"Cashless Payments by 2021" - a slogan that the UAE is making in its smart transition to digital financial services through the UAE's digital portfolio, away from the traditional money that UAE residents have largely avoided, paying for cards or phones.

The Emirates digital portfolio, which is expected to be piloted early next year, will pave the way for non-cash transactions, money transfers and savings for all residents and employees in the UAE. The portfolio brings together expertise and best practices from a wide range of global payment systems, With the needs and environment of the local UAE.

The UAE digital portfolio has been developed over the past four years under the umbrella of the Union of Emirates Banks, which has created a special committee composed of its members from banks to contribute ideas and suggestions that will find the best solutions for the UAE environment. The central bank has also played a key role in providing advice and guidance on how to set up the platform and working to comply with the highest legislative standards.

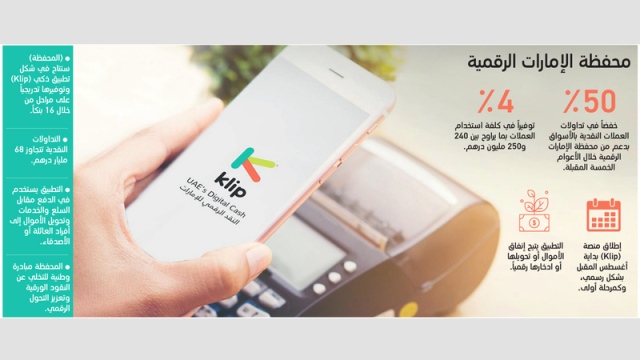

The portfolio will be activated at the beginning of next year and will offer a number of features, including financial coverage, which will provide a mechanism for opening instant accounts for all residents of the UAE, enabling them to make payments and transfer money via mobile devices. The portfolio will be made in the form of a smart application (Klip) and will be gradually provided in stages through 16 banks.

The Klip platform is expected to be launched early next August as a first stage.

Emirates Digital Wallet is a convenient and efficient way for individuals and companies in the UAE to make and receive payments instantly, as well as save or transfer money through a single payment platform that is easy to use and connected to the use of smartphones and other mobile devices.

The portfolio is designed to replace cash and is a platform for all banks in the UAE and provides a mechanism to open instant accounts to all residents of the UAE, enabling them to make payments and transfer money through mobile devices and mobile devices.

Emirates banks are seeking to reduce cash transactions of over AED 68 billion by 50% through the Emirates Digital Portfolio project, which is being negotiated with a number of government agencies, airlines and e-commerce platforms to allow for payment of purchases through the digital portfolio. Will allow payment for different purchases and money transfer between individuals via a dedicated application on smartphones.

Regular payments

One third of the population of the UAE has regular payments and bank accounts. The application of Clip will provide them with a greater level of integration into the country's financial system by providing them with a safer alternative than using paper money without the need for bank accounts. Of the amount of paper money circulating in the economy, enhances financial inclusion, enhances the efficiency and security of payments and the economic business environment in the country. The proportion of non-cash consumer purchases in Singapore, the Netherlands, France and Sweden was almost 60%. Interestingly, these transactions accounted for about 6% in Italy, Greece and Mexico, and in the UAE it was 8%.