On Friday, July 31, the Russian currency demonstrates weakening on the Moscow Exchange. At the beginning of trading, the euro rose by 1.22% and for the first time since March 30 exceeded 87.7 rubles. At the same time, the dollar rate rose by 1.27%, to the level of over 74 rubles. The last time a similar indicator could be observed in mid-May.

The official exchange rate of the Central Bank as of August 1 was set at 73.43 rubles per dollar and 87.29 rubles per euro.

The sharp rise in the euro against the ruble is largely due to the record strengthening of the European currency on the global market. This point of view in an interview with RT was expressed by Alexey Korenev, an analyst at FINAM Group. Since the beginning of the month, the rate of the single European currency against the US dollar has grown by more than 6% and reached $ 1.19 per euro at the auctions on July 31. The value was the highest since May 2018.

“Now on the world market the euro looks stronger than all other currencies, including the dollar. This is primarily due to the very weak US macroeconomic statistics. The day before, data were published that in the II quarter of the United States GDP collapsed by almost 33% - the maximum collapse since the beginning of the measurement in 1947. At the same time, a difficult situation with a pandemic remains in the country, which may force the American leadership to introduce new quarantine restrictions, "Korenev explained.

According to him, the end of the tax period in Russia, which has supported the national currency in the past few weeks, also put pressure on the ruble. So, in mid-July, exporting companies sold foreign currency and bought rubles to pay taxes. At the moment, the corresponding operations have been completed.

In addition, the Russian currency reacted negatively to the end of the dividend season in Russia. Dmitry Babin, an expert on the stock market BCS Broker, spoke about this in a conversation with RT.

“The received dividends are converted by foreign participants of our market into foreign currency. Of course, they have an option to reinvest dividends back into Russian stocks, however, due to the increased geopolitical risks, players still prefer to withdraw this money, ”the expert explained.

According to him, investors are alarmed by the possibility of an exacerbation of the US sanctions rhetoric against Russia. Earlier, the House of Representatives of the United States Congress approved the draft defense budget for the 2021 fiscal year, which contains amendments to strengthen restrictions against the Russian Nord Stream 2 gas pipeline.

“The fact is that with the approach of the November US presidential elections, sanctions and other foreign policy risks for Russia are increasing. So, we are already seeing the resumption of anti-Russian rhetoric and sanctions initiatives in the West, ”explained Dmitry Babin.

As the Deputy Minister of Finance Timur Maksimov noted earlier, the discussion of sanctions may cause "nervousness" in the Russian financial market. Nevertheless, according to him, the ministry does not expect a real tightening of restrictions against Russia.

“Words by words - it is important to understand what will happen as a result of all these words in terms of specific decisions. So far, we do not see any expectations or reasons to expect that there will be a tightening of the sanctions policy against Russia, ”Maximov quotes TASS.

Support factors

According to experts, the observed weakening of the Russian currency has a positive effect on the state of the country's budget. At the same time, analysts do not expect a significant depreciation of the ruble in the near future.

“As a result of the consequences of the coronavirus pandemic and the measures taken by the government to support the economy, this year we will have a budget deficit. In the current environment, the simplest option for balancing the budget is a moderate depreciation of the ruble. At the same time, the government does not need high volatility in the foreign exchange market, so the Central Bank will control this process, ”explained Alexey Korenev.

Recall that in order to stabilize the exchange rate from March 10, the regulator began proactive sale of foreign currency in the domestic market. Thus, the Central Bank artificially increases the demand for rubles. In total, during this time, the volume of currency sales amounted to about 1.07 trillion rubles.

