The rise in prices is spreading throughout the global telephone business and the home market is a redoubt when it comes to passing the new costs on to rates.

"Spain is the last country to adjust telecommunications prices in Europe," summarizes a sector report from the McKinsey consultancy to which EL MUNDO has had access.

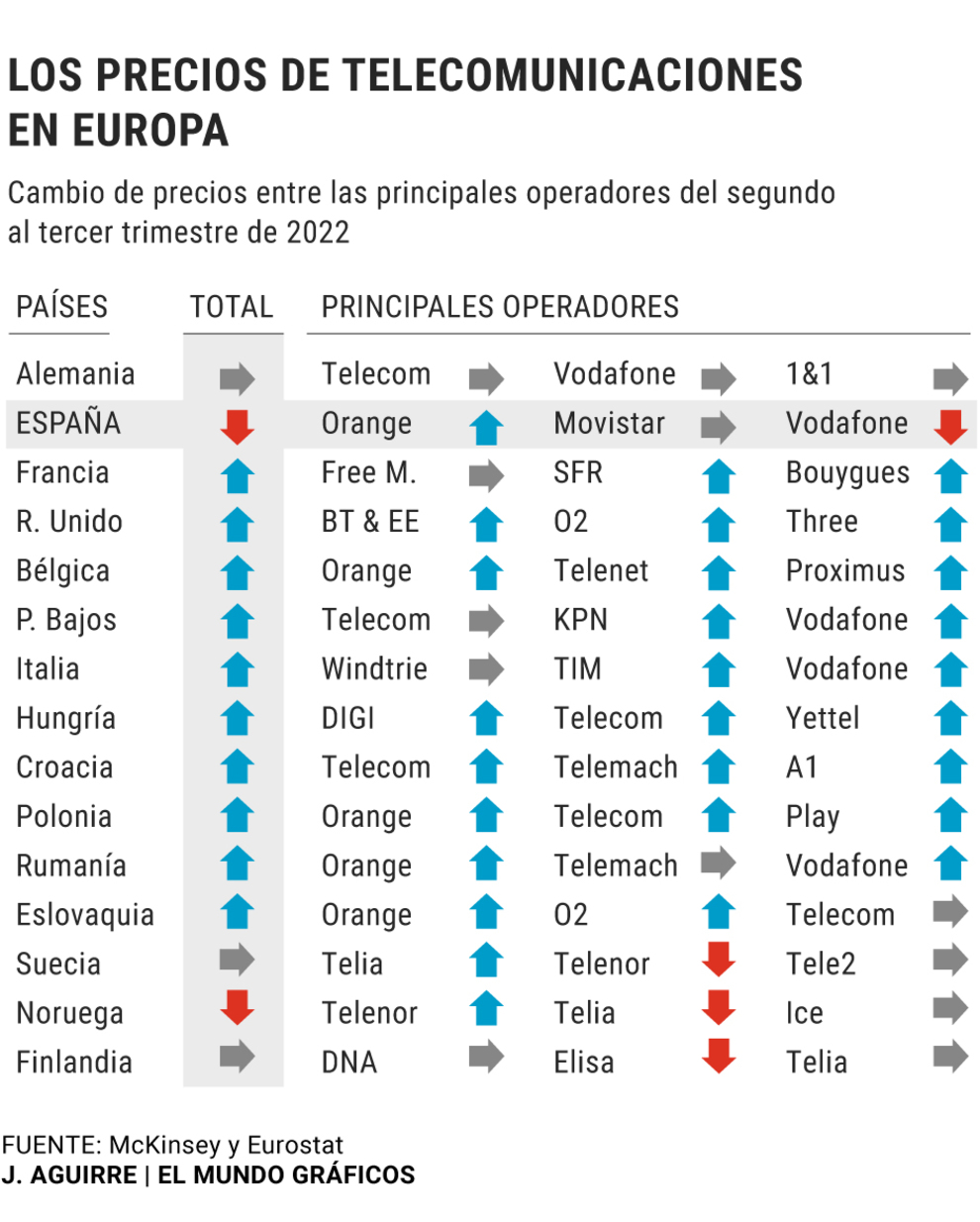

The strong national competition in this sector (together with the will of the operators) has worked as a dam against the general increase in prices, to the point that absolutely all the territories of the continent had already applied joint price increases in the summer as a reaction to the CPI, with the sole exception of Spain and, to a lesser extent, Italy and Norway.

Spanish operators have resisted two inflationary trends: the rise of the sector in Europe during 2022 and the rise of practically any business area that develops within our borders.

According to the INE detail on November data, that of telecommunications is the only negative general index (-2%) of all year-on-year comparisons in Spain.

In reality, throughout Europe, as can be seen in the graph, behavior has historically been deflationary.

In reviewing the continent carried out in this report, there has always been a company that has taken advantage of the CPI to undertake a price increase and that has served as an example (or excuse) for its rivals to launch similar increases.

"Telecommunications operators have followed the first to make a move", exposes this international analysis, which reflects how, for example, if the VOO company raised rates in April within Belgium, its commercial policy was traced by Proximus in May and by Orange and Telenet in June.

The trend is not limited to Europe: on May 3, AT&T raised prices by $6 per line and $12 per family pack, and just two weeks later, on May 16, Verizon replicated the price increase, exactly in those same magnitudes.

Spain has held

out until the summer without any of the large operators modifying prices

.

In fact, in the second line of the market some are still resisting, such as the Romanian

Digi

, which is highly commercially aggressive in this territory (in other countries the CPI has had an impact on their rates).

In addition, there is no shortage of options to control spending on devices, instead of on services, with options ranging from mobile leasing such as Rentik to reconditioning offered by other firms such as Smaaart.

Telecommunications in Europe 2022. Evolution

Orange

took advantage of the month of August to carry out an increase that that company framed in the so-called

more for more

, that is, more expensive but with the justification of enjoying better services.

The increase was applied to packages and was estimated at around 6 or 7%, which would be similar to the CPI for the first months of this year (and also to that of the final stretch of 2022), but which in any case remained for below the CPI of the summer months, when it exceeded 10%.

Vodafone, Telefónica and MásMóvil have not taken the step until this month of December.

Both the

red

operator of British origin and the Spanish multinational will undertake their respective increases in January.

Vodafone

quantifies the increase at 6.5%, taking the average CPI from October 2021 to September 2022 as a reference.

For its part,

Telefónica

will also raise the rates in the new year, specifically from January 13: then its customers will receive the first impacted invoices, although the entire application will not be fully appreciated until February, when January is already accounted for. like full month.

The increase could reach up to 14 euros as contracted, although the average calculated by the company remains at 6.8%, which coincides with the CPI for November and is similar to the increases undertaken by Orange and Vodafone.

MásMóvil

, the fourth operator in the territory although pending a consolidation operation that will allow it to merge its business with that of Orange in Spain, has also raised rates in December, and like the French operator, it maintains this increase due to a commercial policy of

more

for

more

Specifically, the change in MásMóvil rates can only be seen in packages and additional lines: the

yellow

operator does not have a calculation of the average increase, but it does estimate that less than 20% of its lines will be affected by the increases.

In another country, any rise would surely have been more noticeable and, above all, earlier.

According to the criteria of The Trust Project

Know more

Companies

telephone

Graphics