Last year's financial results for companies listed on the Tokyo Stock Exchange are almost complete.

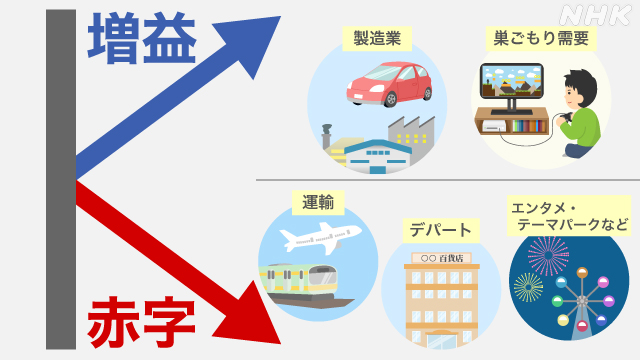

While the effects of the new coronavirus have been prolonged, 50% of companies have "increased profits" in the final profit, while 48% have "decreased profits" or "deficits" in total. It is pointed out that it is a "K-shaped" settlement of accounts that will become clearer.

"The pace of recovery differs between manufacturing and non-manufacturing industries."

By last weekend, more than 90% of the listings on the first section of the Tokyo Stock Exchange, 1426 companies, disclosed their financial results for fiscal 2020 last year.

According to the summary of SMBC Nikko Securities, of the 1033 companies that announced their financial results by the 13th of this month, 519 companies, which is 50%, secured a "profit increase" in the final profit and loss.

With the recovery of exports to the United States and China, profits increased significantly in the "manufacturing industry" such as electric appliances, automobiles, and semiconductors.

In addition, the “information / communications industry” was also strong due to the progress of teleworking.

On the other hand, 370 companies (35%) had a "decrease in profit" and 135 companies (13%) had a "deficit".

In the "non-manufacturing industry," the financial results for aviation and railroads, as well as eating out, were severe.

As the effects of the new coronavirus have been prolonged, the polarization between industries that have been affected by the increase in exports and other industries that have been affected by movement restrictions and shortened business hours has become clear.

Hikaru Yasuda, a stock strategist at SMBC Nikko Securities, said, "The pace of recovery is different between manufacturing and non-manufacturing industries, and it looks like the letter" K "in the alphabet. In addition, it will be interesting to see how the conflict between the United States and China affects the production of companies. "

"K-shaped" The financial results of each polarized company

Last year's financial results of a listed company, which is also called "K-shaped". There is a clear polarization between industries that have been hit by the tailwind of demand for nesting due to the increase in exports and the influence of the new coronavirus, and those that have been affected by restrictions on movement and shortened business hours.

In the manufacturing industry, profits increased significantly due to an increase in exports against the backdrop of the economic recovery in the United States and China.

Of this amount, Toyota Motor's final profit for the entire group increased by 10% to 2,245.2 billion yen, exceeding 2 trillion yen from the previous year.

Tokyo Electron, the largest manufacturer of semiconductor manufacturing equipment, recorded record high operating income, which indicates the profits of its main business, and final income increased 31% to 242.9 billion yen.

The final profits of companies that have taken in the so-called “needing demand” have also increased significantly.

The Sony Group recorded a record high of 1,171.7 billion yen, double the previous year, and Nintendo recorded a record high of 480.3 billion yen, 85.7% higher than the previous year. The time spent at home increased, and sales of home video game consoles and game software were strong.

In addition, the SoftBank Group's final profit was 4,987.9 billion yen. Profit was boosted by the initial public offering of investee companies and rising stock prices, making it the highest ever listed company in Japan.

On the other hand, as the impact of the new Corona continued for a long time, a number of companies had severe financial results.

Japan Airlines posted a final deficit of 286.6 billion yen for the first time since 2012, when Japan Airlines relisted its shares after the bankruptcy, and ANA Holdings also posted a record deficit of 404.6 billion yen.

For railways, the final loss of JR East was 577.9 billion yen. This is the first time that the final deficit in the full-year financial results has been reached since the privatization of the former Japanese National Railways in 1987.

The other 5 JR companies and the 15 major private railway groups nationwide also all fell into the final deficit.

In addition, Isetan Mitsukoshi Holdings, a major department store, posted a final deficit of 41 billion yen due to continued closures and shortened business hours.

Oriental Land Co., Ltd., which operates Tokyo Disneyland and Tokyo DisneySea, also posted a final loss of 54.1 billion yen, the first full-year financial result since its listing in 1996.

Strong semiconductor-related companies Concerns about the future of US-China relations

Even though the effects of the new coronavirus have been prolonged, semiconductor-related industries are representative of industries that have achieved favorable financial results due to rising global demand.

However, some companies are paying close attention to whether the relationship between the United States and China, where conflicts are a concern in the economic field, will affect future business results.

CKD, a parts manufacturer with approximately 4,400 employees in Komaki City, Aichi Prefecture, manufactures parts for semiconductor manufacturing equipment.

With the spread of the communication standard "5G" and the expansion of telework, the demand for communication equipment that uses semiconductors is increasing, and the capital investment of semiconductor manufacturing equipment manufacturers is increasing. It increased by a little less than 20% from the previous year.

In the one-year financial results announced on the 13th of this month, the final profit is expected to increase by 40% over the previous year, and the earnings forecast for this year is also expected to be the highest ever.

Meanwhile, companies are concerned about other concerns than the new coronavirus.

This is because the Biden administration in the United States has ordered the reconstruction of the supply chain of important resources that does not rely on China, the so-called supply chain, and the target includes semiconductors.

The company is closely watching the whereabouts of US-China relations, saying that if export restrictions to China are tightened, sales may be affected.

Kazunori Kajimoto, president of CKD, said, "Since November last year, the number of orders has continued to be high and the wave is stronger than ever. On the other hand, trade friction between the United States and China is progressing. If regulations occur, it is possible that our company will not be able to use the supply chain, and we are at risk. We would like to be able to respond even if the future is uncertain. "