- Companies: The OECD proposes a global 'Google rate' for digital giants to pay based on where their users are

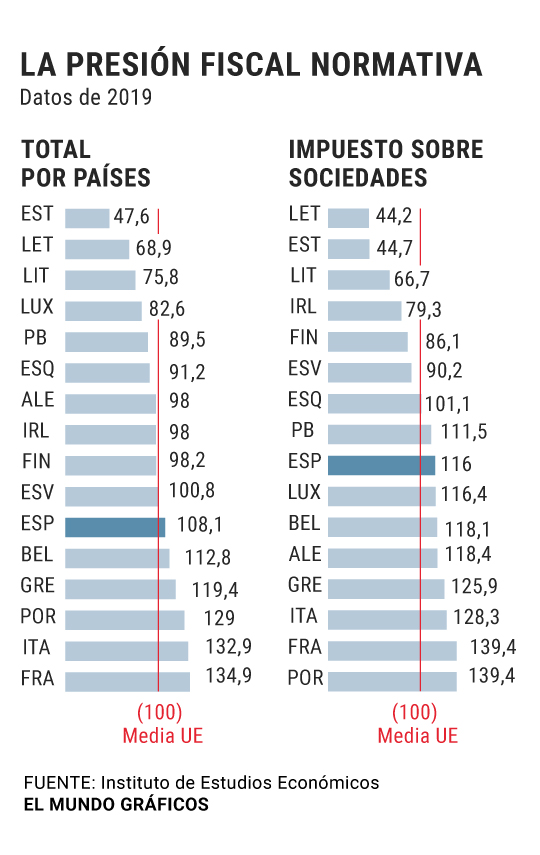

The Institute of Economic Studies (IEE) published yesterday the Index of Fiscal Competitiveness, document in which it maintains that the tax pressure in Spain is superior to the one of the average of the European Union. Specifically, he affirms that “ the regulatory tax pressure in Spain is of the order of 8% higher than the EU average ”, and thus contradicts the Government of Pedro Sánchez, who points out that the Spanish figures are lower and that it is necessary to “converge »With the European average.

This «normative fiscal pressure», explains the CEOE think tank , is a reference that those responsible for the document have designed and that allow, they affirm, a better comparison with other countries and assessment of the real situation. “The use of the fiscal pressure indicator [tax collection as a percentage of GDP], to make comparisons between different countries and justify tax increases or changes in the tax system, implies an insufficient and erroneous analysis ,” they explain.

«The problem is intensified», they add, «due to the greater weight of the economy submerged in Spain in relation to the EU, which makes the Spanish tax pressure ratio that taxpayers bear much greater in Spain than in the EU» . This situation is also observed, according to the document, in the Corporation tax, which presents a pressure 16% higher than the average. And he draws a context, he adds, in which Spain «appears in position 23 in the general classification of the Fiscal Competitiveness Index on a group of 36 countries , so that only 13 countries out of 36 have a fiscal system with less competitiveness than the Spanish".

For this reason, the Institute linked to the employer's association rejects the increase in taxes that Sánchez includes among its electoral promises and explains that: the corporate tax “must be revised in order to reduce the nominal and effective rates until they are below OECD average »; «The introduction of new fiscal figures (financial rate, diesel tax) would increase the complexity of the tax system and create new obstacles for business activity»; and the increase in Successions or Donations "not only generate significant distortions, but also have a marginal collection impact".

According to the criteria of The Trust Project

Know more- CEOE

- Taxes

10-N The deterioration of the economy dynamite the electoral campaign of Sánchez

Elections 2019 The political blockade has already cost 200,000 jobs to Spain

CompaniesThe confidence of Spanish entrepreneurs stagnates amid political uncertainty