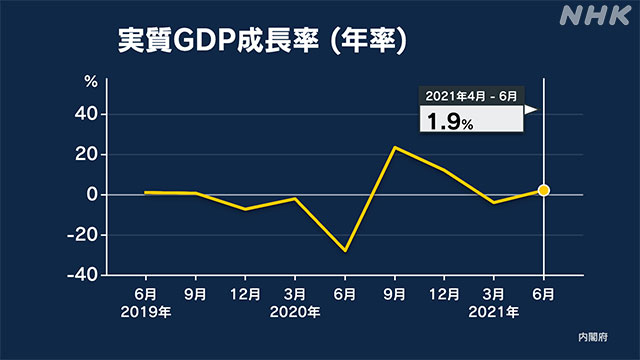

This year, GDP = gross domestic product from July to September will be announced on the 15th.

As for the average of private sector forecasts, the real growth rate excluding price fluctuations is slightly negative, and the results are noteworthy.

GDP will be announced by the Cabinet Office at 8:50 am on the 15th.

The average forecast of 37 private economists compiled by the Japan Center for Economic Research, a public interest incorporated association, shows that the real growth rate excluding price fluctuations is minus 0.56% on an annualized basis.

If it actually becomes negative, it will be the first time in two terms.

The main reason for this is that "personal consumption," which accounts for more than half of GDP, is expected to decline due to the state of emergency issued at that time.

Private consumption forecasts were minus 0.47% compared to the previous three months.

Some economists expect GDP to be positive this time, but the average of the top eight forecasts is only + 0.80% on an annualized basis, and the results are noteworthy.

October-December GDP is forecast to be positive

On the other hand, many experts expect GDP from October to December to be positive.

According to the Japan Center for Economic Research, a public interest incorporated association, the GDP forecast for the three months to next month is the current average of 37 private economists, and the real growth rate excluding price fluctuations is The annualized rate is + 4.93%.

The state of emergency has been lifted by the end of September, and the recent infection situation has settled down, so we expect that "personal consumption," which accounts for more than half of GDP, will recover.

There is also a voice that so-called "revenge consumption", in which the consumption that individuals have endured so far, can be expected, and the private sector forecast of "personal consumption" for the three months until next month is compared with the previous three months. It is plus 1.69%.

However, this prediction seems to be based on the premise that the infection will not spread rapidly again, such as the sixth wave of the new coronavirus.

There are other risk factors as well.

"Soaring crude oil prices" and "bad yen depreciation".

High crude oil prices lead to higher prices for various raw materials.

If the “bad yen depreciation” progresses while corporate profits are being squeezed and personal income is not rising, it may lead to further burdens on corporate management and households that are being hit by the new corona.

The government expects GDP to return to pre-corona levels "within the year," but it is still pointed out that the risk of continued economic downturn is high.