry side" will be consistent with the Science and Technology Innovation Board and ChiNext.

However, the specific review process will be focused, supplemented and improved according to the characteristics of SMEs.

In addition, in order to promote the formation of enthusiasm for innovation and entrepreneurship in the whole society, the Beijing Stock Exchange may further strengthen the supervision of the whole chain and the whole process, emphasizing the compaction of the responsibilities of intermediary agencies, so as to accelerate the formation of a benign market ecology.

In terms of continuous supervision, Li Yongchun stated that the Beijing Stock Exchange will implement the "zero tolerance" policy, severely crack down on all types of violations of laws and regulations, consolidate the "key subject responsibility", strengthen the endogenous motivation of listed companies to improve quality, and smooth the market "export customs." ", resolutely clear out companies in extreme circumstances such as major violations of the law and loss of the ability to continue operations.

(Securities Daily)