Why foreign trade will weigh down Spain's growth this year and next

In the first seven months of the year,

Spain has experienced

an increase of 24.2% year-on-year in exports (

an increase due to the fact that we have sold 6.1% more in volume, at a price 17.1% more expensive ), but despite the general improvement, the country has experienced

a drop in exports of some star products

such as

automobiles

, according to the latest

Foreign Trade Report

published this week by the Ministry of Commerce, Industry and Tourism.

The good behavior of

the foreign sector

has been largely responsible for the

economic growth registered in the second quarter of the year,

1.5

%

compared to the previous quarter and

6.8%

in year-on-year terms, as updated this Friday by the National Institute of Statistics (INE).

In fact, exports contributed 7.9 points to the interannual rate of growth of the Gross Domestic Product (GDP), which was cushioned because imports subtracted 3 points.

Foreign demand contributed 4.9 points to year-on-year growth.

In the accumulated from January to July, the country exported goods and services worth 222,961 million euros, a historical maximum for this period;

but

imports have grown by 40.2%

(especially due to the greater need for energy and at a higher price), hence the country's trade deficit has increased and with what we export we only cover 85% of our purchases to other countries.

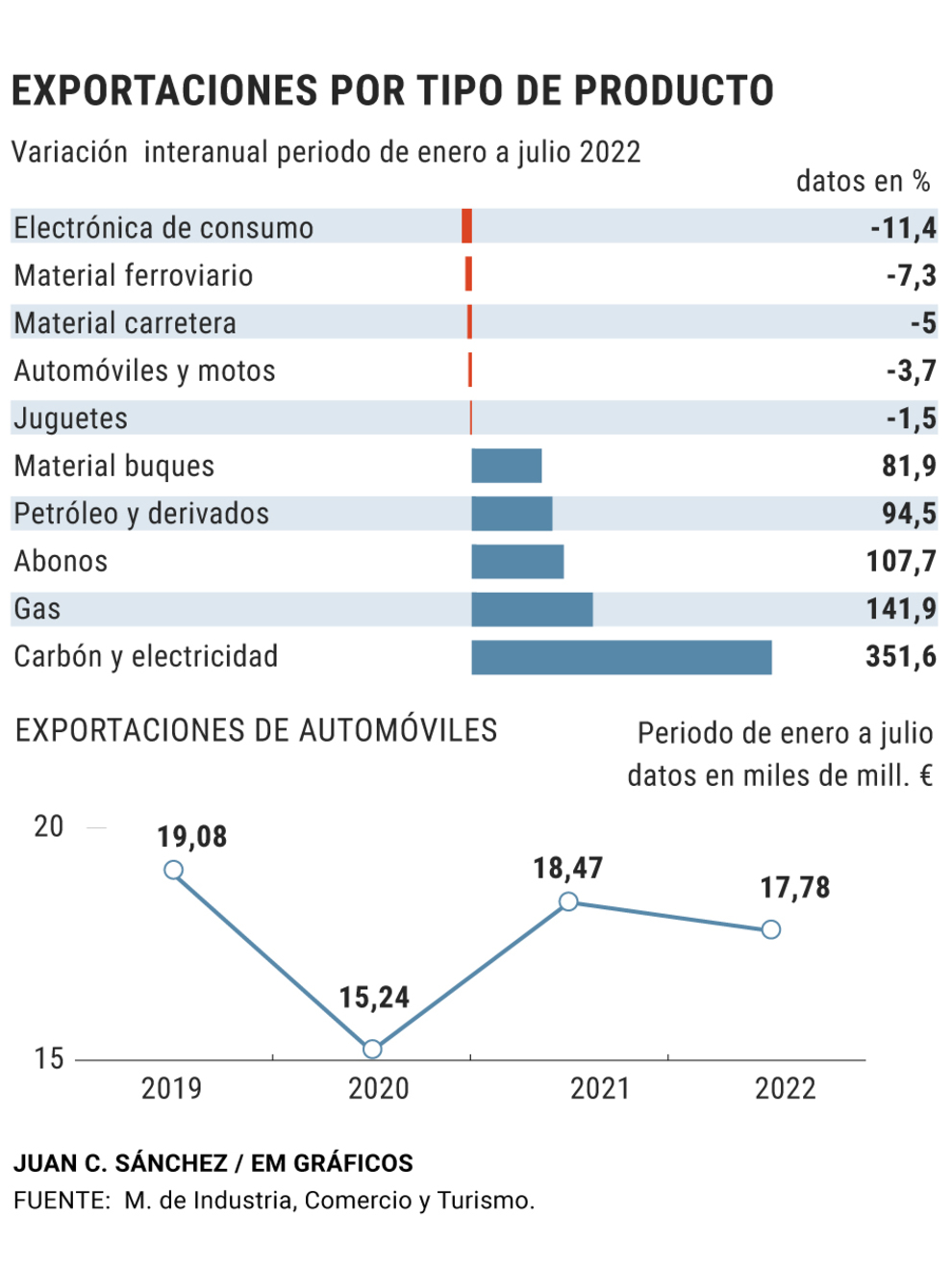

The breakdown by product, however, reflects a

3.7% drop in car sales volume,

to

17,789.2

million euros (8% of total foreign sales);