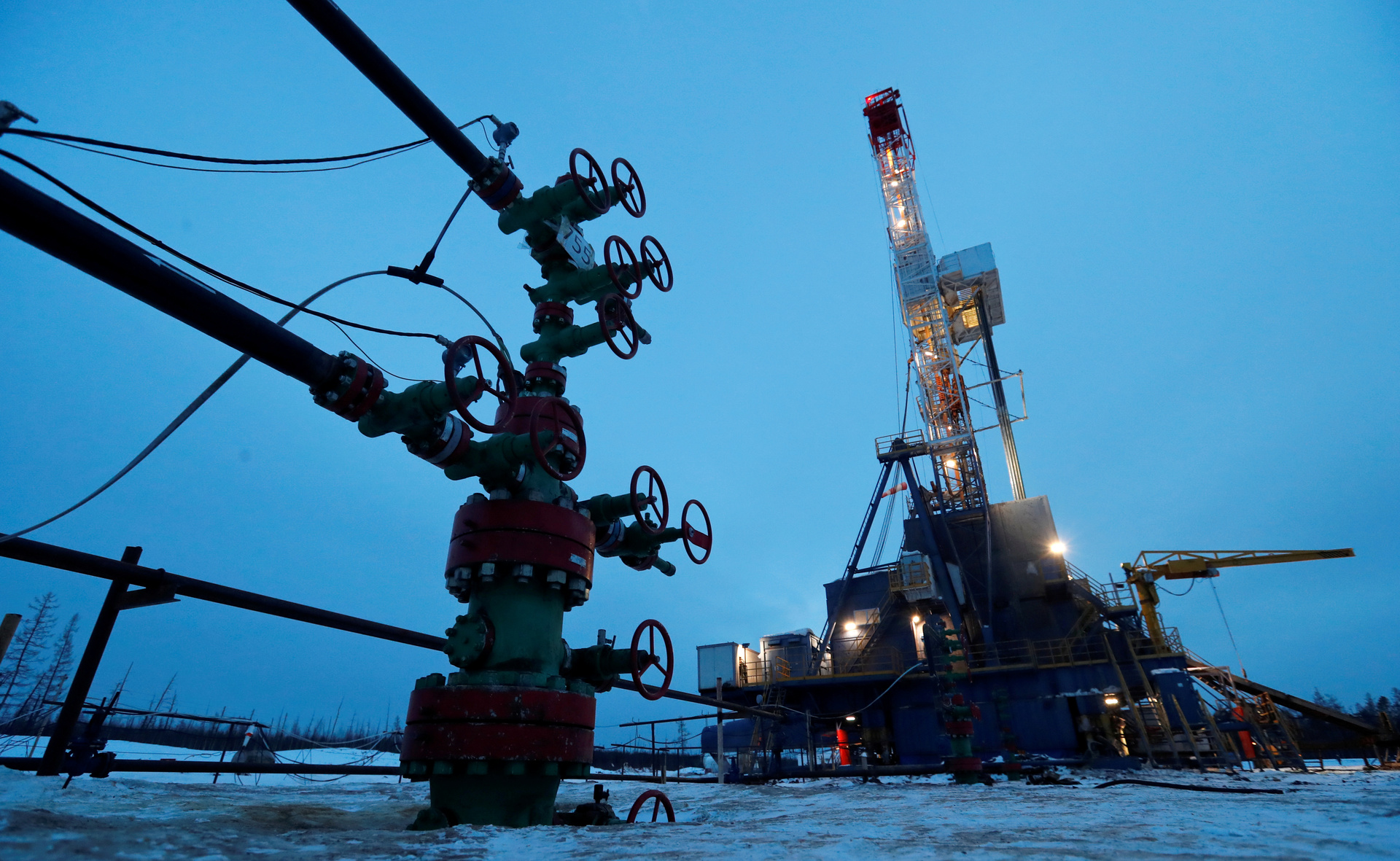

- Reuters

- © Vasily Fedosenko / File

Moreover, the stabilization of oil prices provides additional support to the Russian currency, analysts say. On Friday, the price of Brent crude on the ICE exchange in London grew by almost 1% and reached almost $ 43.8 per barrel.

“The OPEC + agreement did its job - it turned out to be surprisingly timely and effective. Now there are no grounds for significant changes in oil prices, if there are no sudden geopolitical exacerbations, for example, in the Middle East. Also, the reserves of energy resources in the United States have decreased, which is a blessing for oil prices, ”Korenev added.

In general, the experts interviewed have different assessments of the further dynamics of the Russian currency. As Vadim Iosub, a senior analyst at the Alpari Eurasia information and analytical center, told RT, in August the dollar exchange rate could rise to 75-76 rubles, and the euro rate to 89 rubles. According to Dmitry Babin, over the next month, the indicators will fluctuate in the range of 74-76 and 85-89 rubles, respectively.

At the same time, according to Aleksey Korenev, by the beginning of autumn the levels may drop to 73-75 rubles per dollar and 84-87 rubles per euro.