- Bankia case: The Bank of Spain puts the CNMV vice president on the list under suspicion

"You received this email." The Bank of Spain extended the investigation on its former head of Accounting Regulation, Jorge Pérez , extended even to his contacts with Parliament and reproached him for having them. The supervisory body investigated the help of its critical manager to the parliamentary commission that wanted to clarify what happened in Spain in the financial crisis last year. The Bank of Spain ordered Deloitte to extract Pérez's emails with suspicious accounts of PSOE members and came to analyze personal emails from deputies. This is how it appears in the statement of objections against the dismissed former Chief of Accounting Regulation of the Bank of Spain to which EL MUNDO has had access.

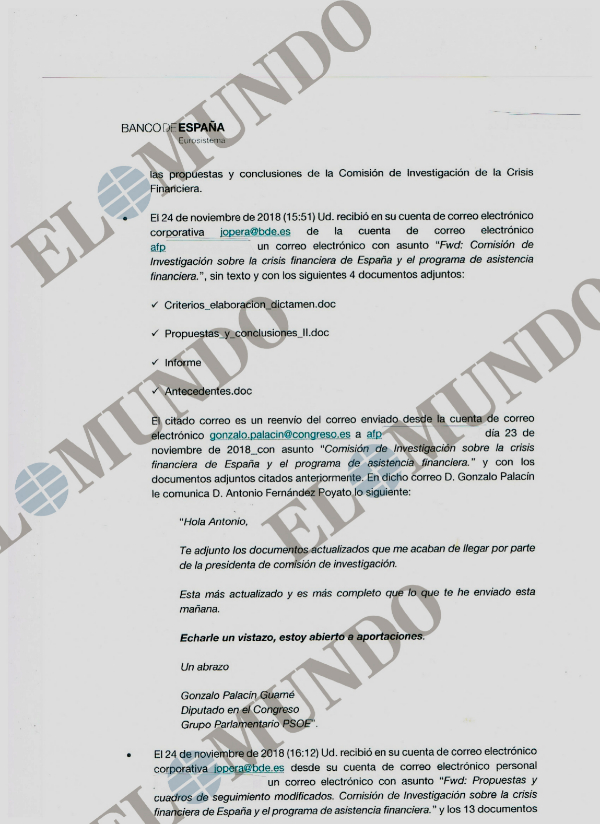

The supervisor analyzed in the Perez mailbox personal emails of the then socialist spokesman of the parliamentary commission of inquiry and current senator, Gonzalo Palacín , who asked for "contributions" for the preparation of the opinion and who ended up being very critical last year with the role of Bank of Spain during the financial crisis.

The Bank of Spain reprimanded the then manager - whom he fired last July - such collaborations and included in his statement of objections that he lent himself to such activity in support of the parliamentary commission without having requested internal permission, because he could thereby "harm the interests of the Bank of Spain ".

The instructor of the disciplinary file, the lawyer of the Bank of Spain, Cristina Taboada , showed Pérez between reproaches the Palacín emails discovered, according to legal sources, and criticized him for supporting a commission of critical investigation with the Bank of Spain, being employed of the institution. In particular, he showed the paragraph of the final opinion of the commission of inquiry that disqualifies the Bank of Spain with this phrase: "The Bank of Spain incurred a serious irregularity of dire consequences by allowing Caja Madrid, Bancaja and five other boxes in the so-called SIP [Institutional Protection System] uniquely account for all the net impairment at the end of 2010, of 7,619 million euros, against reserves instead of going to the income statement ".

Coincides with the opinion that Perez presented on May 6 at the National Court against the supervisor accepting such concealment of losses and also harms the auditor Deloitte, who endorsed the rinse.

"Act with disloyalty"

Taboada commissioned precisely his computer expert from Deloitte to include in the mailing list to be monitored as suspects of receiving secret information from Antonio Fernández Poyato , a socialist member of the Pablo Iglesias Foundation and former vice president of Cajasur. This one acted as liaison with Palacín, according to the investigation.

Pérez said he did not remember helping Palacín, but that the serious irregularity criticized by Parliament to the Bank of Spain responds to a public and known fact. The Anticorruption prosecutor, Carmen Launa , is also critical in the Bankia trial with which the Bank of Spain accepted that charge to reserves of cash impairments and not to its income statement.

The Bank of Spain did not finally include this alleged collaboration of Pérez with Las Cortes in his final letter of dismissal, but it would have helped prepare his appearance before the same parliamentary committee to the former director general of Supervision, Aristobulo de Juan , who was also critical of the performance of the supervisor in the boxes at the stage of the then governor, Miguel Ángel Fernández Ordóñez.

The Bank of Spain has justified the dismissal for passing confidential information to third parties and acting with disloyalty during working hours. Pérez categorically denies it and has filed a lawsuit for unfair dismissal against the institution alleging violation of fundamental rights.

The legal service of the Bank of Spain, directed by Francisco Javier Priego, appointed secretary general by Fernández Ordóñez in 2011, considers Perez's investigation impeccable with the help of Deloitte.

Numerous members of the Bank of Spain appeared with the authorization of the then governor, Luis Linde , in the investigation commission, including critical employees such as the then president of the Association of Inspectors, Pedro Luis Sánchez , although he received later reproaches of the dome for the refusal vision of the management of the institution that he had offered in Parliament.

In the statement of objections he also criticizes him for sending to his contact at the PSOE "a note regarding a financial proposal for a social housing fund that the Government of Pedro Sánchez intended to promote." Pérez helped, according to the statement of objections, to "show how to financially structure the operation so that it can be approached without financial consequences for Sareb," the so-called bad bank. The fired assures that he gave his opinion to friends in a selfless way and with public data.

According to the criteria of The Trust Project

Know more- economy

Finance An ex-director demands the Bank of Spain to be fired "for being an uncomfortable witness in the Bankia case"

Economy The Bank of Spain puts the CNMV vice president on the list on suspicion of receiving secret information

Courts The Bank of Spain gave Deloitte access to thousands of emails from an opposite witness to the auditor in Bankia