a decrease of

11.4%

in the export of

consumer electronics

(computers, smartphones, tablets, headphones, etc.);

a fall of 7.3% in the sale of

railway material

;

5% in

road material

and 1.5% in

toys

.

These are the only products of all those exported by the country that have suffered a

drop in sales abroad,

but especially the lower sales of automobiles is worrying for the experts consulted by this means, who see in this decrease a reflection of the

weakening of external demand.

Vehicle

exports

are not only 3.7% lower than those of 2021 (which were 18,470.9 million), but they are still

below those registered in 2019

, the year before the pandemic, when they were 19,082.6 million.

The sale of car

components

has performed better, hence the automotive sector as a whole has registered sales only

0.2% lower than last year.

The main reason for the fall in sales lies in the

weakness of the main destination markets for

Spanish exports -both in general and for automobiles-, which are mainly European, with a special weight from

France and Germany.

This is having a direct impact on our exports as it translates into

less effective demand.

Raúl Mínguez Fuentes

, director of the study service of the

Spanish Chamber of Commerce,

explains to EL MUNDO that this weakness in demand that began in the covid, later worsened with the impact of the war in Ukraine and the

decrease in purchasing power

that It has been caused by

the increase in inflation.

"There has been a fall in purchasing power by both individuals and companies, and this is compounded by

expectations

, which are impregnated with uncertainty, and discourage purchases, especially of some durable products such as automobiles."

The loss of purchasing power that potential buyers have suffered due to the effect of inflation, which in the Eurozone stood at

9.1% in August,

means that their ability to purchase a vehicle is lower and that in many cases this It is no longer among their priorities.

Supply problems and more expensive credit

On the

supply

side there have also been problems that have harmed exports, such as the

lack of semiconductors and chips

, which has led some manufacturers to even have to stop production, as in the case of

Volkswagen

at its plant in

Navarra

.

In some cases, despite the fact that demand from abroad has been maintained, exports have been affected by not having finished vehicles to sell abroad.

Sources from the Spanish Association of Automobile and Truck Manufacturers (

ANFAC

) point out to this newspaper that it is precisely the offer that is to blame for the fall.

"The drop in car exports is a

direct consequence of the production cuts

derived from the breakdown of the semiconductor and chip supply chain. In fact,

the drop in the production of 'made in Spain' vehicles

from January to July is 4.4% and exports are down 6%".

"It is not a problem of demand, which remains strong," they

defend.

"It is the global problem of the semiconductor crisis that affects production. And it affects all types of vehicles, makes and models, regardless of whether they are general or premium, all of them. Because

the demand from the main recipient countries of Spain which are Germany, the United Kingdom, France and Italy remains strong,

understanding itself strongly within this current supply situation that has been influenced by the war in Ukraine and closures due to confinement due to Covid in world-renowned ports such as Shanghai a few weeks ago".

These difficulties, both on the demand side and on the supply side, "do not appear to be going to dissipate in the remainder of the year", which is why Mínguez predicts that, although inflation is moderating,

car exports will show "weakness or stagnation" at the end of the year.

Another factor is the

tightening of monetary policy

and less favorable financing conditions, which may lead buyers to

postpone decisions to purchase

high-priced durable goods for which they may need to apply for credit, such as a car or a computer. .

"It is empirically proven that tightening monetary policy has a disincentive effect on the purchase of durable goods," he notes.

Added to these factors from the point of view of demand is a

change in the consumption trend in the

sector, since consumer preferences in many cases are turning towards the green economy -electric or hybrid cars-, hence The

demand for traditional combustion cars

has fallen

.

This structural change in demand explains why the lower Spanish exports have not been massively replaced by sales from other countries.

"There is no market that is substituting our exports.

Spanish manufacturers are very competitive

and this is a question of demand in general", points out the expert from the Chamber of Commerce.

Conforms to The Trust Project criteria

Know more

France

Germany

Inflation