Attempts by Western countries to impose a price ceiling on Russian oil or create obstacles to its supply may lead to an even greater rise in the cost of raw materials, Russian President Vladimir Putin said following a working visit to Iran.

“Now we hear all sorts of false ideas about limiting the volume of Russian oil, limiting the price of Russian oil.

It's the same thing that happens with gas.

The result - even surprisingly, this is said by people with higher education - will be the same - a rise in prices.

Oil prices will skyrocket,” Putin warned.

Earlier, Russian Deputy Prime Minister Alexander Novak noted that the possible creation of a cartel of oil buyers discussed in the West to curb prices for raw materials from the Russian Federation poses risks for the entire global energy market.

“This is another attempt to interfere in market mechanisms, which can only lead to market imbalance, to a shortage of the market and energy resources on the market, which, in turn, will lead to an increase in prices and, accordingly, to payments by consumers, primarily European and G7 countries , at a higher price of energy in the world market.

In my opinion, this is a measure directed against them," Novak said.

At the end of May, it became known that the G7 (USA, UK, Germany, France, Italy, Canada and Japan) was exploring the possibility of setting ceiling prices for oil from Russia.

Along with this, the West is going to deprive Russian ships of insurance for the transportation of energy resources.

As US President Joe Biden explained, in this way Washington, together with its allies, wants to reduce Moscow's profit from the sale of hydrocarbons.

However, experts interviewed by RT consider the implementation of such a plan unlikely.

According to Igor Yushkov, an analyst at the National Energy Security Fund, if a price ceiling is set, Russia could reduce oil exports, as a result of which the cost of raw materials on the global market will rise from the current $100-110 to $150-200 per barrel.

“Of course, the Europeans can still go along with the Americans, but the scheme will work only if all buyers of Russian oil agree with this proposal.

I do not think that many are ready to take such risks.

Russia may stop selling oil altogether to those who are trying to impose a price ceiling on it.

Similarly, we have already stopped gas exports to countries that refused to pay in rubles, ”the RT interlocutor emphasized.

Natalya Milchakova, a leading analyst at Freedom Finance Investment Company, also doubts the success of the G7 initiative.

According to her, consumer cartels have always been short-lived, unlike producer cartels.

It is always easier for an individual buyer to negotiate with a supplier and get a discount than to participate in a cartel for this purpose and, as a result, win much less, the specialist explained.

“In addition, the cartel of buyers will make it impossible for them to conclude long-term contracts.

Yes, and the EU may be in a stupid position: after all, if the EU has imposed an embargo on Russian oil imports, although it has not yet officially entered into force, why then participate in a consumer cartel?

Meanwhile, Asian countries are already buying Russian oil at a discount, so we believe that this US venture is aimed mainly at weakening Europe, ”Milchakova added in a conversation with RT.

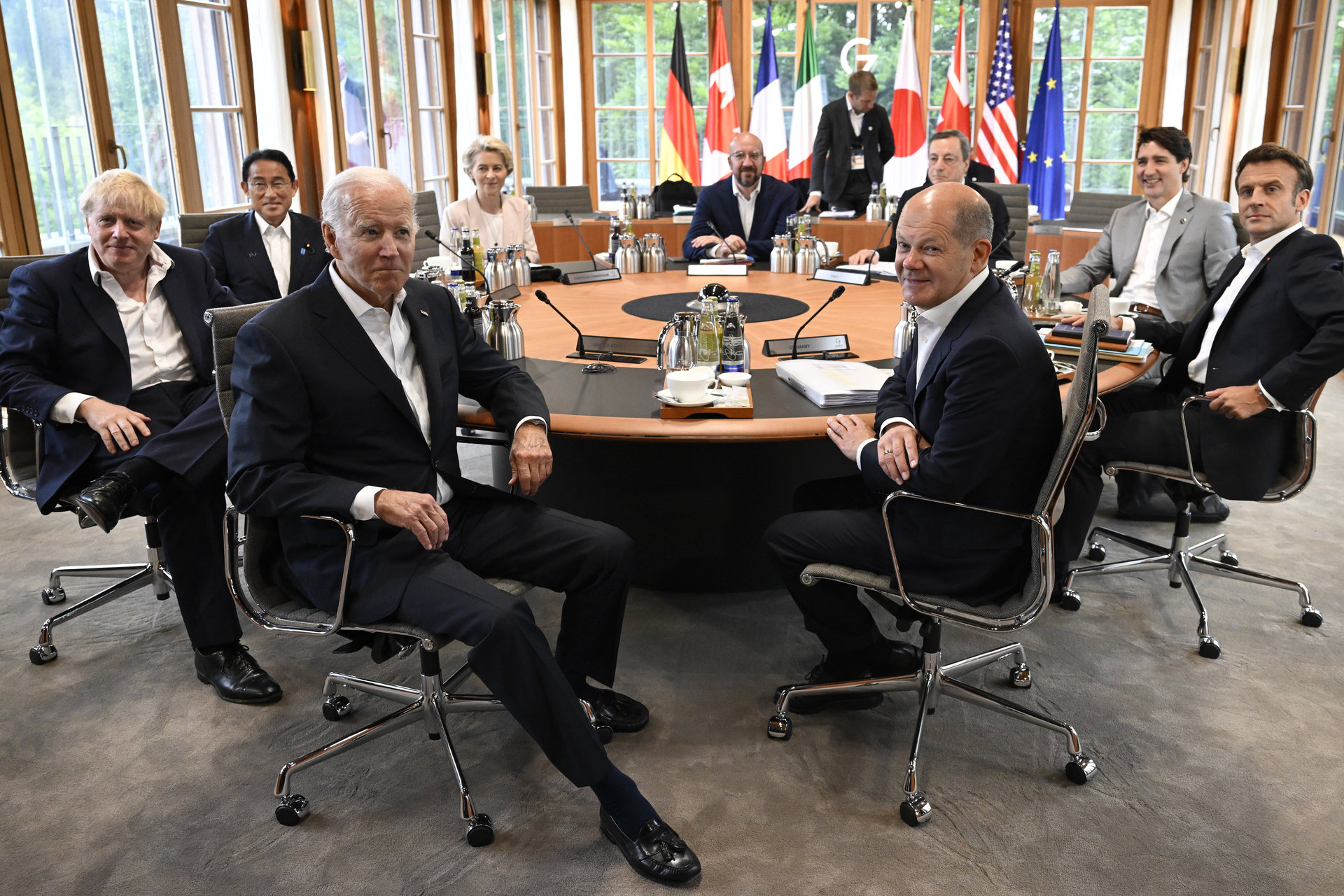

G7 summit

AP

© John Macdougall

New Deal

Recall that back in early March, the United States introduced a complete ban on the import of energy resources from Russia.

At the same time, the British authorities announced plans to stop buying oil from Moscow before the end of the year.

Later, on May 31, the European Union also announced the rejection of Russian raw materials, but the embargo should be fully operational only by the beginning of December and will only apply to sea supplies, and not to pipeline ones.

In response to Western actions, Moscow has already begun actively diverting its oil supplies to friendly countries.

For example, in June 2022, Russia sold about 7.3 million tons of raw materials to China for a total of $5.1 billion. Compared to the same period in 2021, exports grew by 9.5% in quantitative terms and by 51.7% in monetary, evidenced by the materials of the General Administration of Customs of the People's Republic of China.

According to the agency, for the second month in a row, Moscow remains the largest supplier of oil to China and bypasses Saudi Arabia in this indicator.

Moreover, in July Russia may become the main seller of raw materials for India, ahead of Iraq.

This conclusion was made by specialists of the Energy Development Center.

According to the organization's calculations, India purchased 985,000 barrels of Russian oil per day in June.

In annual terms, imports increased by more than 20 times.

“New Delhi has repeatedly stated its readiness to buy more Russian oil at a more significant discount.

At the same time, it should be noted that India processes part of the resulting fuel for subsequent resale to Europe.

China, in turn, is recovering from the pandemic and is also actively buying Russian oil due to growing fuel consumption,” Igor Yushkov explained.

Although Moscow provides its partners in the Asian region with significant discounts, the cost of energy resources sold is still almost double the level included in the Russian budget.

According to the Ministry of Finance of the country, in June the average price of Urals oil was $87.25 per barrel.

At the same time, the budget for 2022 was drawn up based on the average cost of raw materials at $44.2 per barrel.

“Russia is still fully able to compensate for the sanctions losses.

Even taking into account the discount, we sell oil at a price that is comfortable for us due to the high cost of raw materials on the market.

Deliveries have returned to pre-crisis levels,” Yushkov stressed.

Gettyimages.ru

© Stephen Swintek

Over the past few months, Russia has been able to significantly increase the supply of petroleum products to the countries of the Middle East.

For example, from April to June 2022, Saudi Arabia purchased 647 thousand tons of fuel oil from Moscow, which is twice as much as in the same period in 2021, Reuters writes, citing data from Refinitiv Eikon.

“At one time we had a problem with fuel oil, since earlier we mainly supplied this type of fuel to the USA.

However, the solution was found in the Middle East.

There are quite a lot of power plants in the region that can use fuel oil to generate electricity.

Saudi Arabia now buys a lot of fuel oil at a discount, and sells the released volumes of oil to world markets at a high price.

In addition, the Saudis also buy our oil at a discount, leave it for their own needs, and sell theirs at a market price, ”said Igor Yushkov.

The popularity of Russian oil in the Middle East is partly due to the peculiarities of its composition, explains Natalya Milchakova.

According to the expert, Urals raw materials are heavier due to the high sulfur content.

This grade of oil can be used for further processing and production of fuel oil.

In turn, the light oil produced by the Middle Eastern countries is not suitable for these purposes, the analyst emphasized.

According to established plans

Today, Turkey, Japan and Egypt are also among the major buyers of Russian oil.

At the same time, it is European countries that continue to buy raw materials from Moscow in significant volumes.

In particular, we are talking about Germany, the Netherlands, Italy, Poland and France.

This is stated in the report of the independent Finnish Center for Energy and Clean Air Research (CREA).

“European countries are buying Russian oil and filling tankers in anticipation of an oil embargo.

Whatever politicians say about the rejection of Russian energy resources, they understand that winter is coming, and the adopted sanctions have already hit the EU itself.

They just don't want to admit it and hold Europeans for patience.

There is nothing to replace energy resources in the volumes that they receive from Russia, ”Vladislav Antonov, financial analyst at BitRiver, explained to RT.

Gettyimages.ru

© Aldo Pavan

According to Igor Yushkov, back in early spring, Russian oil was considered “toxic” on the world market - the EU countries were reluctant to buy it, fearing protests from consumers.

Now in Europe, the realization is gradually coming that there is nowhere else to take relatively cheap raw materials.

“Under these conditions, the purchase scheme has also changed.

No one indicates exactly where the oil goes.

We release it from the port in Novorossiysk, then the barrels are reloaded, for example, onto a Greek tanker, and now it ceases to be Russian.

Everything eventually goes to Europe, ”added Yushkov.

In addition, the EU often resorts to the practice of mixing several types of oil, which helps to disguise the origin of raw materials, the expert said.

According to him, Europe worked out such schemes back in the days when it bought Iranian oil in circumvention of its own sanctions.